offer cap

FERC approved a PJM proposal to limit capacity prices to between $175 and $325/MW-day for the next two Base Residual Auctions, resolving a complaint from Pennsylvania Gov. Josh Shapiro.

PJM announced it will seek to establish a $325/MW-day price cap on capacity prices and a $175/MW-day floor for the 2026/27 and 2027/28 Base Residual Auctions following discussions with Pennsylvania Gov. Josh Shapiro to resolve a complaint he filed over increased capacity costs.

FERC accepted CAISO’s proposal to allow for storage resources to bid above the ISO’s $1,000/MWh soft offer cap in the real-time market to account for their intraday opportunity costs.

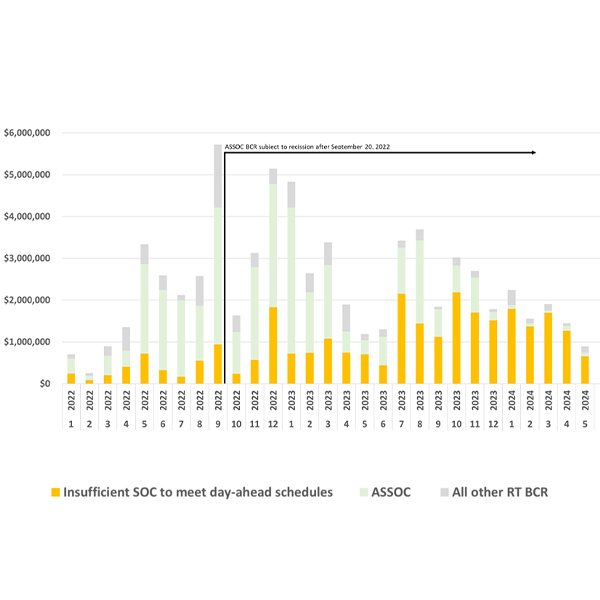

Batteries may be receiving excessive or inefficient bid cost recovery payments in CAISO, an issue that could be exacerbated by the ISO’s recent move to increase its soft offer cap to allow for higher bids by storage resources.

The D.C. Circuit directed FERC to review a series of 2022 orders requiring wholesale electricity sellers in the West to refund a portion of the high prices they earned during an August 2020 heat wave.

The Texas Supreme Court ruled ERCOT and the Public Utility Commission were within the law when they raised wholesale prices to more than 300 times above normal during Winter Storm Uri.

CAISO’s Board of Governors and WEIM Governing Body unanimously voted to approve an expedited proposal to increase the ISO’s soft offer cap from $1,000/MWh to $2,000.

CAISO is proposing to raise the soft offer cap in its market from $1,000/MWh to $2,000 to accommodate the bidding needs of battery storage and hydro resources in time for operations this summer.

The Texas PUC exercised its newfound authority to bypass ERCOT’s stakeholder process and direct utilities to add a second circuit to an existing line.

CAISO won FERC approval for its second effort to allow generators to recover the costs of higher natural gas prices.

Want more? Advanced Search