operating reserve demand curve (ORDC)

Top utility executives urged PJM’s Board of Managers to act on price formation at its Feb. 12 meeting after stakeholders deadlocked on the issue last week.

PJM members were unable to reach consensus on any of five proposals to improve price formation for energy and reserves Thursday.

Calpine’s modification of PJM’s energy price formation proposal emerged as the first choice members will consider at Thursday’s Markets and Reliability Committee meeting.

A summary of the issues scheduled to be brought to a vote at the PJM Markets and Reliability (MRC) and Members committees (MC) on Jan. 24, 2019.

The mothballing of a coal-fired plant has reduced ERCOT’s reserve margin of 8.1% to 7.4%, prodding the Texas PUC into ordering market changes.

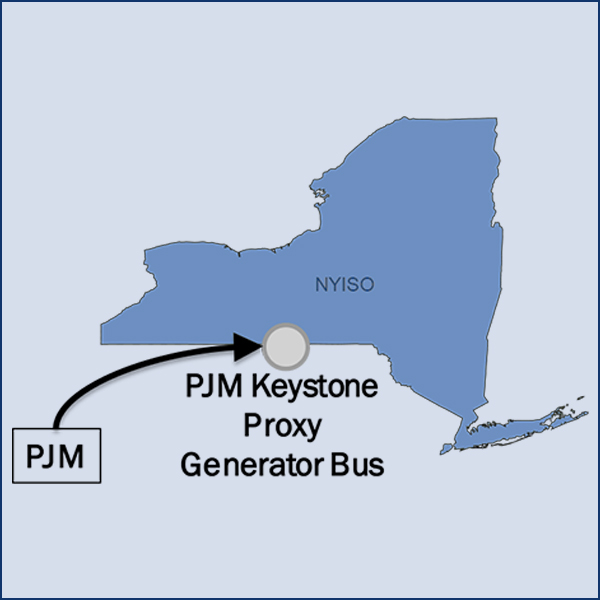

The working group charged with shepherding carbon pricing into New York’s wholesale electricity market discussed how to handle import/export transactions.

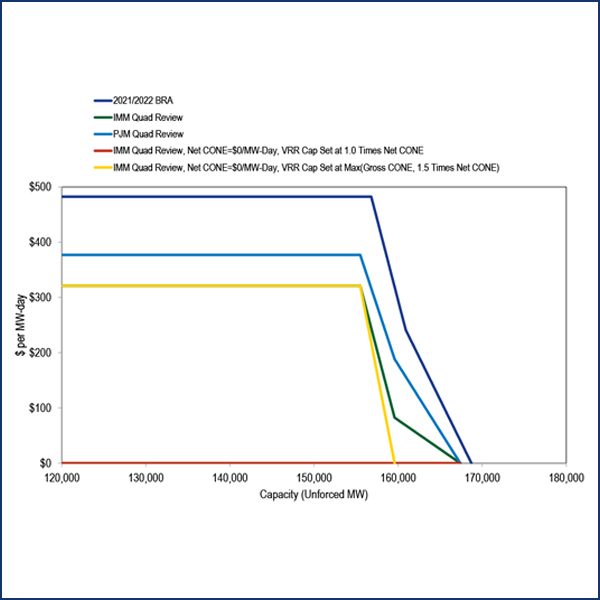

Independent Market Monitor Joe Bowring said PJM’s proposed revisions to how it prices reserves necessitates changes in the capacity market.

PJM stakeholders appeared resigned to a unilateral FERC filing by the Board of Managers revising the RTO’s proposed price formation rules.

ERCOT is preparing to take on the Texas heat again in 2019 with reserve margins that have shrunk even further than last summer's.

PJM CEO Andy Ott responded to concerns about the Board of Managers’ recent ultimatum around price formation, and stakeholders offered additional ones.

Want more? Advanced Search