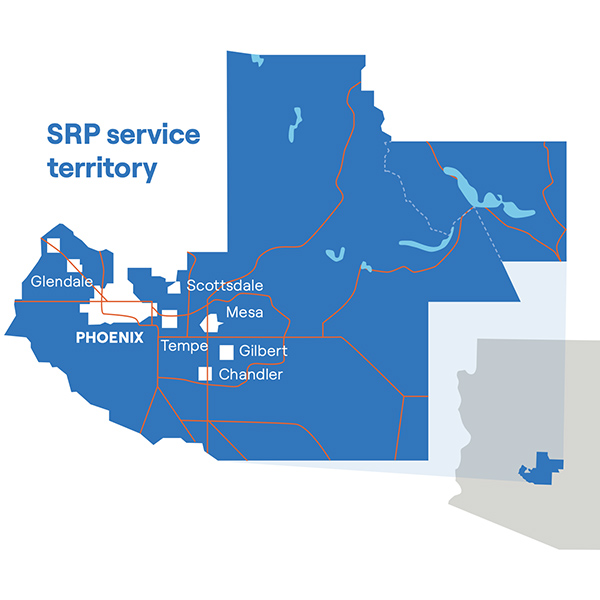

Salt River Project (SRP)

Two Arizona utilities received approval to convert coal-fired power plants to run on natural gas, projects they say will enhance grid reliability, reduce emissions and preserve jobs.

Arizona Public Service would save $110 million/year by joining CAISO's Extended Day-Ahead Market rather than SPP's Markets+, a new analysis found.

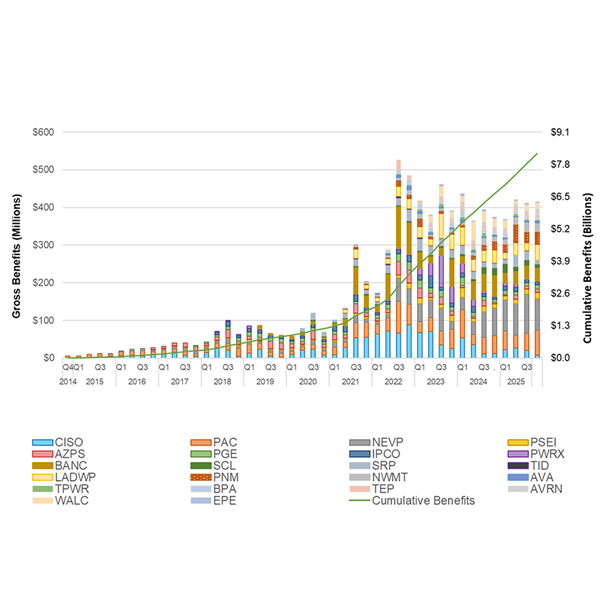

CAISO’s Western Energy Imbalance Market surpassed $8 billion in cumulative economic benefits since its 2014 launch after providing participants with $415.65 million in gross benefits in the fourth quarter of 2025, according to an ISO report.

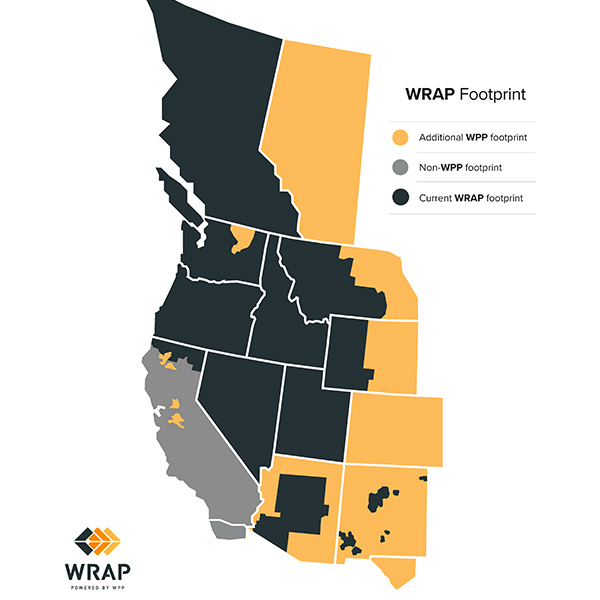

The Western Power Pool’s WRAP secured enough participants for the program to enter the first binding phase after 11 utilities reaffirmed their commitment.

