Energy and Environmental Economics (E3)

The Bonneville Power Administration has executed new long-term wholesale electric power contracts with more than 130 public utility customers under the agency’s Provider of Choice initiative, according to an announcement.

Citing an energy “emergency” in the Northwest this winter, DOE ordered TransAlta to continue operating Washington’s last coal-fired generating plant for three months beyond its scheduled retirement at the end of this year.

The Western Transmission Expansion Coalition plans to publish its 10-year outlook for Western transmission needs in February 2026 and has begun outlining the 20-year plan, according to Energy Strategies, which is developing the report.

The Northwest faces a “pretty scary” situation, with a new study showing a potential 9-GW capacity shortfall by 2030, increased energy prices and building constraints, PNGC Power's CEO said.

Utilities face significant forecasting risks from large loads, prompting the industry to develop various strategies to eliminate speculative projects, experts said during a Western Interstate Energy Board webinar.

Though BPA removed any uncertainty by selecting SPP’s Markets+ over CAISO’s EDAM, the debate over whether BPA made the right choice likely will heat up as the West confronts a split into two major markets.

Facing an expected surge in energy demand, New Jersey’s Board of Public Utilities outlined a draft EMP that would continue the state’s existing, vigorous electrification strategy.

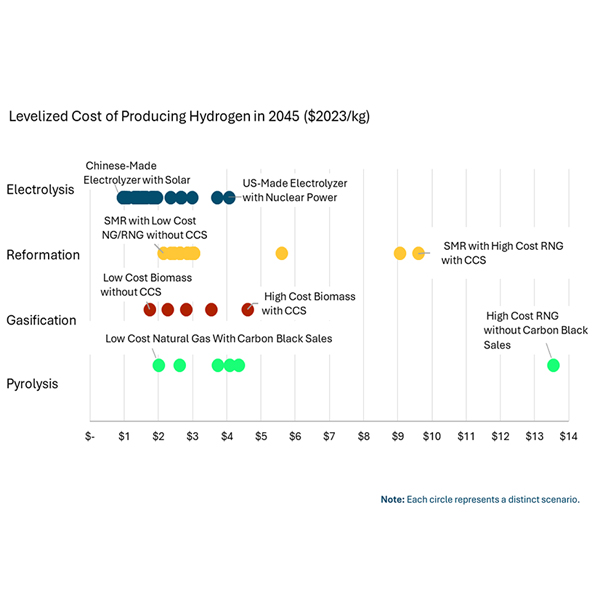

Consultants are evaluating four primary pathways for hydrogen production in California, and say it’s too soon to eliminate any of them from a long-term strategy for the state’s green hydrogen industry.

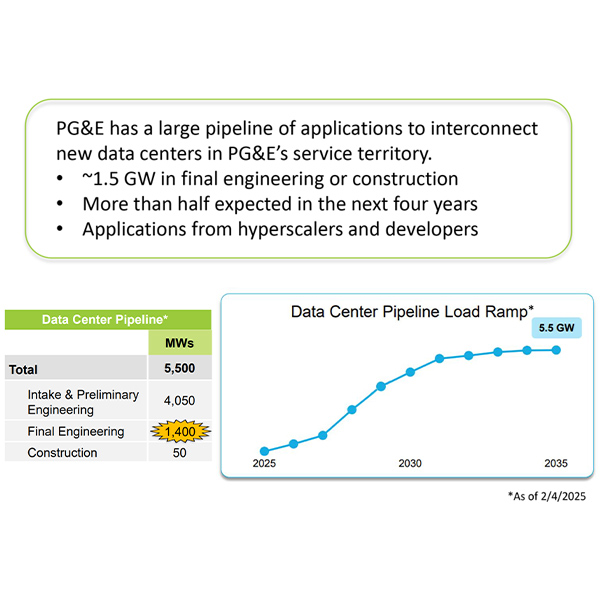

As some data center operators plan to power their facilities with onsite generation, one researcher a California Energy Commission workshop suggested it might be better to get electricity from the grid instead.

New Jersey Gov. Phil Murphy and the Board of Public Utilities are pushing ahead with ambitious clean energy plans even as they face the reality of President-elect Donald Trump, a fierce skeptic of clean energy, taking office.

Want more? Advanced Search