Joe Bowring

PJM presented a preliminary proposal to overhaul its capacity market to the Resource Adequacy Senior Task Force.

PJM stakeholders appeared split over proposals to delay the RTO’s capacity auctions to include market rule changes being considered by the Board of Managers.

Average PJM LMPs doubled to a record-high $80/MWh last year, driven mostly by coal and natural gas prices, the RTO’s Independent Market Monitor reported.

PJM’s Board of Managers is opening an accelerated stakeholder process to address rising reliability concerns about the RTO’s capacity market.

PJM and its IMM gave first reads of their proposals exploring whether generators should be permitted to recover upgrade costs for some critical facilities.

PJM's Independent Market Monitor has proposed a plan to eliminate performance assessment intervals and related penalties from the RTO’s capacity market.

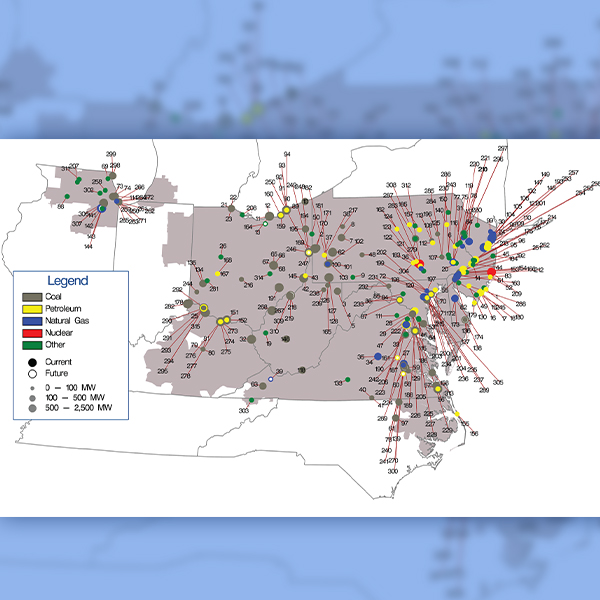

A new study found that interconnection costs have been steadily rising for decades in the PJM region and are disproportionately high for renewable resources.

PJM backtracked on posting “indicative” results of the 2024/25 capacity auction in the face of stakeholder opposition.

PJM said it will ask FERC to modify the rules of its 2024/25 capacity auction to avoid artificially high prices in one region of the RTO.

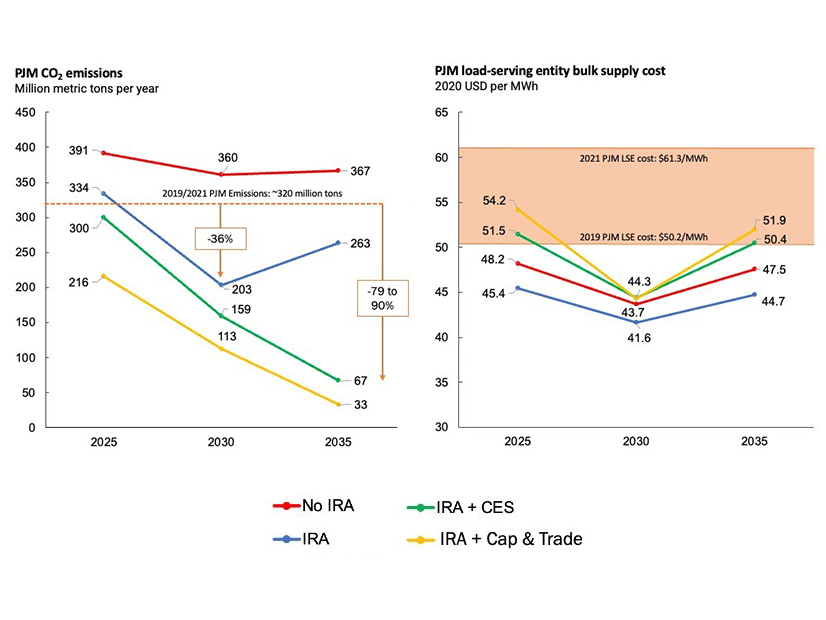

A new study projects that the Inflation Reduction Act will reduce PJM’s carbon emissions while delivering more affordable power.

Want more? Advanced Search