SPP Markets+

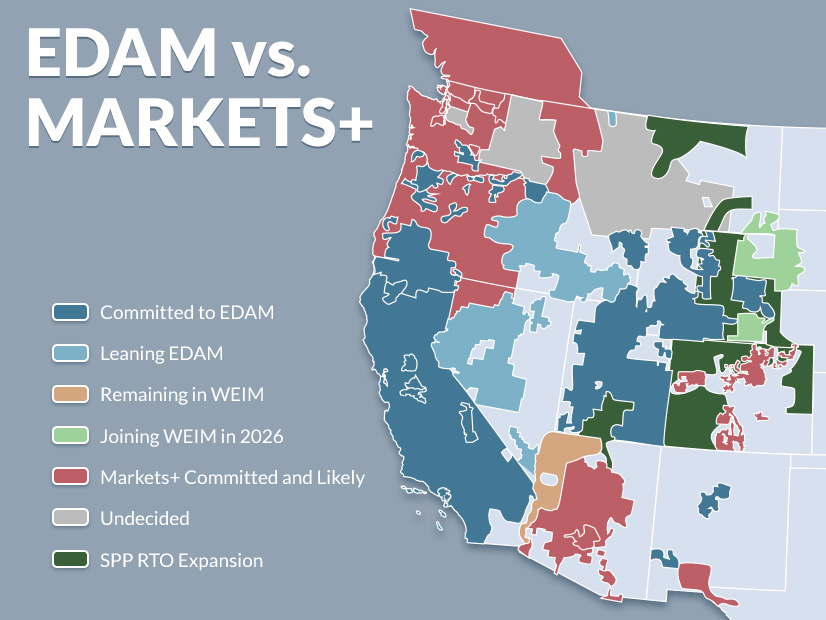

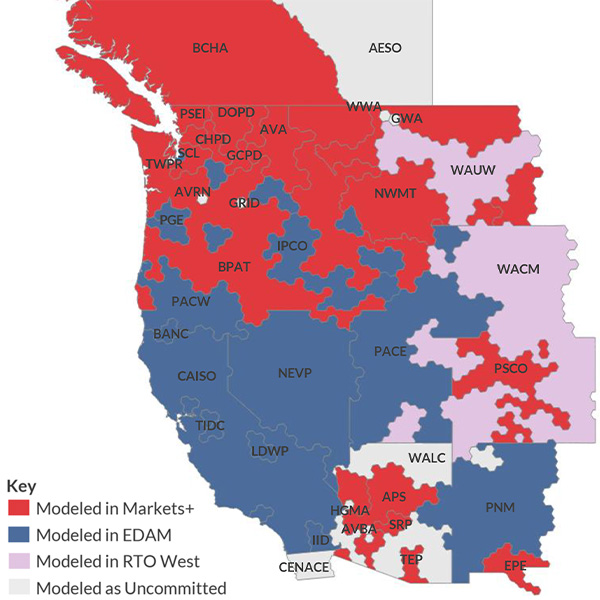

For the first time in years, California’s grip on Western market design is genuinely at risk, writes Nick Myers of the Arizona Corporation Commission.

Conversations remained cordial despite the ongoing competition between CAISO and SPP in the west as the RTOs’ top executives took the stage at Yes Energy’s annual EMPOWER conference.

SPP has secured two new commitments for its day-ahead Markets+, as Grant County Public Utility District and Tacoma Power in Washington state announced their intent to join.

Arizona Public Service would save $110 million/year by joining CAISO's Extended Day-Ahead Market rather than SPP's Markets+, a new analysis found.

The consequences of the Bonneville Power Administration’s decision to join SPP’s Markets+ could hit the Northwest sooner rather than later even though the agency has yet to formally join the market, a group of nonprofits suing it over the choice told the 9th U.S. Circuit Court of Appeals.

CAISO released a set of guiding principles for upcoming discussions about seams between the ISO, SPP and other entities as the Extended Day-Ahead Market nears its opening in May.

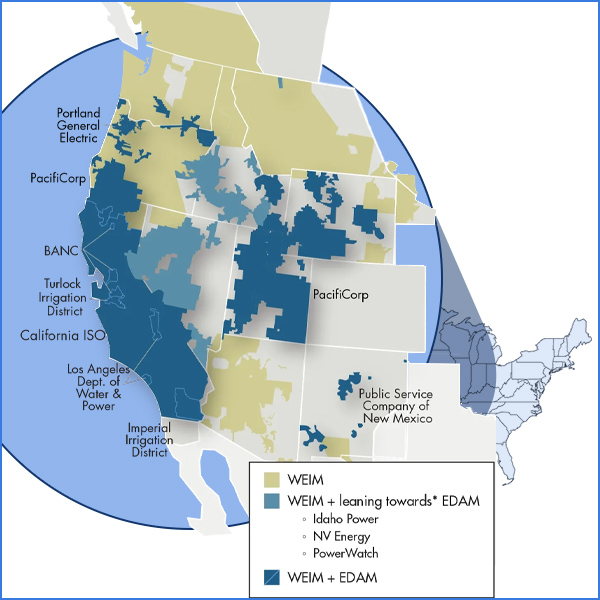

Some parties are urging Nevada regulators to wait until initial results are in for CAISO's Extended Day-Ahead Market before deciding whether to allow NV Energy to join.

CAISO leaders staged a virtual “town hall” to stress the importance of a smooth rollout to the ISO’s Extended Day-Ahead Market in May and promise to address market seams issues.

As the West appears to move toward two separate day-ahead markets, data center developers like Google and clean energy companies are investing with the intent to mitigate seams and ensure operational consistency, panelists at an Advanced Energy United webinar said.

SPP has hired former Idaho commissioner Kristine Raper as its senior director of state regulatory policy for the West.

Want more? Advanced Search