Southwest Power Pool (SPP)

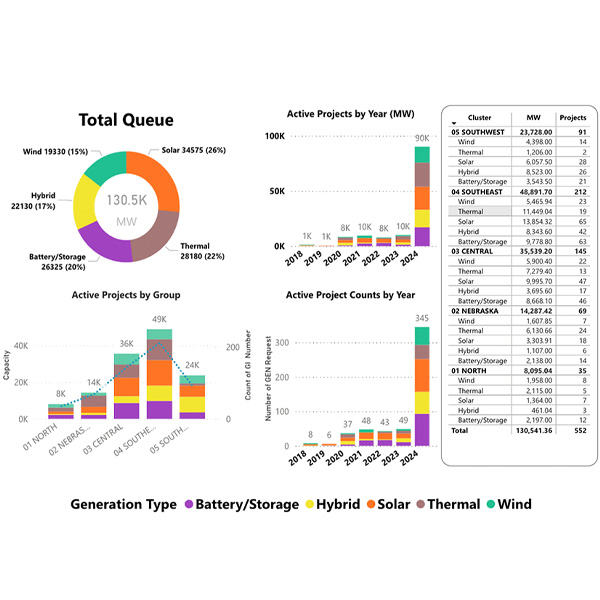

SPP says it has cleared its backlog of generator interconnection requests that date back to 2018, paving the way for a transition to its “first-in-the-country” Consolidated Planning Process.

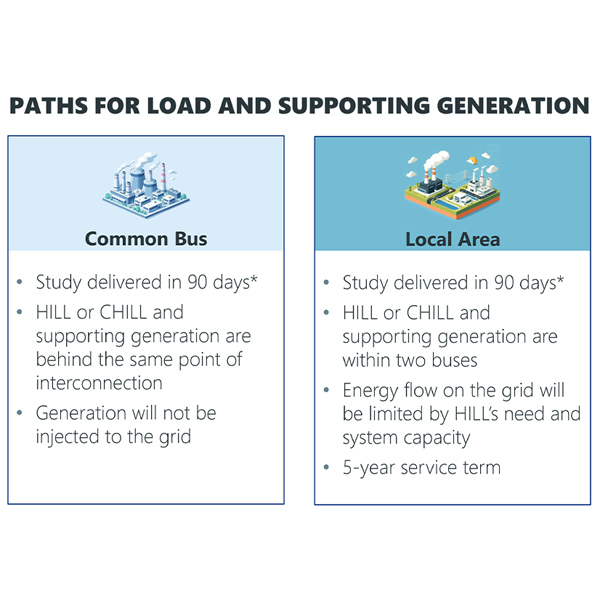

SPP’s Board of Directors has approved a pair of contentious measures that were put aside during its August quarterly meeting, a tariff change to integrate and operate high-impact large loads and a revised cost estimate for a 765-kV transmission project.

SPP and its members are working together on a draft 765-kV transmission overlay as part of its 2025 Integrated Transmission Planning assessment that will dwarf 2024's record study.

CAISO’s EDAM clinched a set of wins when FERC approved the market’s revised congestion revenue allocation model and authorized participation for the EDAM’s first two members — PacifiCorp and Portland General Electric.

