increment offers (INCs)

PJM's Market Monitor told FERC that proposals by the RTO and a marketer to change the FTR forfeiture rule would weaken protections against market manipulation.

A summary of the issues discussed and measures approved by the PJM Markets and Reliability Committee on May 28, 2015.

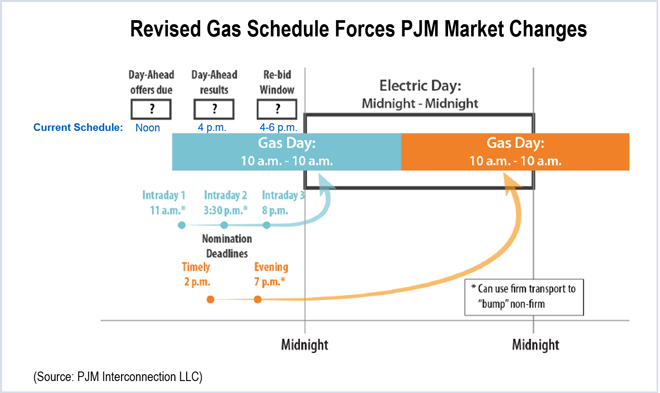

PJM and the Monitor are considering the changes to reduce uplift and gaming opportunities and allow quicker solving of the day-ahead energy market.

Our summary of the issues scheduled for votes at the PJM MRC on 05/28/15. Each item is listed by agenda number, description and projected time of discussion, followed by a summary of the issue and links to prior coverage.

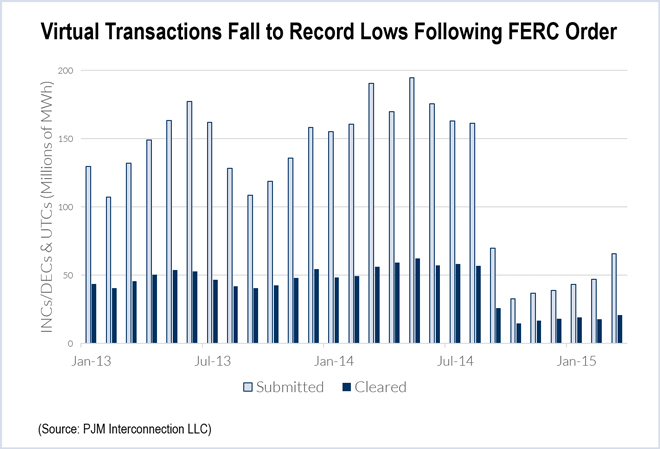

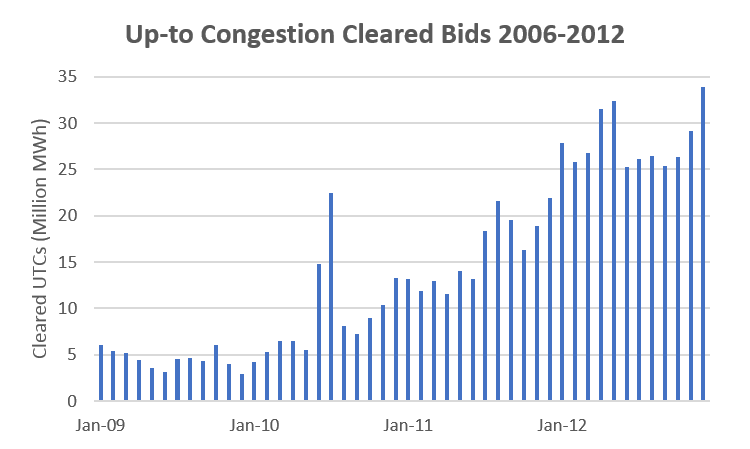

If FERC keeps its word, virtual traders in PJM should have clarity by the end of October on whether up-to-congestion transactions will be subject to additional charges.

A proposal to impose a temporary $0.07/MWh uplift charge on all netted virtual transactions received a cool response from PJM members Thursday — including a rebuff from the attorney for the Financial Marketers Coalition.

The RTO stakeholder process came under fire last week at a FERC technical conference on the treatment of financial transactions in PJM.

