CAISO Market Surveillance Committee

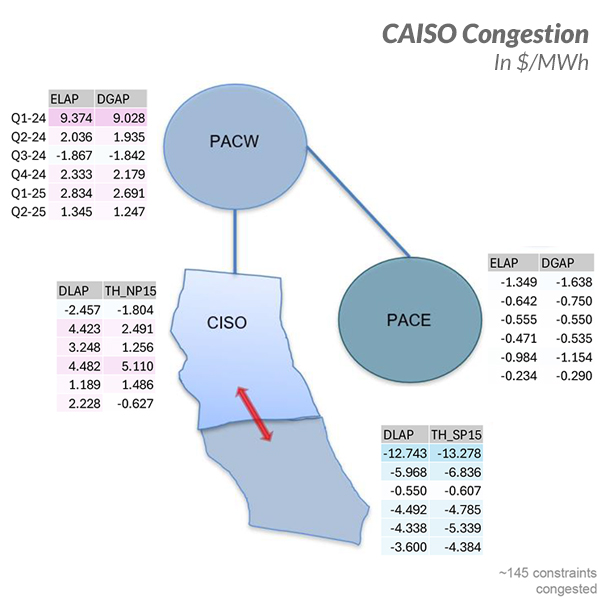

CAISO continues to work to revise the rules around how congestion revenues will be allocated to participants in the ISO’s Extended Day-Ahead Market, which will be launched in spring 2026.

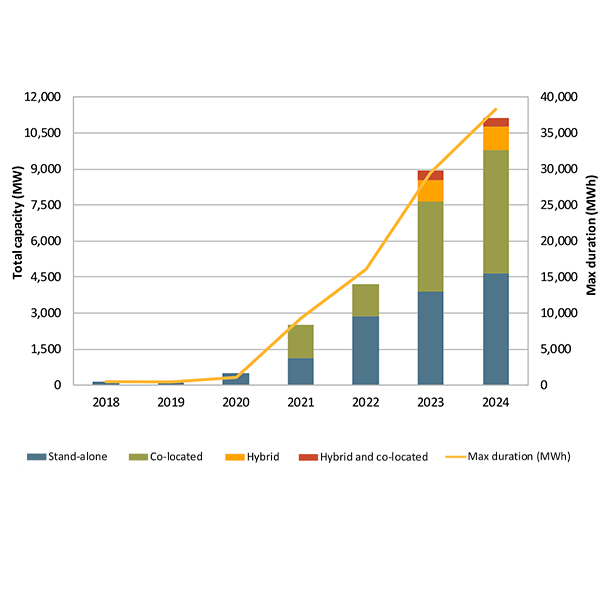

CAISO kicked off a new Storage Design and Modeling Initiative intended to tackle an array of challenges related to the growing market participation of storage resources.

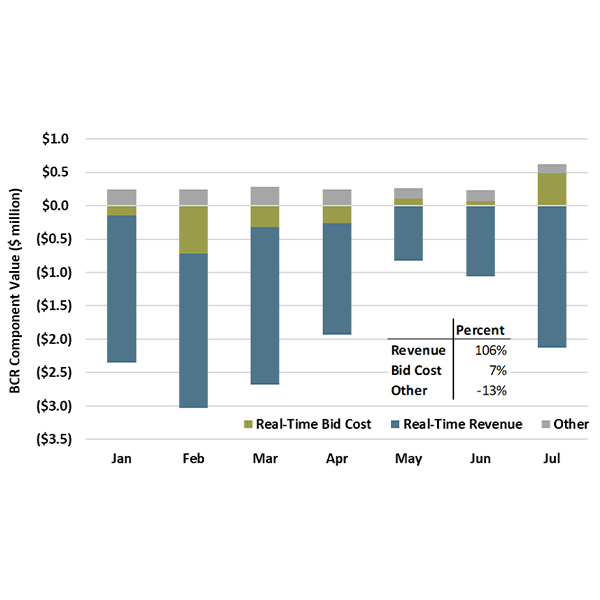

CAISO’s Board of Governors and the Western Energy Markets Governing Body voted unanimously to pass a proposal that will modify the calculation used to determine bid cost recovery payments for storage resources.

CAISO is reconsidering its proposal to address unwarranted bid cost recovery payments for storage resources following internal analysis that suggested the proposed solution wouldn’t sufficiently address the problem.

Protecting the public interest while implementing the Extended Day-Ahead Market and expanding the Western footprint was central to the discussion in a West-Wide Governance Pathways Initiative workshop.

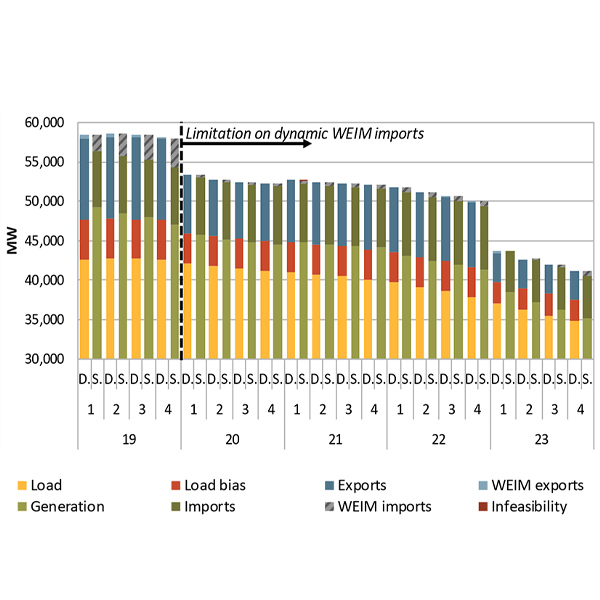

CAISO’s own systems may have contributed to a set of “operational surprises” that forced it to declare a series of energy emergency alerts in July 2023, a member of the ISO’s Market Surveillance Committee said.

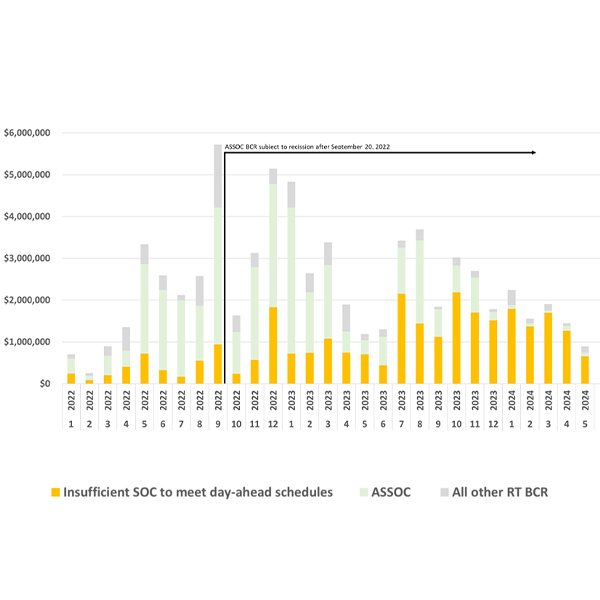

Batteries may be receiving excessive or inefficient bid cost recovery payments in CAISO, an issue that could be exacerbated by the ISO’s recent move to increase its soft offer cap to allow for higher bids by storage resources.

CAISO’s Board of Governors and WEIM Governing Body unanimously voted to approve an expedited proposal to increase the ISO’s soft offer cap from $1,000/MWh to $2,000.

CAISO is proposing to raise the soft offer cap in its market from $1,000/MWh to $2,000 to accommodate the bidding needs of battery storage and hydro resources in time for operations this summer.

Want more? Advanced Search