The Organization of MISO States and MISO are confident the footprint will be resource-sufficient in the 2026/27 planning year but said anything from an 11.4-GW surplus to a 14.1-GW deficit could be in store by the 2030/31 planning year.

The Organization of MISO States and MISO are confident the footprint will be resource-sufficient in the 2026/27 planning year but said anything from an 11.4-GW surplus to a 14.1-GW deficit could be in store by the 2030/31 planning year depending on how swiftly capacity can be added.

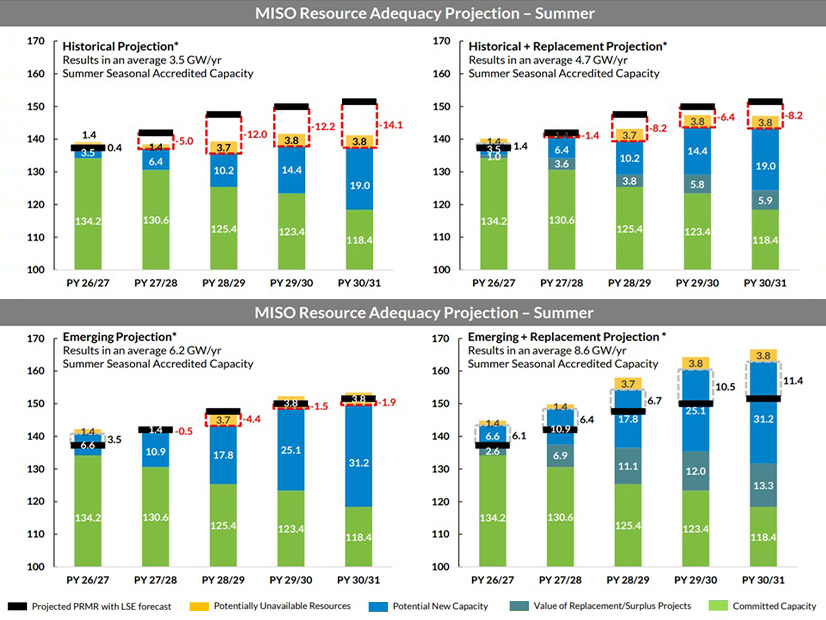

The two drew on more generous capacity construction assumptions than in years past to come up with the 2025 OMS-MISO Resource Adequacy Survey results. MISO said it likely would have a surplus anywhere from 1.4 GW to 6.1 GW for summer 2026 based on survey totals.

For summer 2027, the five-year resource adequacy projection showed the potential for a 5-GW deficit or a 6.4-GW surplus. From there, the possibilities for excesses or shortfalls widen further.

MISO Senior Resource Adequacy Engineer David Kapostasy said OMS and MISO used a range of build rates for this year’s survey, including a more promising replacement trend for retiring generation.

The two used a 3.5-GW/year assumption for capacity builds, based on a three-year historical average of new capacity constructed 2022 through 2024. Factoring in MISO’s historical, 1.2-GW rate of generation replacement projects brought the baseline average to 4.7 GW/year. MISO and OMS also used a more optimistic, 6.2-GW/year alternative projection based on MISO members’ responses to the survey regarding generation plans. Furthermore, MISO said high-end value could grow to 8.6 GW/year using a more generous, 2.4-GW/year replacement rate that reflects an emerging trend of utilities more reliably choosing to build replacement capacity or, better, using surplus interconnection service at existing sites.

Using the 3.5-GW/year build rate alone, MISO could experience a 12-GW shortage by summer 2028. At the 8.6-GW/year rate, however, the deficit dissolves into a 6.7-GW overage. While the 3.5-GW rate returns 12.2- and 14.1-GW shortages in planning years 2029/30 and 2030/31, respectively, the 8.6-GW/year rate could deliver 10.5 and 11.4 GW in extra capacity over summertime needs.

It’s not until MISO applies the 8.6-GW/year average that the possibility of any capacity shortfall is eradicated from the 2027/28 planning year onward.

MISO compared capacity estimates against 2.2% compound annual load growth, instead of last year’s 1.6%.

Last year’s OMS-MISO survey drew on a 2.3-GW/year build rate for accredited capacity based on new capacity built between 2020 and 2022 and a high-end, 6.1-GW/year estimate. (See OMS-MISO RA Survey: Potential 14-GW Capacity Deficit by Summer 2029.)

This year’s survey results are the first time in a few years that MISO and OMS are entertaining the possibility of double-digit gigawatt reserves in summer. The 2024 survey’s best-case scenario showed a 4.6-GW surplus by the 2029/30 planning year. Capacity deficits, according to the 2024 survey, also could top out around 14 GW.

At a June 6 teleconference to review survey results, Kapostasy said MISO reflected an acceleration in construction turnaround times among its membership when preparing survey totals.

“There’s a question of: Is this the queue starting to unclog itself, or is this a return to normal,” pre-COVID construction tempos, Kapostasy said.

Kapostasy said this is the first year MISO projected replacement capacity and new capacity that may result from surplus interconnection service, recognizing that many existing interconnection customers already replace generation or explore using their existing interconnection service to the fullest.

Replacement and surplus interconnection projects should account for 25% of new capacity additions over the next five years and blunt the impact of retirements, Kapostasy said. He also said retirement deferrals in MISO are providing a “short-term buffer” against seasonal capacity deficits.

MISO this year attempted to quantify in survey totals what it calls “stranded GIAs,” or projects with signed generation interconnection agreements that nevertheless won’t become part of MISO’s capacity expansion due to difficulties getting them built.

Kapostasy reminded stakeholders that MISO has about 54 GW worth of planned generation that has signed interconnection agreements but are not yet online. He added that MISO’s recent queue process alterations (read: an annual megawatt cap on project entrants, higher dropout fees and an automated study process) should attract generation projects that are more of a sure thing in the future, minimizing dropouts.

MISO said 91% of existing generation participated in the 2025 OMS-MISO Survey, representing 97.4% of MISO load.

Vice President of System Planning Aubrey Johnson said the bottom line is MISO appears to have sufficient resources for the next planning year.

“Beyond that, we have challenges that need to be met,” he said.

Joe Sullivan, president of the Organization of MISO States and vice chair of the Minnesota Public Utilities Commission, said past surveys seemed to help move the needle on improving MISO’s resource adequacy picture.

“Capacity margins have improved since last year,” he said.

Sullivan said the goal of the survey is to guide planning decisions, “not deliver definitive” projections. He said many variables, including load growth, electrification and fleet turnover, remain in flux.

“As the survey shows, we are continuing to meet the moment,” Sullivan said.