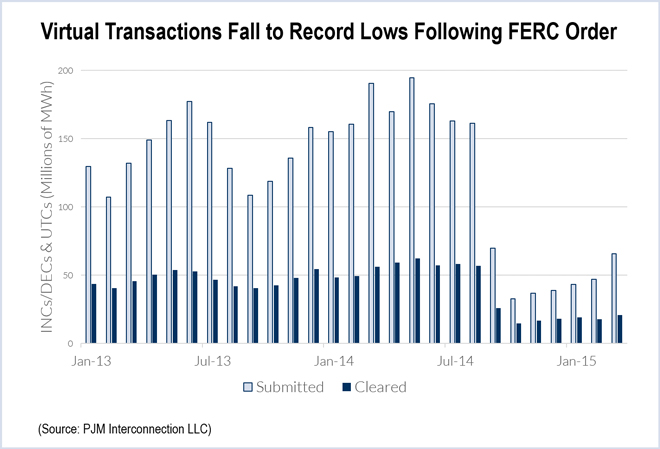

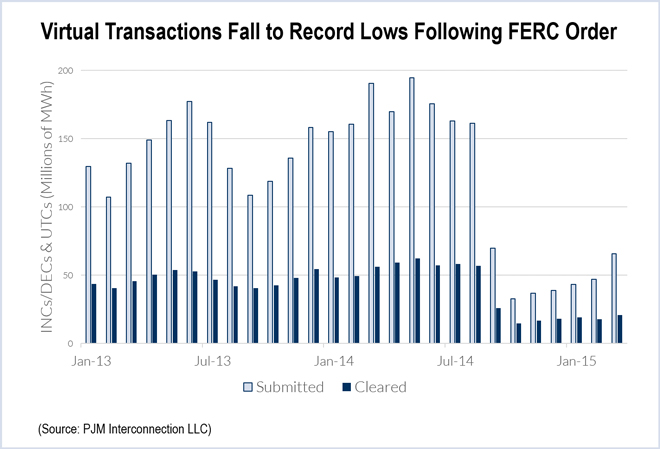

UTCs in PJM have dropped by about 85% since September, after the FERC said it might make the transactions liable for uplift assessments.

