ER18-1314

It’s a good bet the ongoing FERC paper hearing to revise PJM’s capacity construct will be a major topic of discussion at the OPSI annual meeting.

The first round of filings in PJM’s “paper hearing” on revisions to the capacity market showed wide disagreement over broadening the MOPR.

PJM asked FERC to delay next year’s Base Residual Auction to provide it more time to respond to the commission requiring changes to capacity market rules.

FERC wants PJM’s capacity rules to be resolved by Jan. 4 and has dispatched staff to help the RTO and its stakeholders adhere to that timeline.

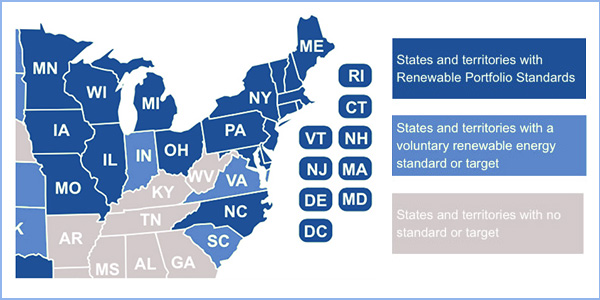

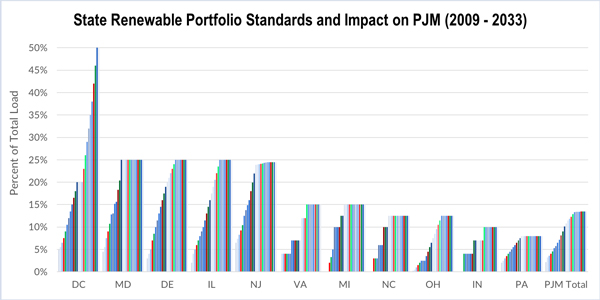

Rising state subsidies for renewable and nuclear power require PJM to revamp its MOPR to address price suppression in its capacity market, FERC ruled.

PJM is pressing FERC to make a decision on the RTO’s “jump ball” capacity filing, arguing that the commission is within its authority to do so and pointing out what it considers to be hypocrisy in opponents’ criticism of the filing.

Comments on PJM’s “jump ball” proposals for protecting the capacity market from subsidized resources were almost uniformly negative.

PJM filed with FERC to consider both its two-stage capacity repricing proposal and its Market Monitor’s plan to expand the minimum offer price rule (MOPR).

Want more? Advanced Search