Reserves

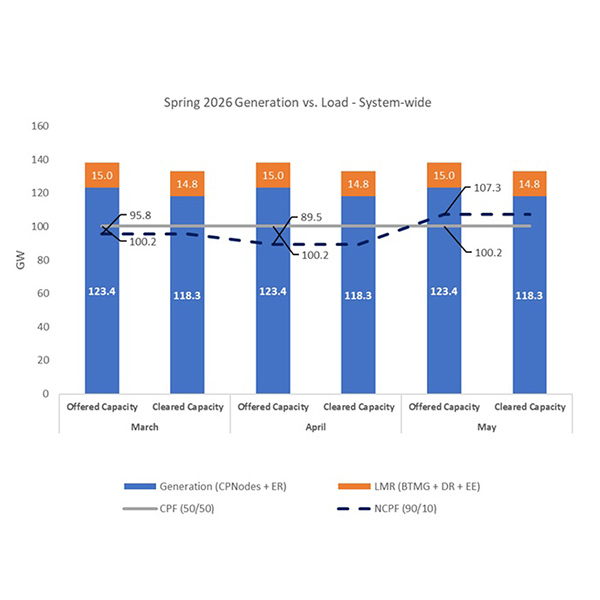

MISO is confident in its ability to meet spring demand, as the grid operator said it will be able to deliver on both its coincident and non-coincident peak forecasts through May.

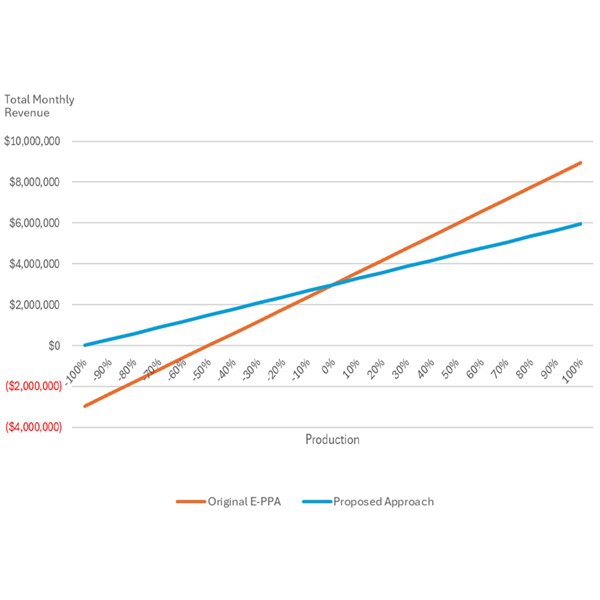

PJM and the Independent Market Monitor are drafting proposals to rework the RTO’s reserve market.

MISO said it likely will create interconnection reliability requirements and explore new rules that could bring large customers online in stages, as capacity becomes available, to get a handle on large loads eyeing MISO locales.

IESO officials held firm on excluding hydro redevelopment projects from the ISO’s Long Lead-Time procurement despite objections from potential bidders.

PJM presented manual revisions to clarify how resources are defined as offline for the purpose of determining whether they are eligible for lost opportunity cost credits.

PJM enters 2026 amid several efforts to ward off a reliability gap attributed to accelerating data center load, sluggish development of new capacity and resource deactivations.

MISO has indicated that new generation to serve data centers and other large loads will be mission critical over 2026 and said it will take pains to interconnect units.

FERC told PJM to change its rules to allow for co-located load at generators, with new transmission services and other tweaks.

PJM’s forecasting of hourly peak loads continued to improve in November, with an error rate of just 1.17%, staff told the RTO’s Operating Committee.

Among other issues, PJM presented a quick fix proposal to address instances in which offline generators are committed as secondary reserves and granted lost opportunity cost credits.

Want more? Advanced Search