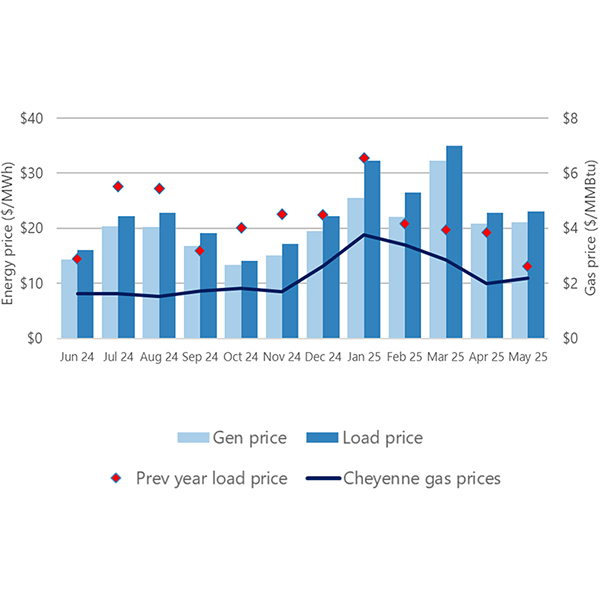

SPP’s Market Monitoring Unit says in its latest report that the Western Energy Imbalance Service market’s average load energy prices rose “significantly” during the spring quarter of 2025.

Vice Chair Ray Hepper has been serving as the SPP Board of Directors' chair in place of John Cupparo, who is stepping away from the position's time requirements.

SPP stakeholders have approved a revised version of the grid operator’s fast-track study to integrate high-impact large loads during a special virtual meeting of the Markets and Operations Policy Committee.

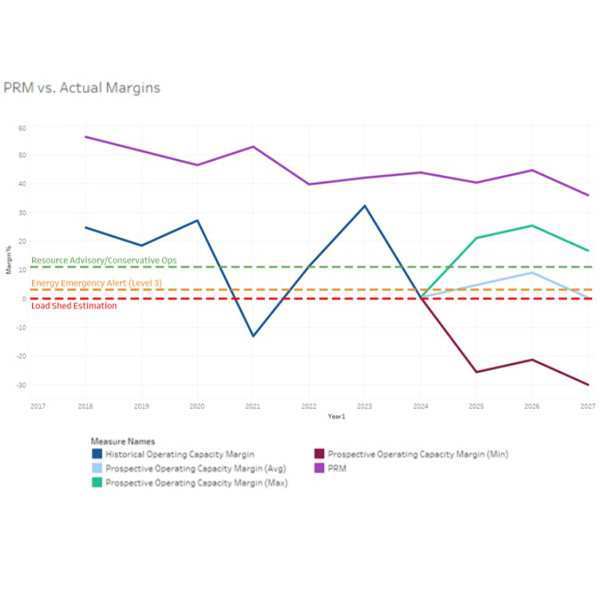

FERC has approved SPP’s tariff revision that establishes separate planning reserve margins for the summer and winter seasons, saying it will provide “more granularity” by recognizing the reliability differences between the two seasons.

The development of SPP's Markets+ has picked up the pace with stakeholders agreeing on an interim governance structure and representation on the working groups that will handle much of the effort ahead.

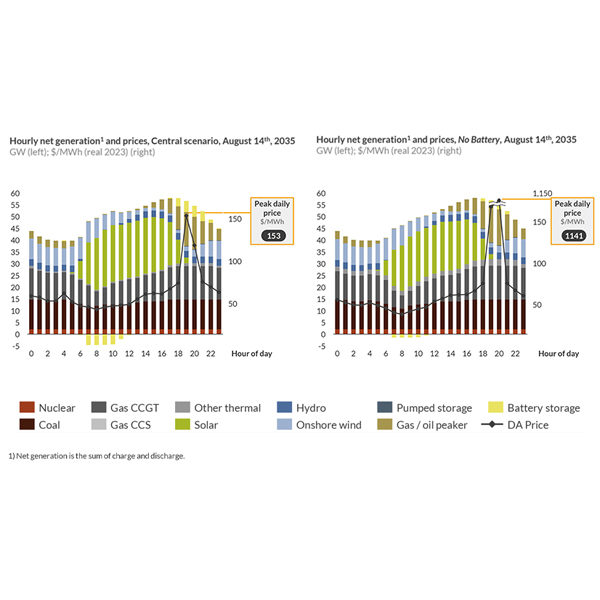

A new report urges SPP to accelerate its interconnection process and reform market rules to allow greater buildout of energy storage.

Want more? Advanced Search