Capacity Market

A group of demand response providers in PJM proposed adding two hours to the availability window that binds when the resource can be deployed by the RTO.

FERC accepted PJM’s request to delay the 2025/26 Base Residual Auction from June 12 to July 17 to give stakeholders time to understand new capacity auction rules.

PJM proposed changes to how it measures and verifies the capacity contribution of energy efficiency resources, drawing concerns the RTO is moving too fast to implement changes ahead of the next capacity auction.

FERC is poised to levy a total $27 million in penalties on a Texas-based LLC meant to sell in-car ketchup holders that collected more than $1 million in undeserved MISO demand response payments.

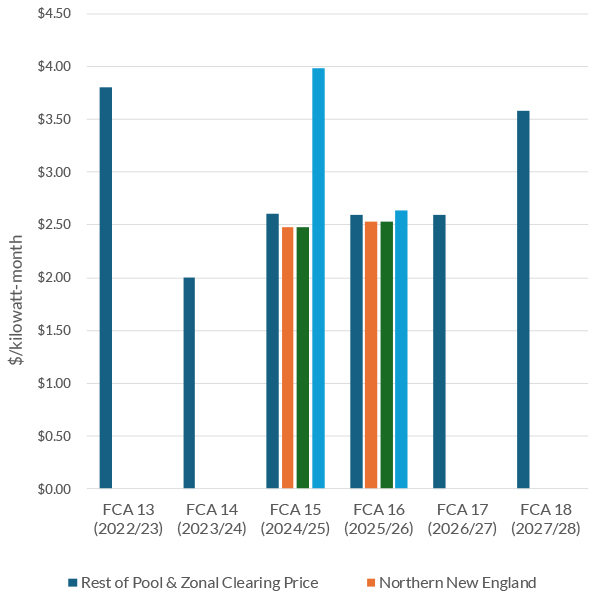

ISO-NE's capacity prices cleared at $3.58/kW-month in FCA 18, a nearly $1 increase over last year.

PJM submitted a waiver request asking FERC to delay the 2025/26 Base Residual Auction by 35 days, which would bump the commencement to July 17.

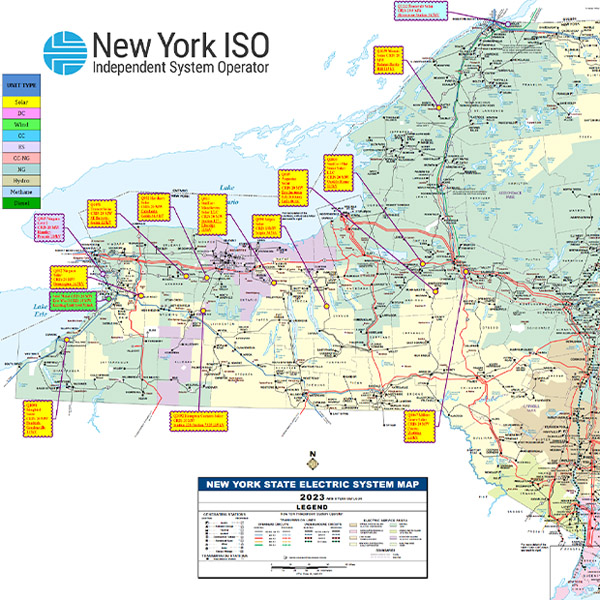

NYISO’s Operating Committee voted to approve the results from the Expedited Deliverability Study (EDS) 2023-01 report that included 16 projects, two of which were found to be undeliverable.

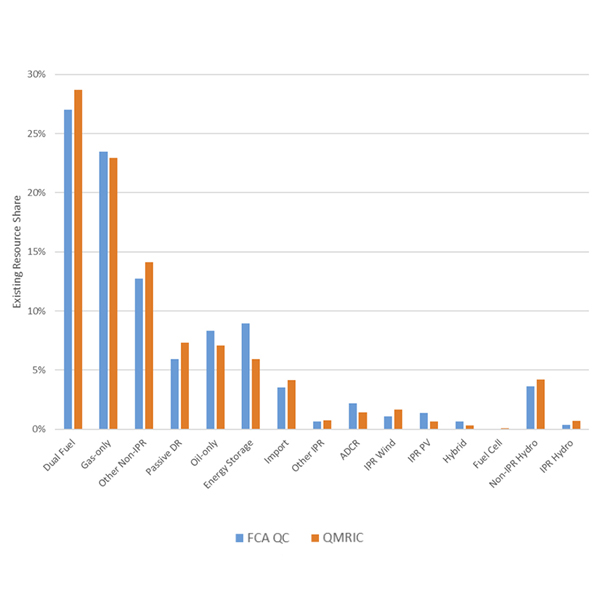

ISO-NE presented the NEPOOL Markets Committee with the initial results of the RTO’s Resource Capacity Accreditation.

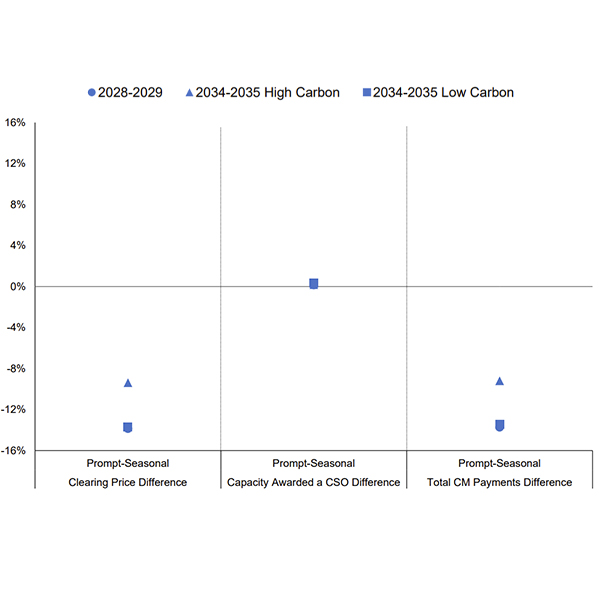

ISO-NE told the NEPOOL Markets Committee that it is proposing a major redesign to its capacity market, moving from a three-years-ahead schedule to a prompt and seasonal design.

FERC has rejected a PJM proposal to rework the role of performance penalties in its capacity market and how the associated risks can be reflected in seller offers.

Want more? Advanced Search