SPP

Markets+Other SPP CommitteesSPP Board of Directors & Members CommitteeSPP Markets and Operations Policy CommitteeSPP Regional State CommitteeSPP Seams Advisory GroupSPP Strategic Planning CommitteeWestern Energy Imbalance Service (WEIS)

The Southwest Power Pool is a regional transmission organization that coordinates the reliability of the transmission system and balances electric supply and demand in all or parts of Arkansas, Colorado, Iowa, Kansas, Louisiana, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Oklahoma, South Dakota, Texas and Wyoming.

FERC approved Tri-State Generation and Transmission’s request to update a program designed to allow its member utilities more flexibility in how they procure power.

FERC terminated a show-cause proceeding against SPP and accepted the RTO’s proposal to revise its collateral requirements for financial transmission rights by including an additional re-marking mechanism for seasonal products.

NV Energy notified the Public Utilities Commission of Nevada that it plans to leave the Western Power Pool’s Western Resource Adequacy Program, citing five critical issues with the program’s design.

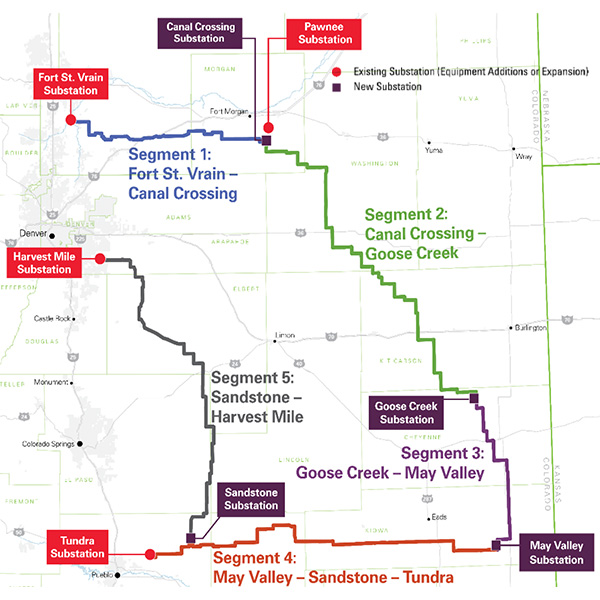

Xcel Energy is fighting two counties that are blocking a segment of the company’s Colorado’s Power Pathway transmission project.

The Western Power Pool’s WRAP secured enough participants for the program to enter the first binding phase after 11 utilities reaffirmed their commitment.

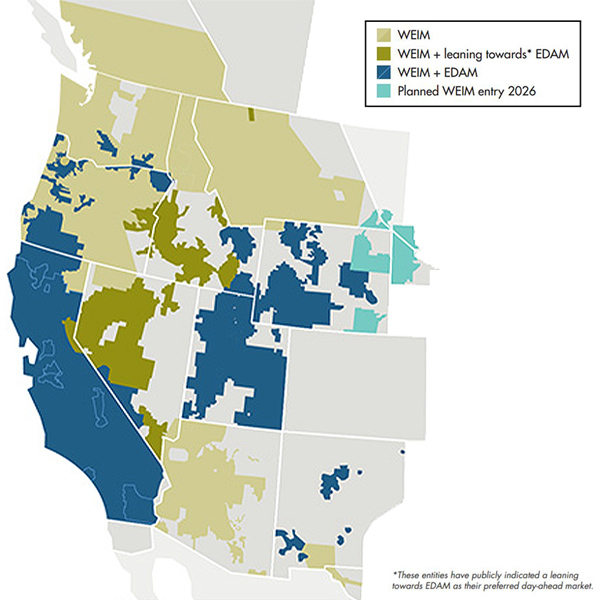

As long as entities across the West remain committed to continued regional trade, coordination, and reciprocal efforts to enable market participation, there can be significant benefits for the region at large, say Chris Robinson and Scott Simms.

A wide variety of stakeholders — including representatives of the DER sector — will serve as advisers to the Pathways Initiative as it enters its next phases.

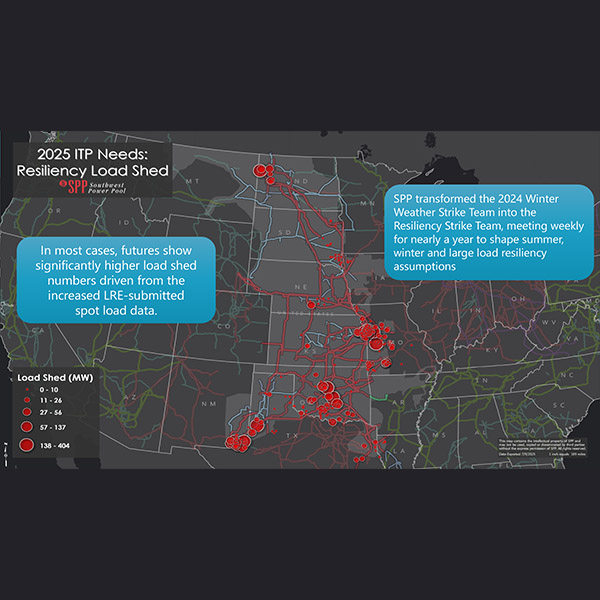

SPP says accelerating load projections will result in a 2025 transmission plan that dwarfs the previous year’s record $7.65 billion portfolio — so much so that it is considering deferring some projects until 2026.

SPP named Tim Vigil, chief member relations and strategy officer for Pacific Northwest Generating Cooperative, as director of the Market Monitoring Unit’s office dedicated to Markets+.

FERC directed SPP to submit a compliance filing for its proposal to unwind credit payment obligations assessed under Attachment Z2 of the SPP tariff for transmission service taken from 2008 to 2016.

Want more? Advanced Search