electric vehicle incentives

Starting in 2024, consumers buying an electric vehicle that qualifies for a $7,500 tax credit under the Inflation Reduction Act.

The U.S. Treasury Department just made its March deadline for issuing guidelines on the domestic content provisions for EV tax credits.

New Jersey's BPU approved a $16.15 million allocation of funds from the RGGI to promote the installation of fast chargers for medium- and heavy-duty EVs.

New Jersey could encourage greater use of EVs in overburdened communities by targeting incentives and creating EV ride-sharing plans, a new report says.

New Jersey is cutting its maximum EV subsidy from $5,000 to $4,000 while adding a $250 grant for home chargers.

Low-income residents in certain parts of California are finding their EV incentives are accompanied by a tax liability.

The narrowly re-elected governor sends a strong signal that he will continue to promote ambitious climate and clean energy policies.

Top incentive would drop from $5,000 to $2,500 for EVs priced up to $45,000 as state aims to target consumers who might not buy an EV without the rebate.

Citing UN's dire warnings on climate change, BPU President Fiordaliso says, program aims to help local governments set the right example and direction.

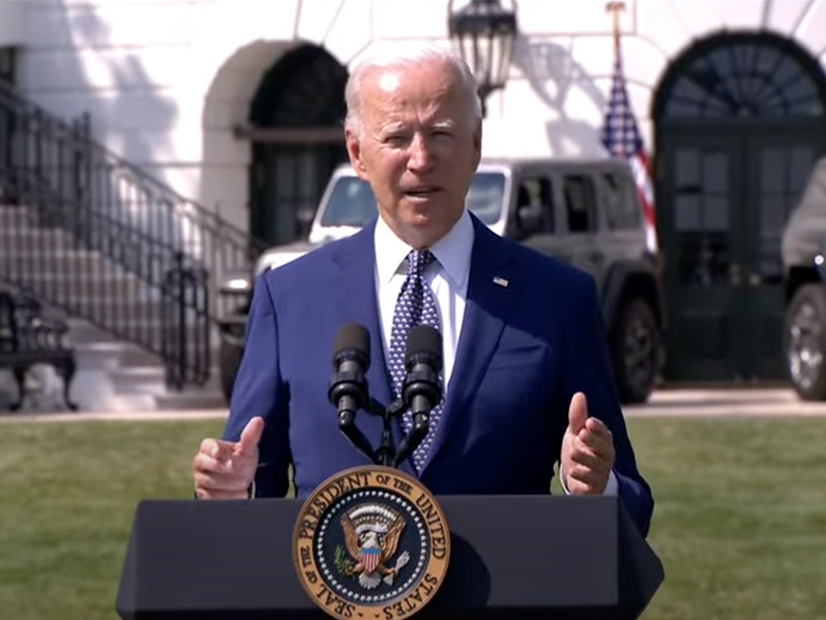

President Biden set a target of 50% of cars sold in 2030 be electric or hybrid electric and announced EPA would seek to increase fuel efficiency standards.

Want more? Advanced Search