Duke Energy

A proposed agreement between Duke Energy and solar advocates would lower the net metering rate residential rooftop solar owners receive for their excess power.

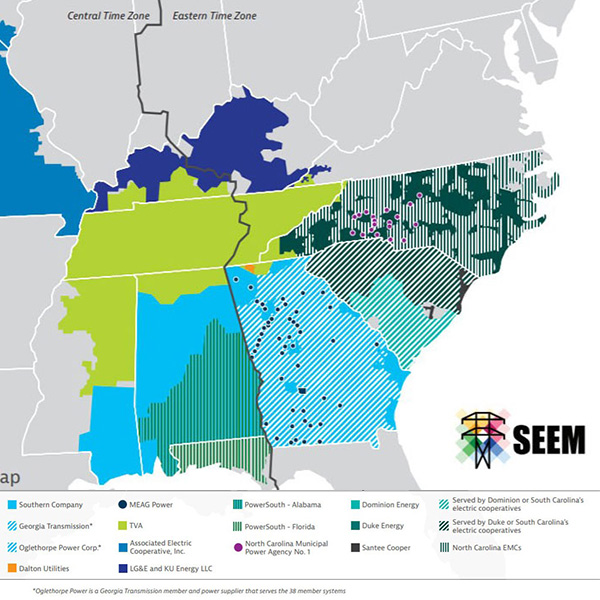

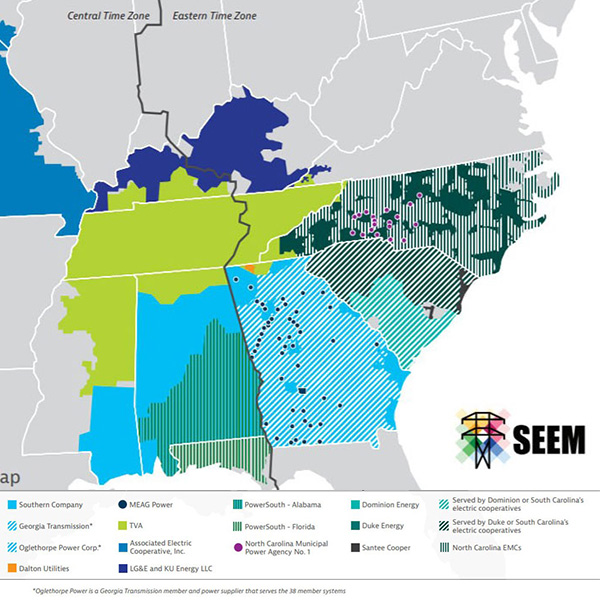

Renewable developers don't expect much from the Southeast Energy Exchange Market, saying it falls short of the transparency and competition in RTOs.

FERC accepted revisions to four SEEM utilities' tariffs implementing the special transmission service used to deliver the market’s energy transactions.

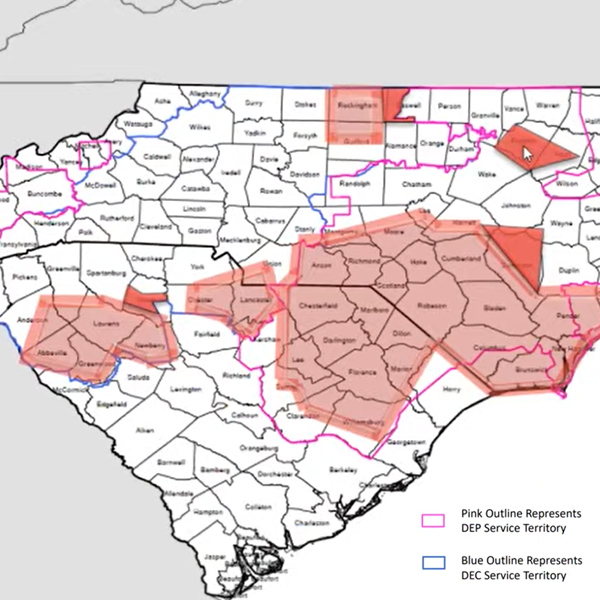

North Carolina law has upped the ante on utility carbon emissions reductions — requiring a 70% cut by 2030.

FERC announced on Wednesday the Southeast Energy Exchange Market will move ahead after the evenly split commission failed to reach a decision in time.

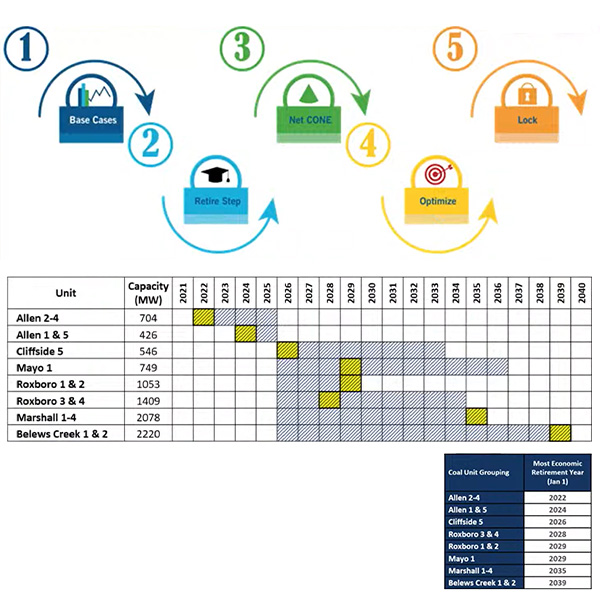

As H951 sits on Gov. Cooper's desk, the NCUC continued its examination of Duke Energy's IRP with a session on the increasing complexity of grid planning.

Grid planners need more input on policy and a reliability “safety valve,” the Eastern Interconnection Planning Collaborative said in a new paper.

A bill in the North Carolina legislature would authorize the Utilities Commission to “take all reasonable steps” to achieve a 70% reduction in carbon.

South Carolina sent the utility back to the drawing board for IRP revisions, while North Carolina looks to changes for Duke's 2022 IRP.

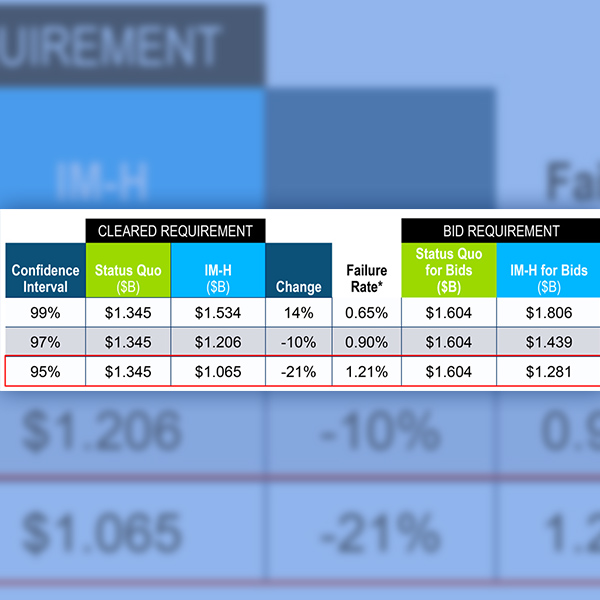

PJM stakeholders endorsed tariff revisions implementing rules related to initial margining

for FTR obligations.

Want more? Advanced Search