Capacity Market

ISO-NE’s Energy Security Improvements initiative hit a snag when the NEPOOL Markets Committee failed to recommend it to the Participants Committee.

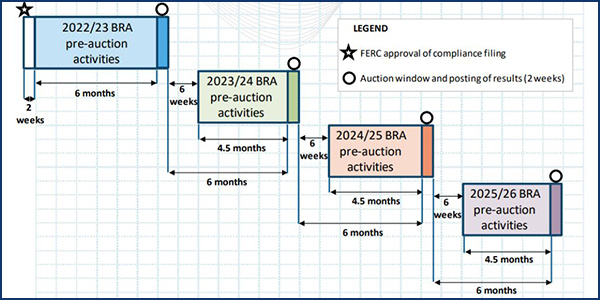

FERC denied rehearings on orders rejecting PJM’s efforts to stop capacity market participants from attempting to arbitrage between the BRA and Incremental Auctions.

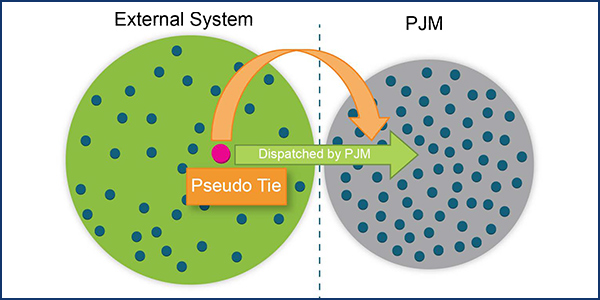

FERC rejected rehearing requests over the commission’s November 2017 order approving PJM’s tougher requirements for pseudo-tied generators.

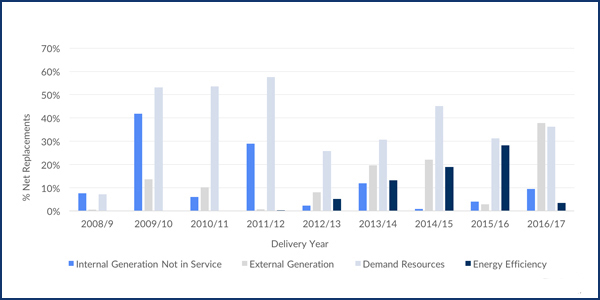

FERC denied what might be a final bid to recalibrate the results of MISO’s 2015/16 capacity auction, blocking Public Citizen’s request for rehearing.

FERC affirmed its 2018 ruling approving MISO’s current resource adequacy construct, rejecting multiple rehearing requests from critics of the decision.

PJM’s expanded MOPR may not hinder renewables as much as some had feared if the RTO’s interpretation of FERC’s Dec. 19 order is accepted by the commission.

PJM filed Tariff changes to comply with FERC’s controversial order requiring expansion of the MOPR to new state-subsidized resources.

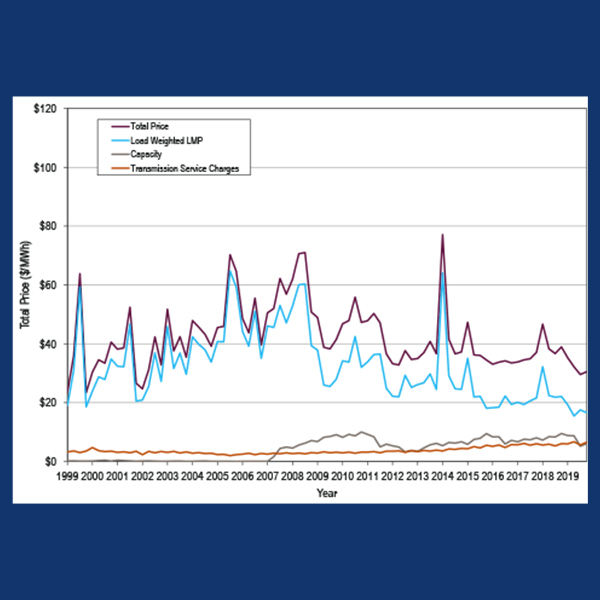

The average load-weighted, real-time LMP in PJM was $27.32/MWh last year, a 28.6% decrease from 2018 and the lowest in the RTO’s 21-year history.

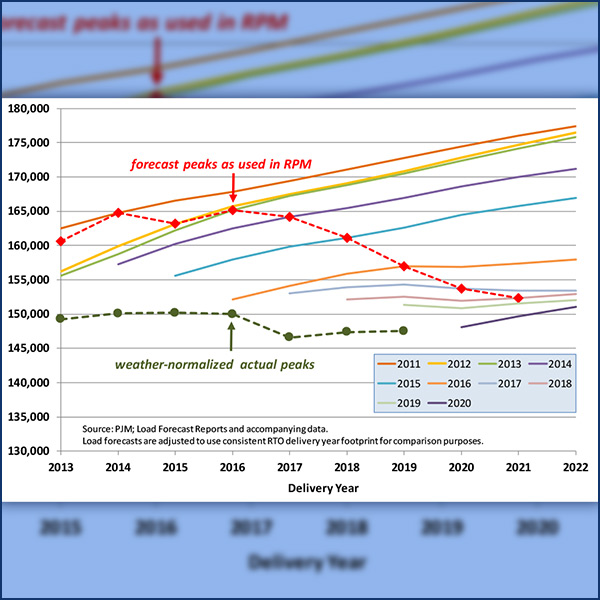

PJM’s Reliability Pricing Model is acquiring more capacity than needed, leading to dirtier, less efficient generation and excessive costs for consumers.

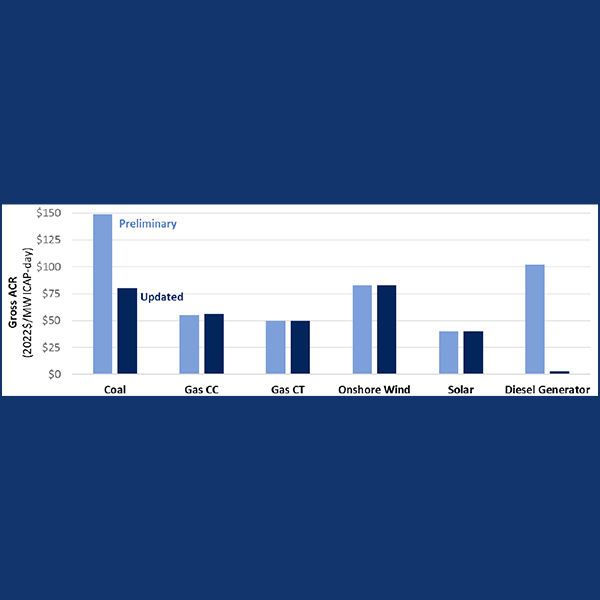

PJM officials told stakeholders that revised calculations show lower floor prices for gas, nuclear and solar generating units under the expanded MOPR.

Want more? Advanced Search