cost of new entry (CONE)

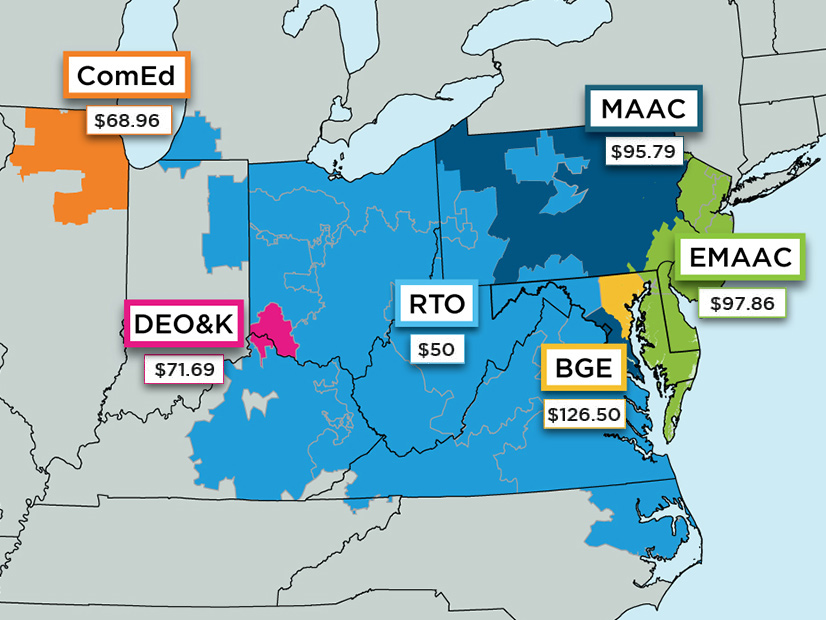

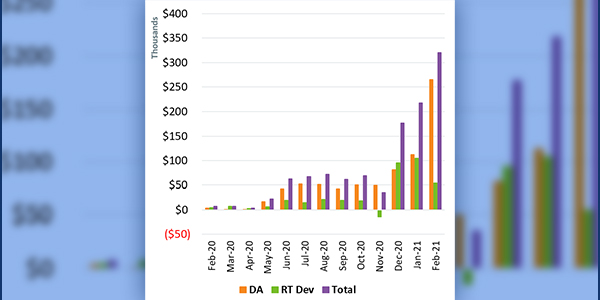

Capacity prices in most of PJM dropped by nearly two-thirds for 2022/23, with EMAAC and SWMAAC recording their lowest prices ever.

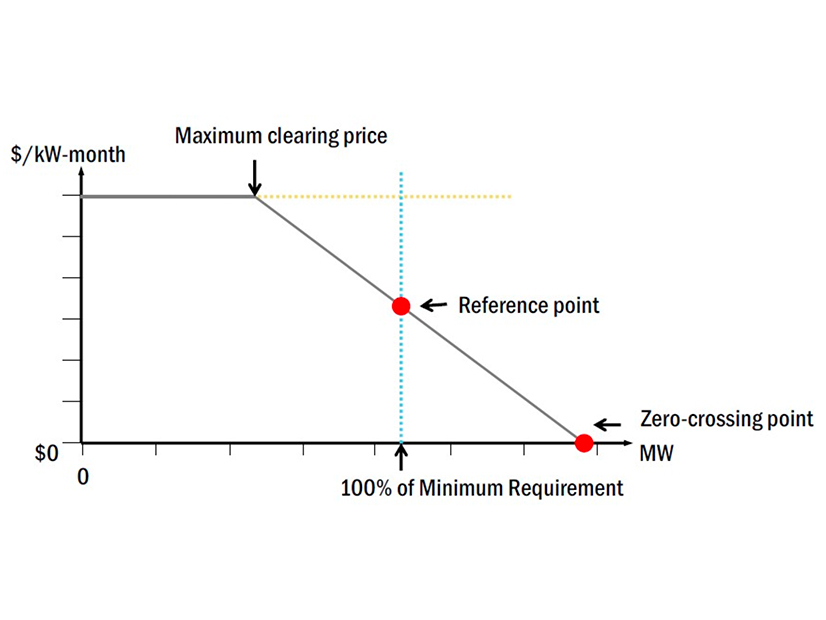

NYISO's BIC approved manual revisions to accommodate a change to the maximum clearing price calculation for ICAP demand curves.

