Monitoring Analytics

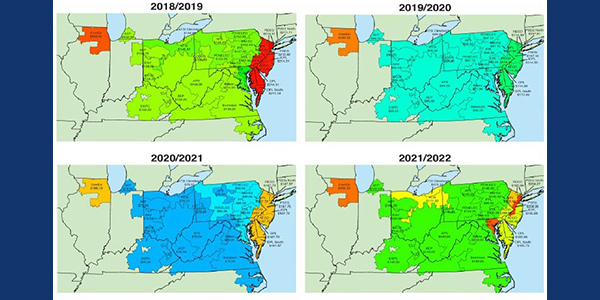

PJM’s Monitor sounded alarms about market power in the energy and capacity markets and said it may intervene in the RTO’s next capacity auction.

PJM's Monitor urged the RTO not to rush into making changes to its capacity market before the approved design is given a chance to succeed.

Stakeholders challenged PJM and its Monitor over updates to the RTO’s black start capital recovery factor table.

PJM’s Monitor opened another front in its bid to strengthen its market power rules, challenging the renewals of rate authorizations in 14 dockets.

PJM has responded to the Market Monitor’s annual State of the Market Report, highlighting five different areas of focus out of hundreds of recommendations.

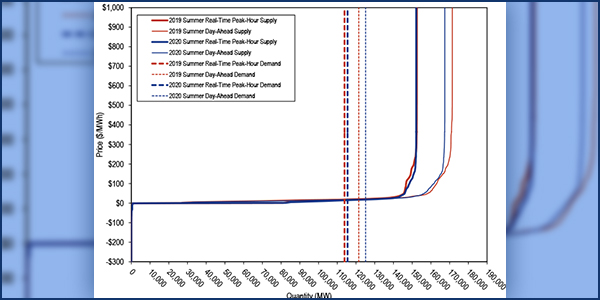

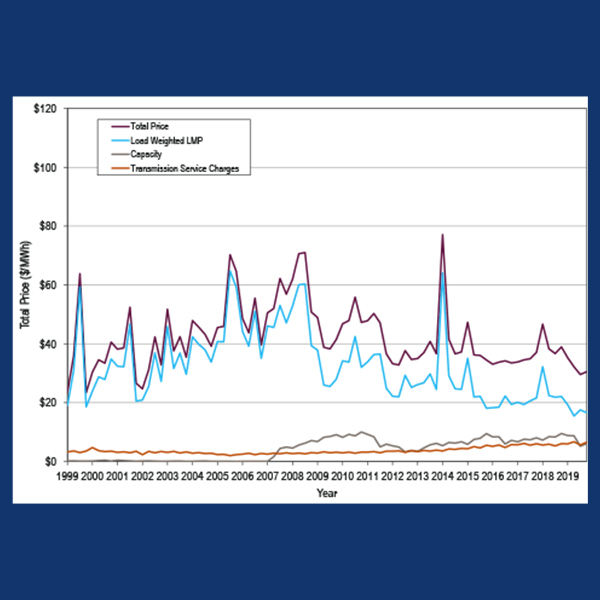

PJM’s first-quarter energy prices fell to their lowest level since the RTO was created in 1999, according to the Monitor’s State of the Market report.

