GreenHat Energy

A proposal to revise PJM’s credit requirements for financial transmission rights in response to the historic GreenHat Energy default will be delayed.

PJM members approved Operating Agreement revisions that would eliminate the requirement that the RTO liquidate a member’s FTRs when it falls into default.

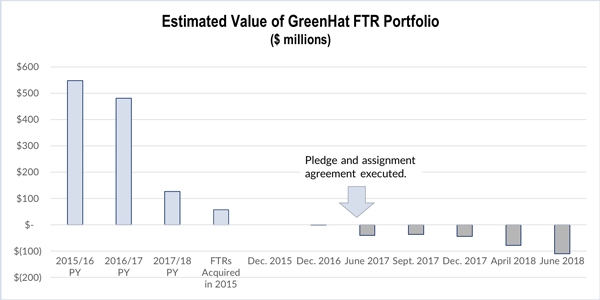

PJM’s lax credit policy allowed Greenhat Energy, whose traders had a history of market manipulation, to run up as much as $140 million in FTR losses.

After earlier forecasts of a small year-end overage, MISO is now on track to be $1.2 million under its $265 million expected budget in December.

PJM asked members to decide whether to liquidate GreenHat Energy's FTR portfolio now or let the positions run their natural course over the coming months.

PJM staff are still working on how to respond to GreenHat Energy’s default in the financial transmission rights market.

Want more? Advanced Search