minimum offer price rule (MOPR)

FERC wants PJM’s capacity rules to be resolved by Jan. 4 and has dispatched staff to help the RTO and its stakeholders adhere to that timeline.

The D.C. Circuit denied a petition to review FERC allowing ISO-NE to exempt a limited volume of state-sponsored renewable power resources from its MOPR.

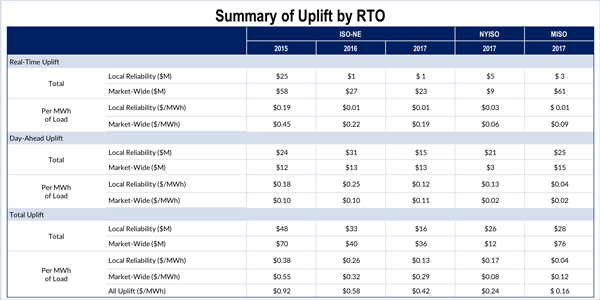

High uplift costs, market power and the capacity market highlighted the External Market Monitor’s concerns in the ISO-NE State of the Market report.

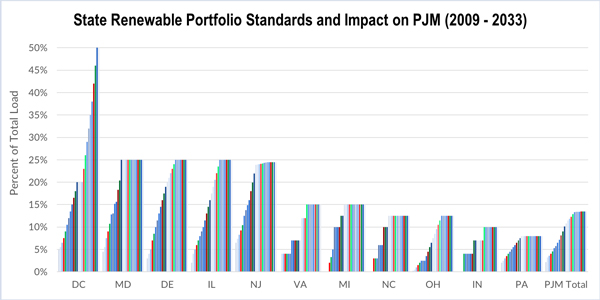

Rising state subsidies for renewable and nuclear power require PJM to revamp its MOPR to address price suppression in its capacity market, FERC ruled.

Three owners of gas-fired generation in PJM’s territory have filed a complaint asking FERC to direct the RTO to adopt what they’ve termed a “clean MOPR.”

Comments on PJM’s “jump ball” proposals for protecting the capacity market from subsidized resources were almost uniformly negative.

FERC Commissioner Robert Powelson said that he sees an “erosion of confidence” in RTO stakeholder processes.

A three-judge panel of the D.C. Circuit Court of Appeals questioned FERC over its approval of ISO-NE’s renewable exemption from the MOPR.

PJM filed with FERC to consider both its two-stage capacity repricing proposal and its Market Monitor’s plan to expand the minimum offer price rule (MOPR).

FERC approved ISO-NE’s two-stage capacity auction to accommodate state renewable energy procurements.

Want more? Advanced Search