SRP and Google are partnering to study the real-world performance of non-lithium-ion, long-duration energy storage technologies.

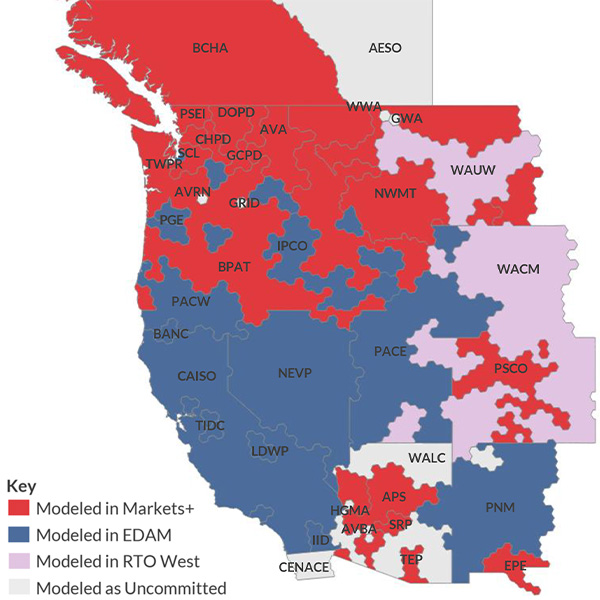

Four Western utility executives participating in an Energy Bar Association webinar presented their reasoning for why they ultimately chose either SPP’s Markets+ or CAISO’s EDAM, with some eyeing the creation of a full regional transmission organization in the future.

The development of SPP's Markets+ has picked up the pace with stakeholders agreeing on an interim governance structure and representation on the working groups that will handle much of the effort ahead.

CAISO’s Western Energy Imbalance Market provided participants with $422.44 million in economic benefits during the second quarter of 2025, up 15% compared with the same period year earlier despite no change in membership.

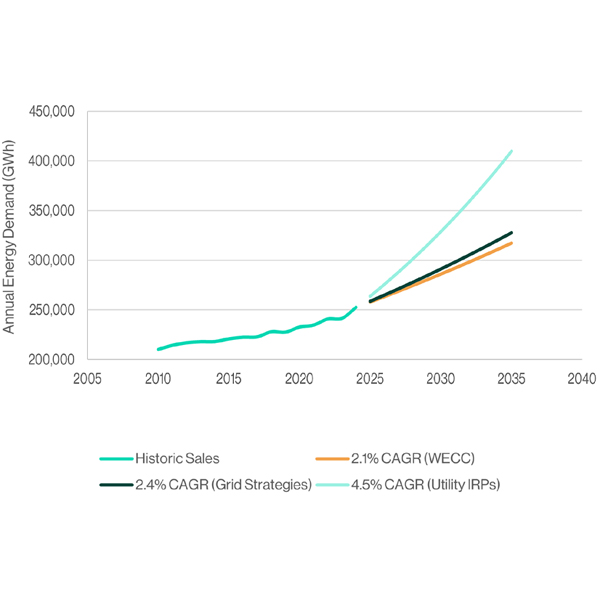

With data centers contributing to surging load growth, a new report suggests that more Western utilities should adopt clean transition tariffs or even make the tariffs mandatory for certain large customers.

Even in its nonbinding phase, the Western Power Pool’s Western Resource Adequacy Program has been a valuable tool for working toward resource adequacy goals, program participants said.

Want more? Advanced Search