must-offer obligation

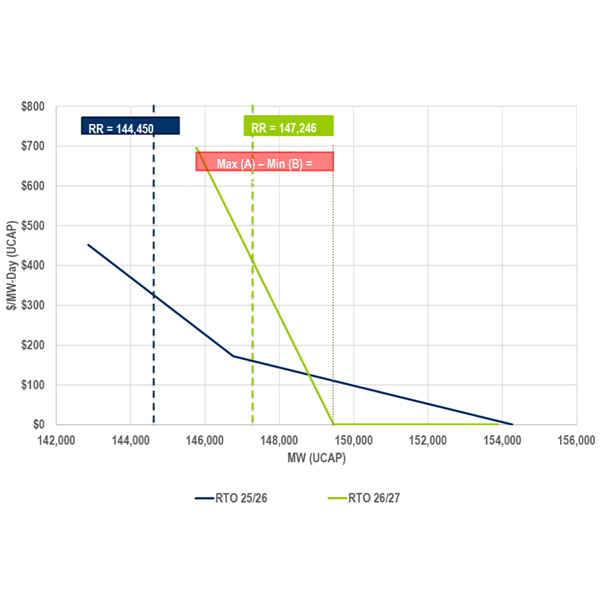

PJM's Markets and Reliability Committee and Members Committee will be asked to endorse the recommended IRM and FPR values for the 2028/29 BRA.

Responding to opposition from suppliers, IESO said it will not include a termination option in its procurement for long lead-time resources.

PJM presented stakeholders with proposed manual revisions to implement a requirement that dual-fuel generators must offer schedules with both of their fuels into the energy market during the winter, as well as changes to the operational and seasonal testing for capacity resources.

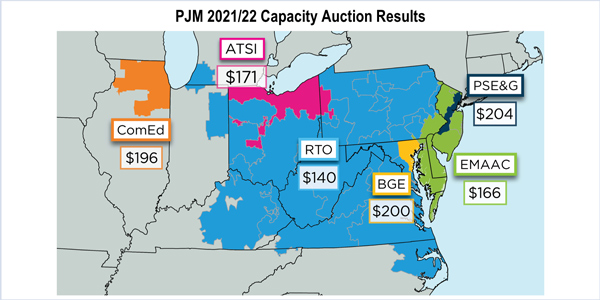

PJM heads into 2025 with several proposals before FERC seeking to rework its capacity market and generator interconnection queue, while stakeholders work on an expedited Quadrennial Review of the market and changes to resource accreditation.

PJM's Adam Keech told the Market Implementation Committee the RTO plans to file governing document revisions with FERC to expand the requirement that resources must offer into the capacity market to also apply to all resources holding capacity interconnection rights.

Several state consumer advocates filed a complaint at FERC alleging PJM’s capacity market is failing to mitigate market power, overestimating future load and producing high clearing prices that generation owners cannot act on.

The PJM Market Implementation Committee endorsed Manual 18 revisions that implement the new must-offer exception process approved by FERC last month.

PJM’s concerns over FTR underfunding on projects with incremental auction revenue rights won’t be addressed through any Operating Agreement revisions.

PJM generators seeking must-offer exceptions will lose their capacity interconnection rights unless they meet CP requirements changes approved by FERC.

The MRC approved a proposal to strip capacity interconnection rights from generators that do not meet Capacity Performance requirements.

Want more? Advanced Search