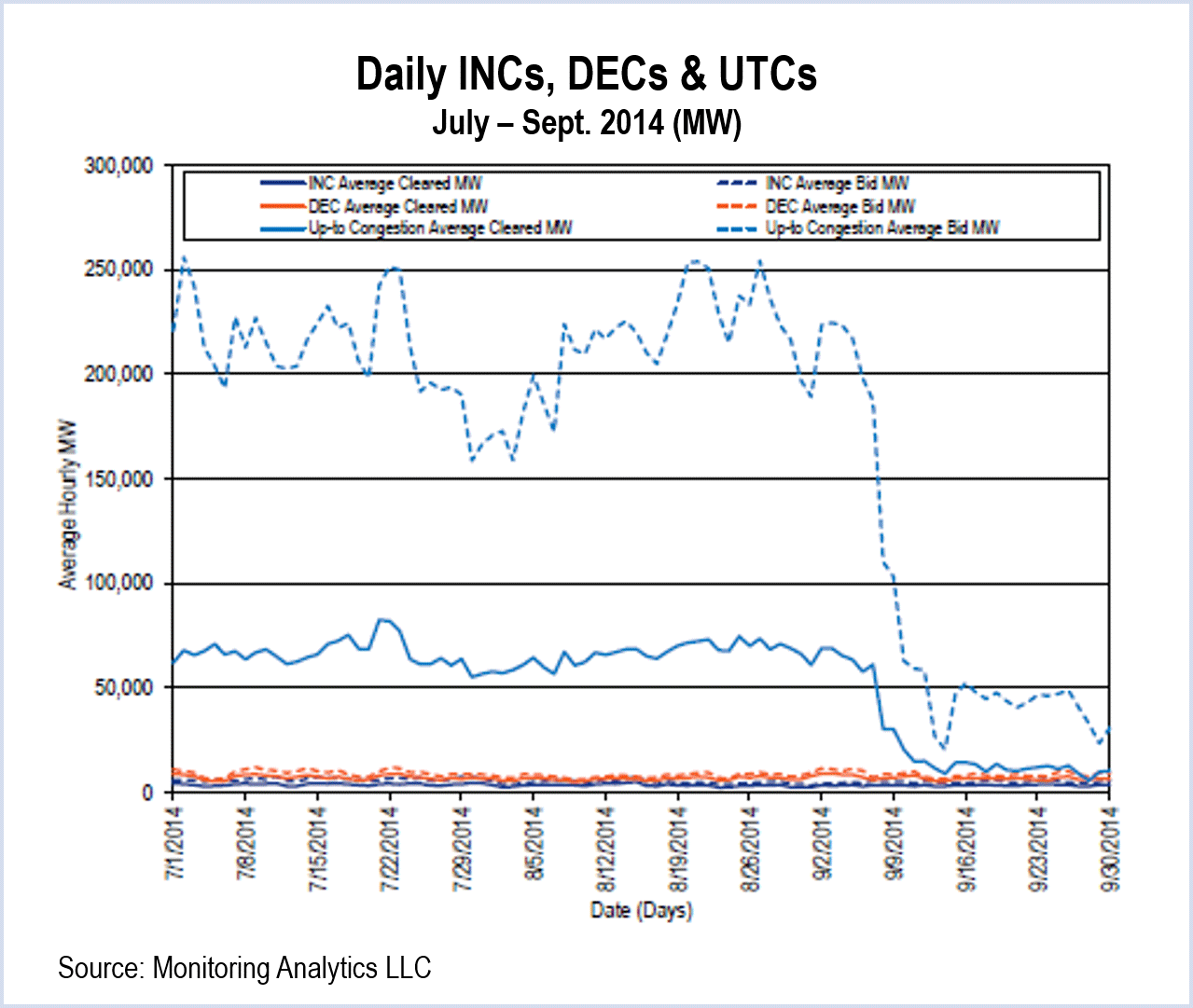

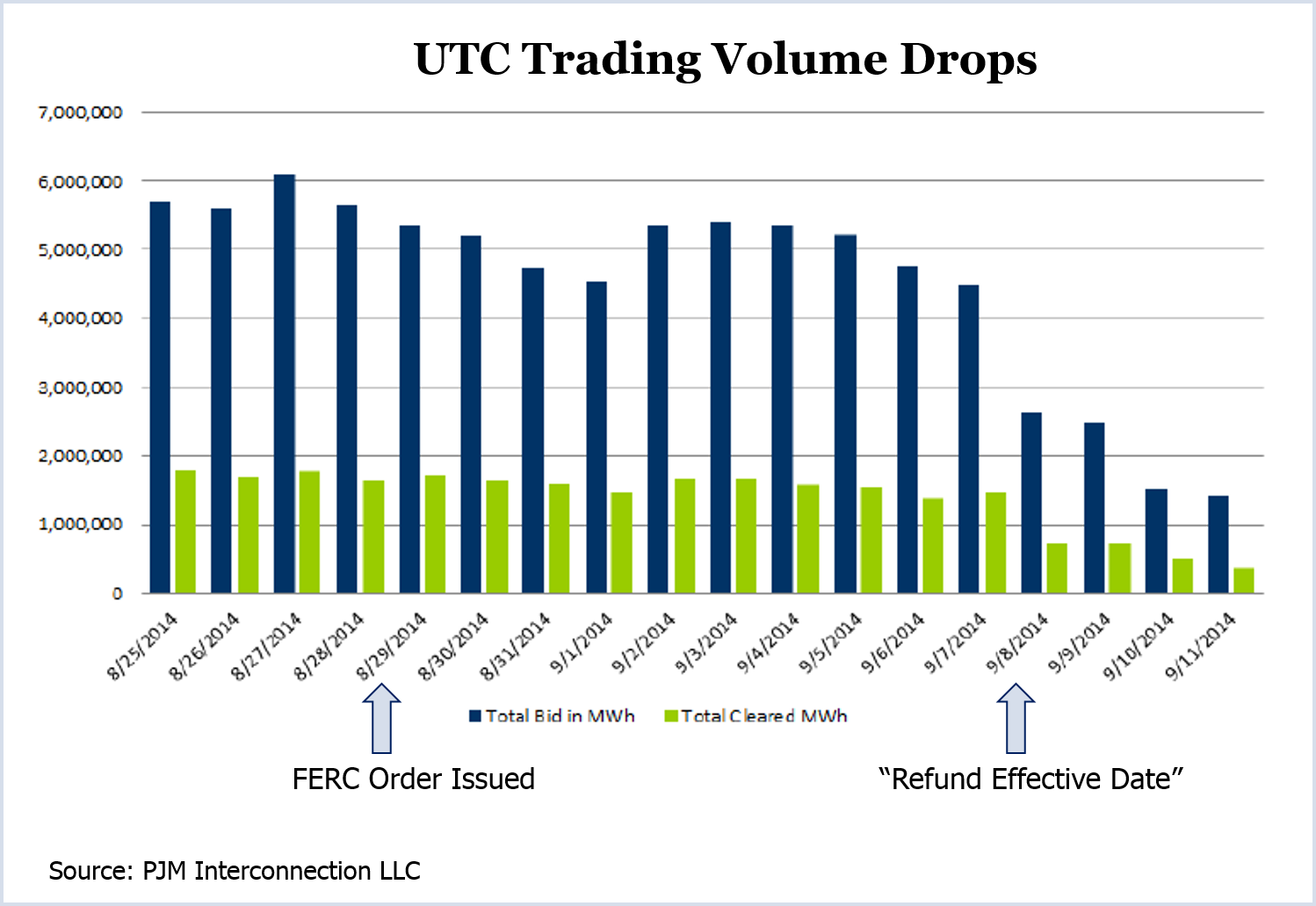

Up-to-congestion (UTC) trading plummeted by about two thirds this week following a FERC order that could result in sharply increased costs for traders.

FERC ordered a review of PJM’s rules regarding up-to-congestion transactions (UTCs), saying the RTO may be discriminating in how it treats these trades.

Want more? Advanced Search