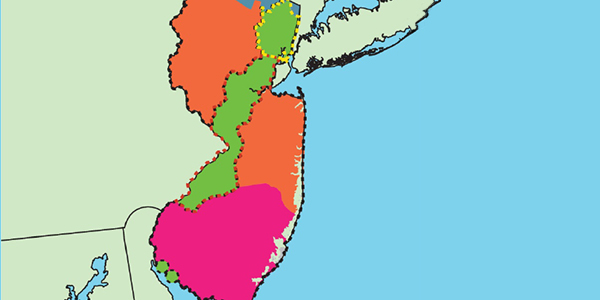

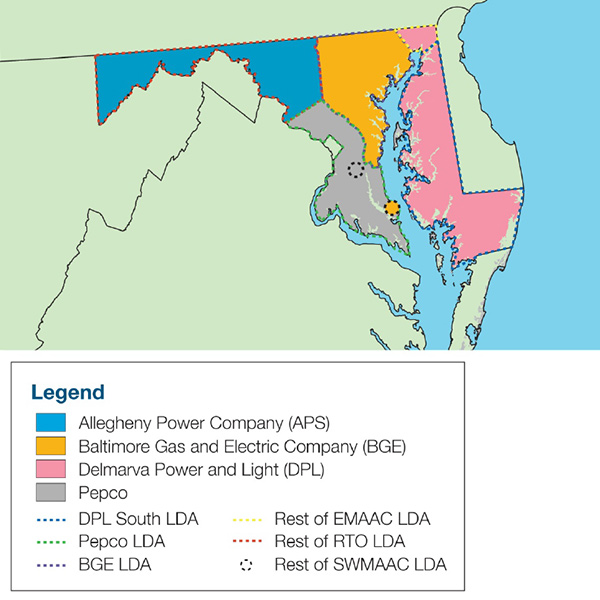

PJM’s Monitor released a report concluding that New Jersey ratepayers would likely see costs increase if the state left the RTO’s capacity market.

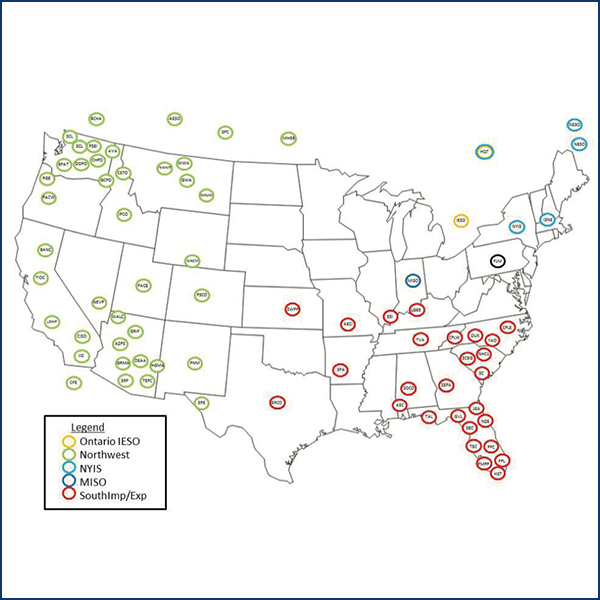

PJM and its Monitor shared with stakeholders their proposals for responding to FERC’s directive that state default service auctions be subject to the MOPR.

PJM’s Monitor defended a conclusion that ratepayers are likely to see cost increases in jurisdictions that exit the capacity market and adopt the FRR option.

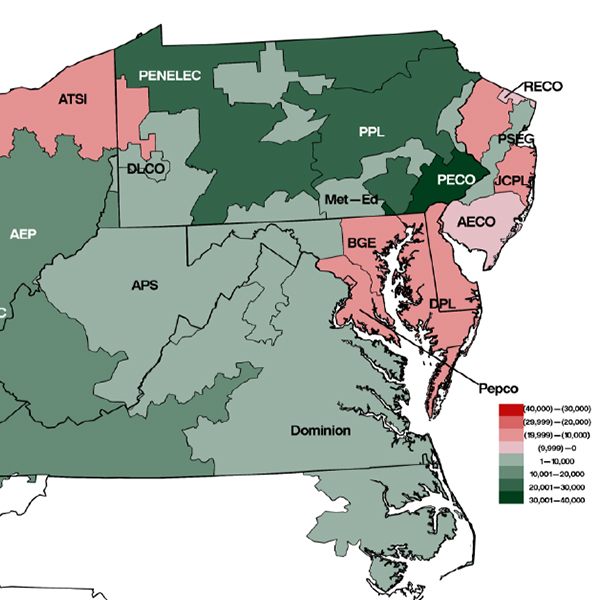

The average load-weighted, real-time LMP in PJM was $27.32/MWh last year, a 28.6% decrease from 2018 and the lowest in the RTO’s 21-year history.

Want more? Advanced Search