minimum offer price rule (MOPR)

The PJM Board of Managers have approved the RTO’s proposed replacement for the extended minimum offer price rule, sending it to FERC.

ISO-NE and NEPOOL kicked off a two-day meeting with a session strictly devoted to discussing removing the MOPR from the capacity market.

For the first time in more than a year, regulators from PJM and NYISO joined in person for the MACRUC annual Education Conference.

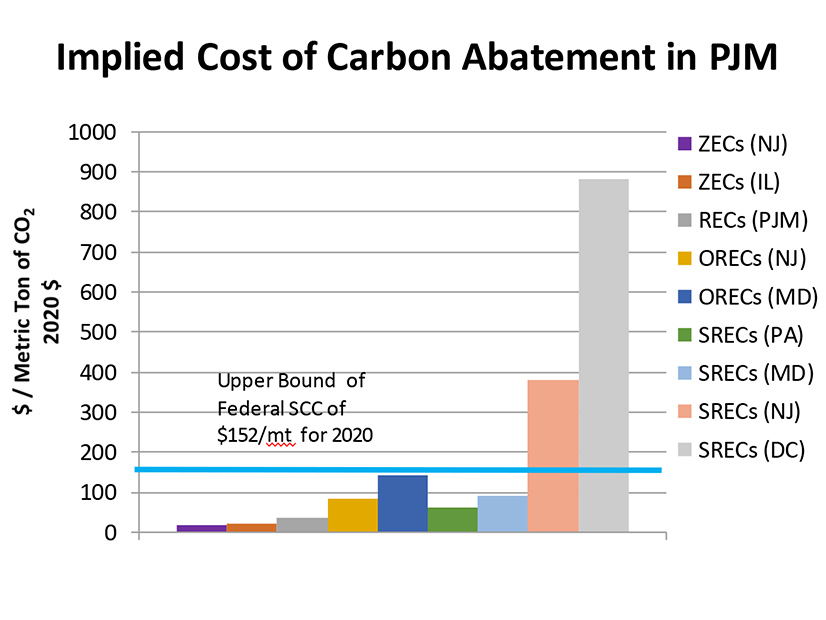

PJM stakeholders voted overwhelmingly in support of the RTO’s proposal to eliminate a capacity market rule that undermined state decarbonization efforts.

According to a report from the External Market Monitor, energy prices and uplift costs in ISO-NE are higher compared to other RTO markets.

A panel during the quarterly meeting of ISO-NE's Consumer Liaison Group discussed the removal of the minimum offer price rule.

ISO-NE and stakeholders formally started work on eliminating the minimum offer price rule at a two-day meeting of the NEPOOL Market Committee.

FERC accepted parts of the ISO-NE and NEPOOL “jump ball” filing on offer review trigger price values in a ruling issued late Monday.

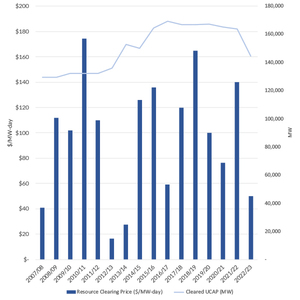

The early impacts of PJM’s first capacity auction in three years began to emerge Thursday as Exelon reiterated plans to retire two of its nuclear plants.

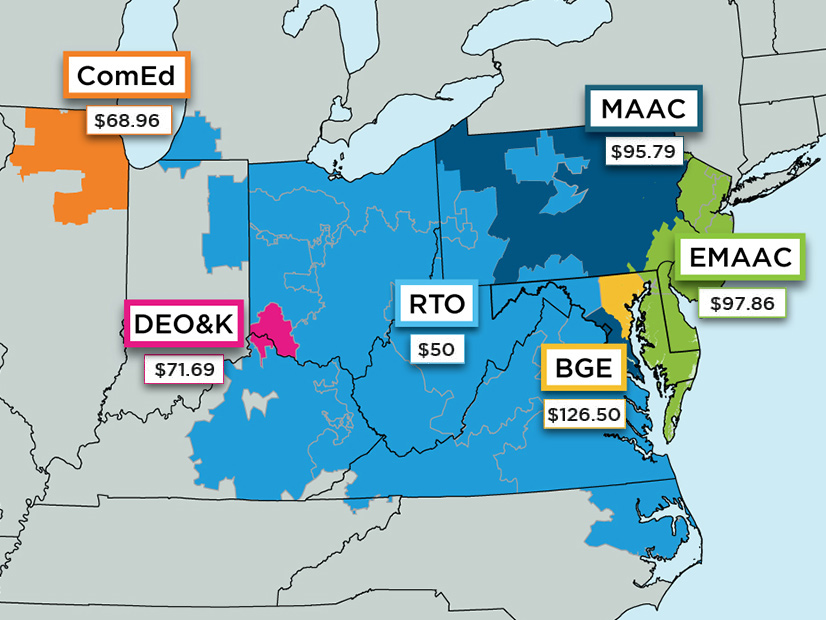

Capacity prices in most of PJM dropped by nearly two-thirds for 2022/23, with EMAAC and SWMAAC recording their lowest prices ever.

Want more? Advanced Search