MISO Board Week

MISO and its Monitor tracked a rise in energy consumption in fall 2025 and reviewed some operational rough patches, while the RTO explained why its machine-learning risk predictor remains a work in progress.

MISO members don’t doubt that large loads will turn up at the beginning of the next decade and are occupied with how the industry can make sure ratepayers don’t subsidize supersized customers.

MISO opened another review of a second project from its first long-range transmission plan portfolio, prompted again by construction cost overruns.

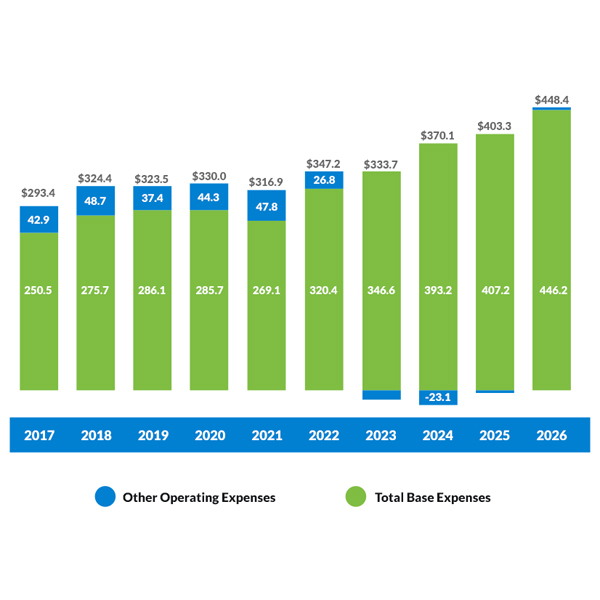

MISO said its 2026 budget requires an increase of more than 11% over 2025’s.

MISO’s Advisory Committee will continue to be led by its vice chair through the end of 2025 after the departure of Sarah Freeman from Indiana’s regulatory agency.

MISO is poised to retain two of its term-limited board members in 2026 while adding an executive from a federal power marketing agency.

MISO’s Board of Directors has asked the RTO’s Independent Market Monitor to better explain its $10.6 million 2026 budget before it agrees to the amount.

MISO said 2025 was the most demanding summer since 2012, though it steered the grid with only a single maximum generation event.

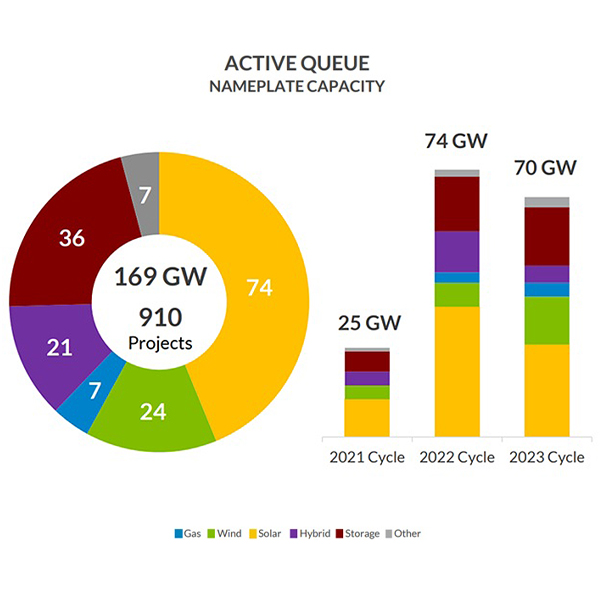

MISO’s generator interconnection queue has fallen to 215 GW as developers cut back on projects in response to the federal phaseout of renewable energy tax incentives, RTO leadership said.

MISO’s Independent Market Monitor said the recently uncovered, eight-year-old repeat error in the RTO’s capacity market that caused a $280 million impact in this year’s auction alone is unfortunate but insisted the resulting prices were efficient.

Want more? Advanced Search