GreenHat Energy

PJM stakeholders approved a charter for a task force that will recommend market rule changes in the wake of the 890 million-MWh GreenHat Energy default.

PJM proposed an alternative stakeholder process to implement market rule changes recommended in a special report on the RTO’s role in the GreenHat default.

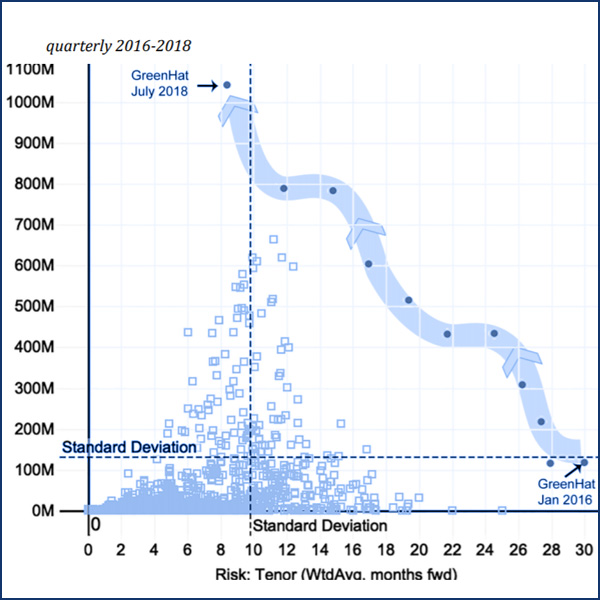

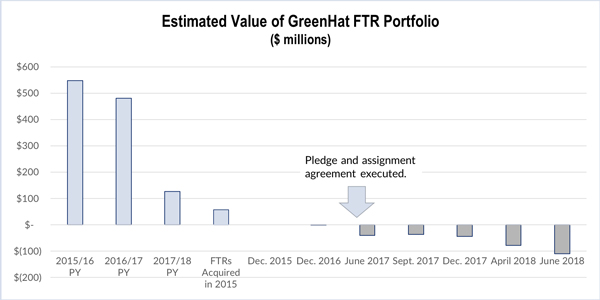

Naive staff and market flaws allowed a trading shop to amass the largest financial transmission right portfolio in PJM history without enough collateral.

The growing fallout stemming from GreenHat Energy’s record default in PJM’s financial transmission rights market prompted MISO officials to reassure members that a similar situation is unlikely to unfold in MISO.

PJM Chief Financial Officer Suzanne Daugherty will retire April 1 after working at the RTO for 20 years.

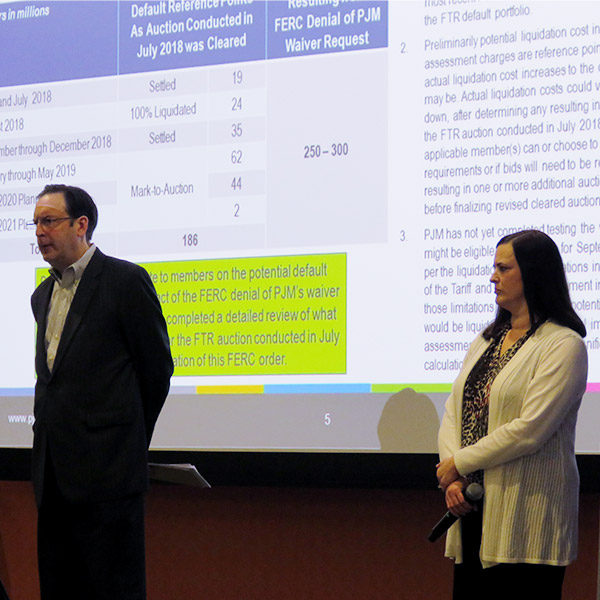

PJM won’t act on FERC’s order to rerun its July 2018 financial transmission rights auction unless the commission denies the RTO’s planned motion for a stay.

SPP continued its effort to modernize its cost-recovery processes last week, agreeing to replace its broad single rate schedule with four targeted ones.

The cost of GreenHat Energy’s default could rise by $250-$300 million if PJM is forced to unwind settlements of the financial transmission rights portfolio.

PJM must unwind five months of settlements for GreenHat Energy financial transmission rights that should have been liquidated sooner, FERC ruled.

The MRC endorsed a change to align PJM’s Tariff with manual language on the process for requesting incremental capacity transfer rights calculations.

Want more? Advanced Search