Energy Market

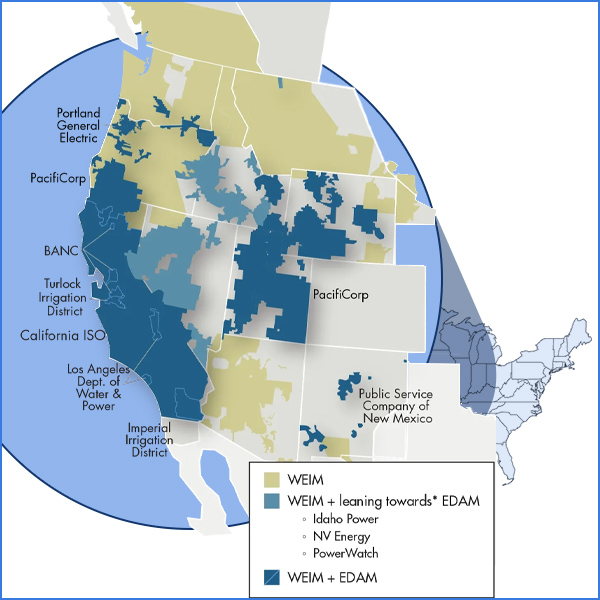

Some parties are urging Nevada regulators to wait until initial results are in for CAISO's Extended Day-Ahead Market before deciding whether to allow NV Energy to join.

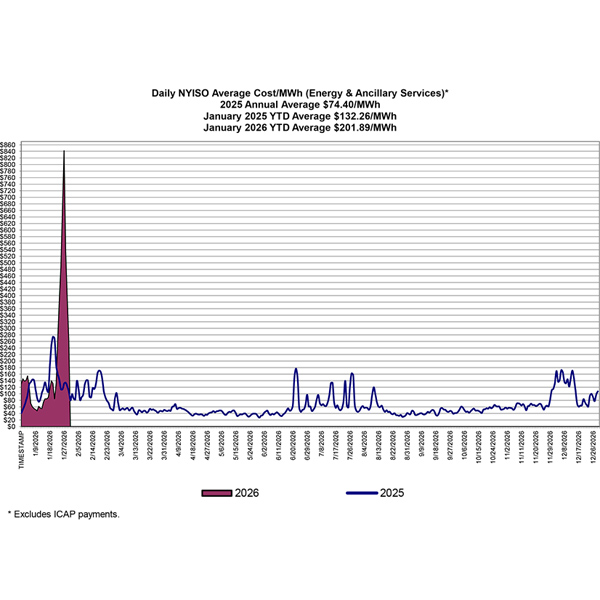

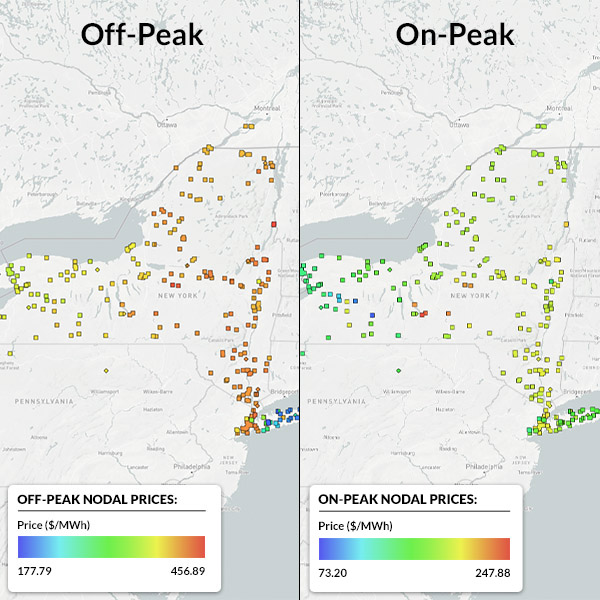

The average cost for electricity in NYISO was $201.89/MWh in January, up nearly 53% from January 2025 and possibly the highest ever for the month, the ISO reported.

PJM’s Market Implementation Committee passed by acclamation a PJM issue charge seeking to more thoroughly define how storage resources participate in the energy and ancillary service markets.

MISO membership called for modernized market rules for energy storage that can capture its chameleon-like roles.

New England experienced record high energy costs in the month of January amid cold weather, high gas prices and a heavy reliance on oil-fired generation.

CAISO leaders staged a virtual “town hall” to stress the importance of a smooth rollout to the ISO’s Extended Day-Ahead Market in May and promise to address market seams issues.

The West-Wide Governance Pathways Initiative’s Launch Committee asked CAISO to initiate a stakeholder process to create a funding mechanism for the newly incorporated organization that is slated to assume governance over the ISO’s energy markets.

As the West appears to move toward two separate day-ahead markets, data center developers like Google and clean energy companies are investing with the intent to mitigate seams and ensure operational consistency, panelists at an Advanced Energy United webinar said.

CAISO released its first mandatory report under the California assembly bill that paves the way for an independent regional organization to assume responsibility over the ISO’s energy markets.

Rising electricity prices in New York are driven by the increased cost of gas because of the ongoing Russia-Ukraine War and increased LNG exports, according to a recent policy paper by NYISO.

Want more? Advanced Search