Midcontinent Independent System Operator (MISO)

Effort seeks to expedite development of the gigawatt-scale generation, transmission and grid infrastructure needed to support large-scale data centers and AI development.

FERC approved MISO’s proposal to increase the number of generation projects it may study under its expedited interconnection queue lane from 10 to 15 per quarter.

MISO is to roll out a new transmission warning declaration to give its members advanced notice when scarce transmission capacity is raising the risk of load shed.

Multiple transmission owners have questioned the need behind a suggestion that MISO work more checks into its process for reviewing troubled transmission projects.

MISO South states have signaled their intent to strike out on their own on a cost allocation design for long-range transmission projects located exclusively in the South subregion.

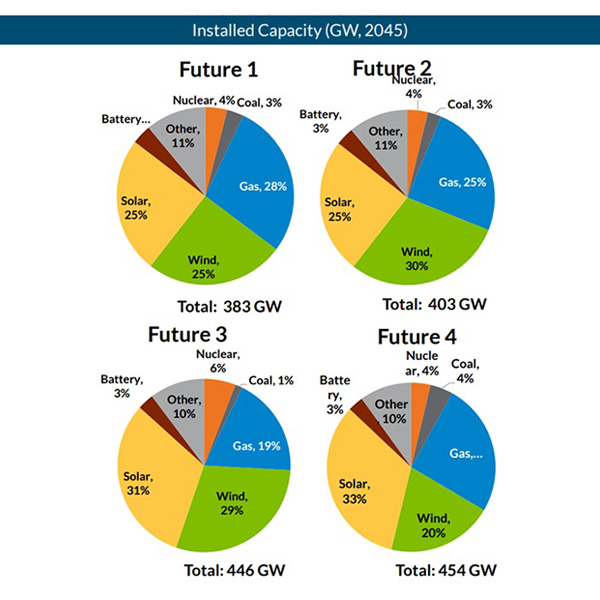

MISO predicts it will have anywhere from 383 GW to 454 GW of installed capacity its footprint by 2045, according to a preliminary version of its 20-year planning futures.

Environmental groups are further pressing their opposition to MISO's and SPP’s fast-track studies for primarily fossil fuel projects, challenging both at the D.C. Circuit in a pair of lawsuits.

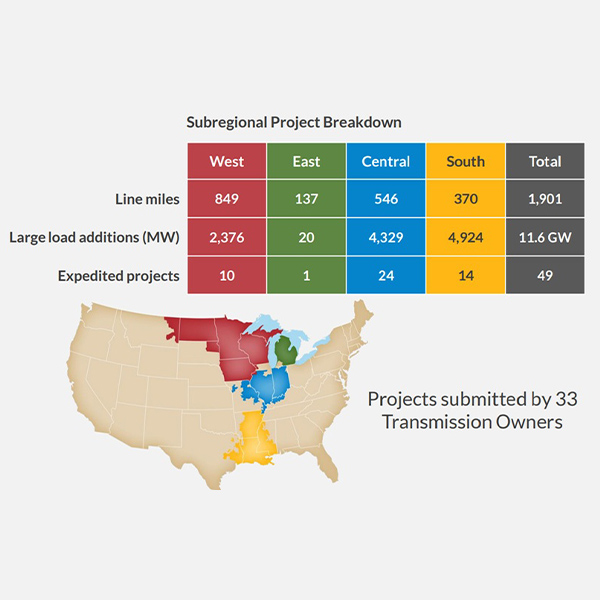

A MISO board committee advanced 432 projects from transmission owners at a cost of almost $12.3 billion under the RTO’s 2025 Transmission Expansion Plan.

FERC greenlit MISO’s plan to require its demand response to make real-world demand reductions to fulfill the RTO’s testing requirements.

The U.S. Department of Energy has reupped a coal-fired power plant in Michigan for another 90-day operations period, preventing its planned retirement for a third time.

Want more? Advanced Search