PJM Market Implementation Committee (MIC)

The Market Implementation Committee held discussions on credit requirements and stability-limited generators, and received updates on the ARR/FTR Market Task Force and the nGEM project.

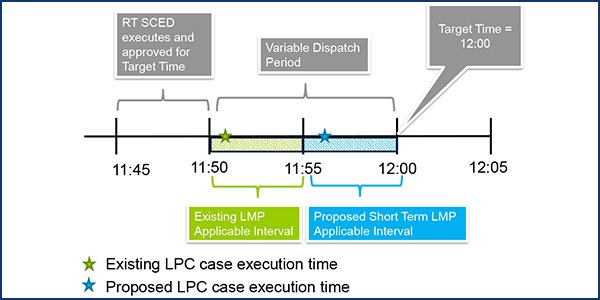

PJM backed off plans to seek a vote on short-term changes to its 5-minute dispatch and pricing procedures after pushback from the Monitor and stakeholders.

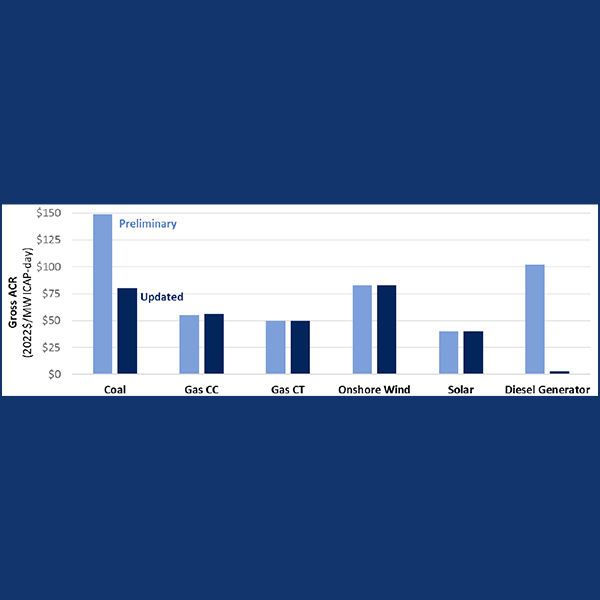

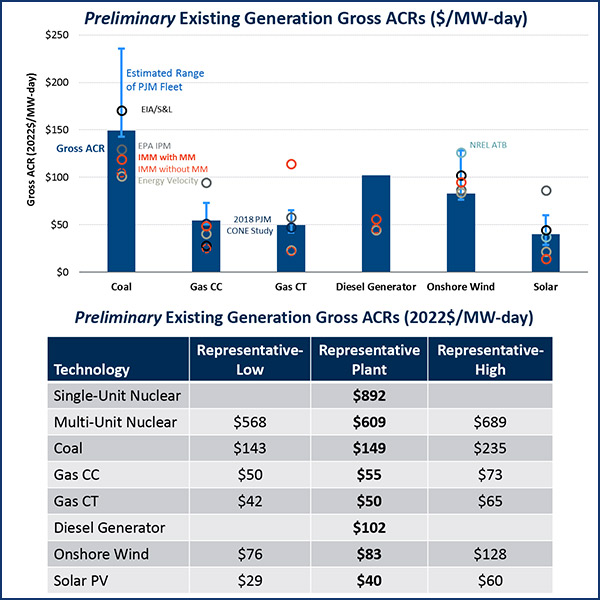

PJM officials told stakeholders that revised calculations show lower floor prices for gas, nuclear and solar generating units under the expanded MOPR.

PJM is “confident” it will meet FERC’s deadline for resolving pricing and dispatch misalignment issues in its fast-start pricing proposal.

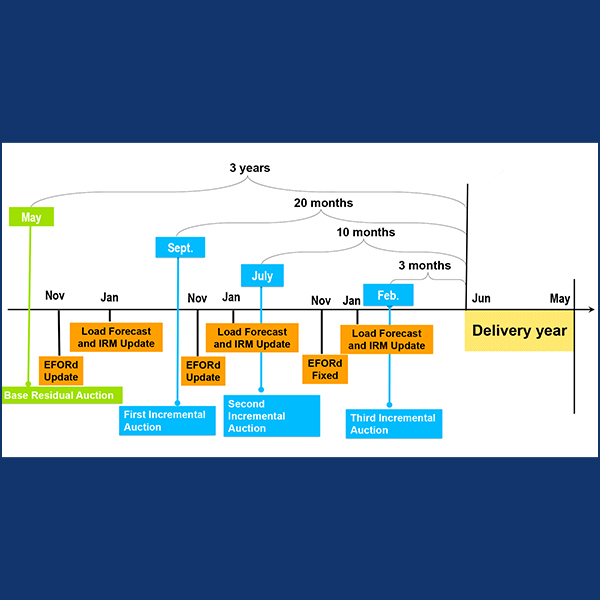

PJM plans to hold the next Base Residual Auction about six months after they receive FERC approval of its compliance filing implementing the expanded MOPR.

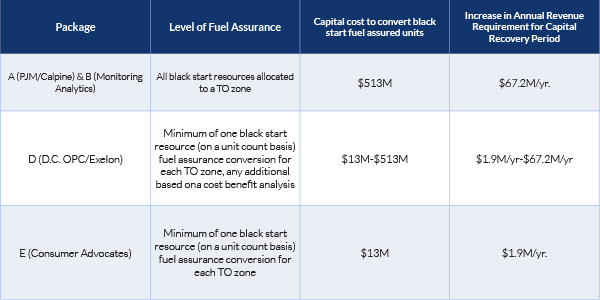

Facing opposition from regulators and consumer advocates, PJM will suspend an initiative that could tighten fuel requirements for black start resources.

PJM stakeholders got their first look at the price floors that could be applied for capacity resources under the expanded minimum offer price rule.

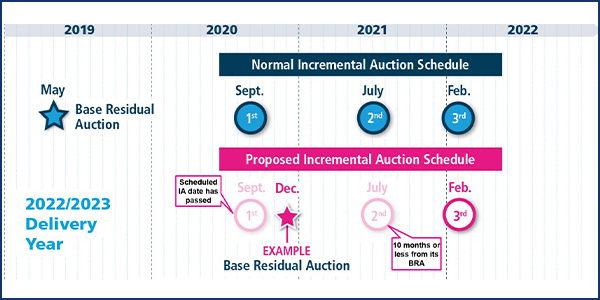

PJM may compress the schedule for the delayed 2022/23 Base Residual Auction and subsequent auctions in response to FERC’s order expanding the MOPR.

PJM dropped its plan to clarify pseudo-tie eligibility after stakeholders argued some of the revisions conflicted with pending litigation.

Exelon said a report from PJM's Monitor uses assumptions to cast a negative light on the FRR alternative members may pursue in the face of an expanded MOPR.

Want more? Advanced Search