mergers and acquisitions

FERC upheld its approval of Constellation Energy’s purchase of Calpine while also addressing arguments from consumer and environmental groups.

FERC approved Duke's proposal to combine its two subsidiaries in the Carolinas, which have been in place since its merger with Progress Energy closed in 2012.

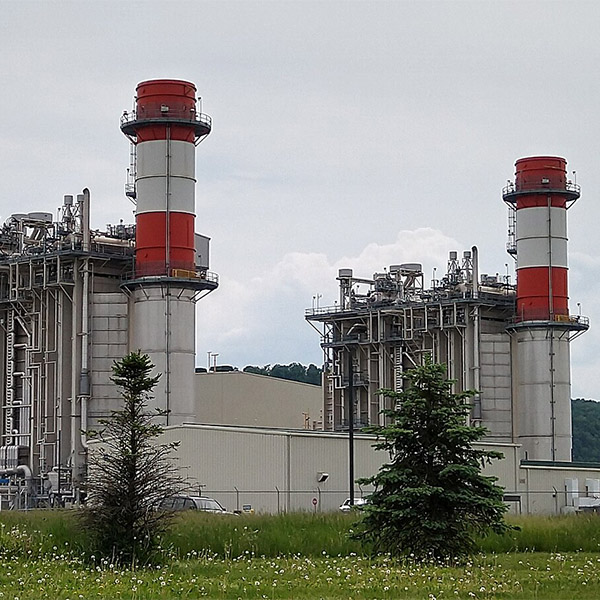

Vistra is paying $4 billion to acquire a fleet of natural gas plants in PJM, ISO-NE and ERCOT.

FERC approved LS Power’s deal to sell 12.9 GW of its gas generation in PJM, NYISO and ISO-NE, as well as its 6-GW demand response business, CPower, to NRG Energy for $12 billion.

The Minnesota Public Utilities Commission approved the $6.2 billion sale of Allete to BlackRock’s Global Infrastructure Partners and the Canada Pension Plan Investment Board.

PJM's IMM is pushing for limits on NRG after it completes its deal with LS Power to prevent its exercise of market power, but the firm argues they are unneeded and the Monitor has failed to show its math

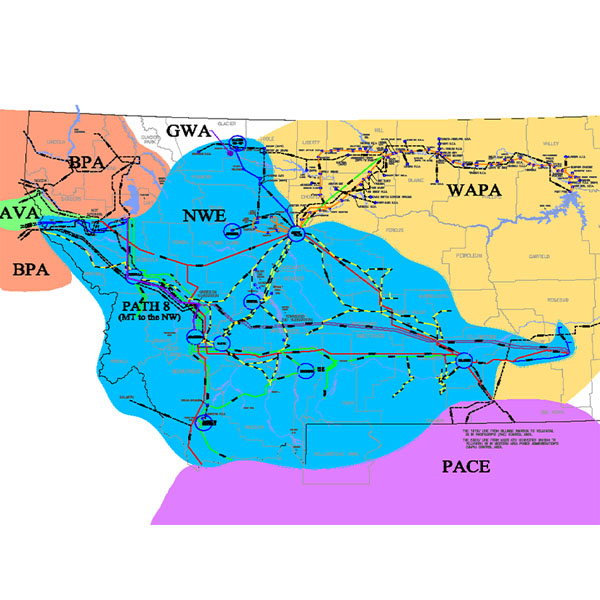

The proposed merger between Black Hills Corp. and NorthWestern Energy likely will reshape the map in the competition between CAISO’s Extended Day-Ahead Market and SPP’s Markets+ — but it’s still too early to know where new boundaries will be drawn.

FERC approved Constellation's purchase of Calpine, which will create an even bigger IPP with nearly 60 GW around the country, with the biggest share of that in PJM.

As part of its review for the Constellation-Calpine merger, DOJ asked PJM for a major trove of market data as it looks into the region where the two firms' operations overlap the most.

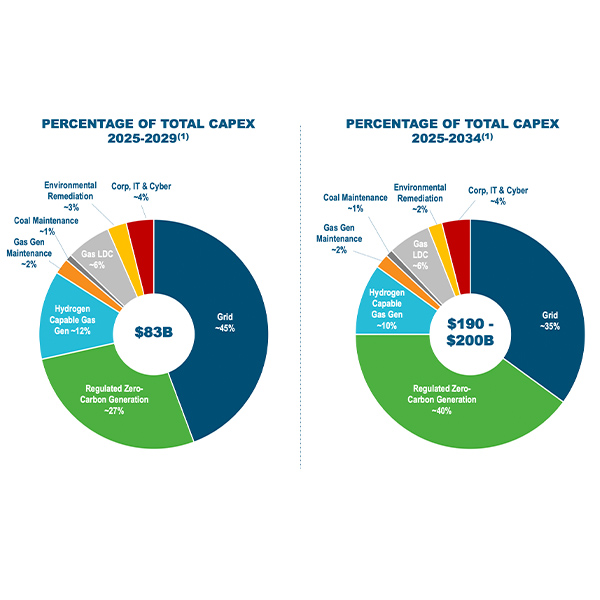

Duke Energy described plans to invest up to $200 billion in the next decade to meet demand growth across its multiple utilities during an earnings call for the first quarter of 2025.

Want more? Advanced Search