FERC approved an update of NYISO's capacity market demand curves but the commission rejected the proposed 17-year amortization period.

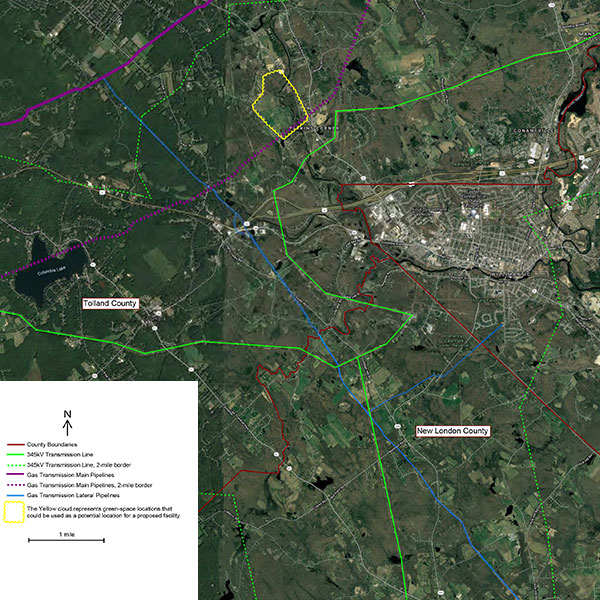

NEPOOL's Participants Committee acted on modified proposals for ORTPs used for Forward Capacity Market parameters in the 2025/26 capacity commitment period.

FERC explained why it would not reconsider revenue calculations in PJM’s capacity market, saying it did want to further delay the RTO's upcoming auction.

FERC sent ISO-NE a deficiency notice regarding the RTO’s proposed rule revisions for capacity auction values, the NEPOOL Participants Committee heard.

FERC approved revisions to the ISO-NE tariff on recalculating the dynamic delist bid threshold for the Forward Capacity Auction.

The NEPOOL Participants Committee approved its consent agenda and elected David Cavanaugh as chair at its final meeting of the year.

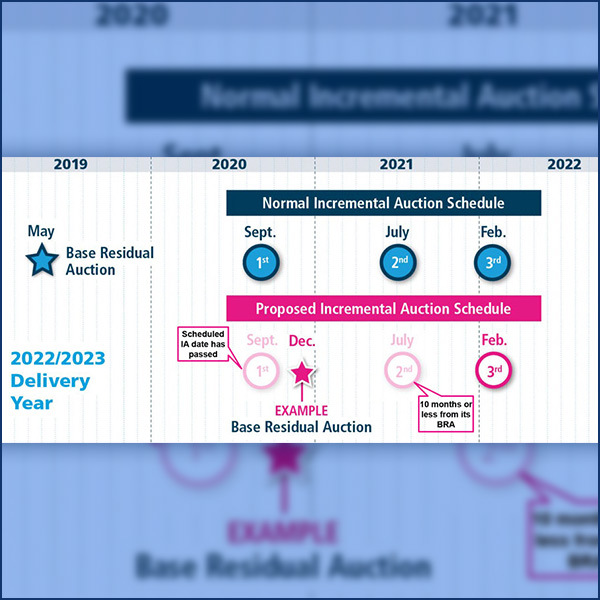

PJM moved closer to restarting its capacity auctions with FERC’s approval of its new energy and ancillary services revenue offset calculation

The NEPOOL Markets Committee passed a motion to update FCM parameters for the 2025/26 capacity commitment period and discussed Order 841.

Want more? Advanced Search