Western Resource Advocates

Though BPA removed any uncertainty by selecting SPP’s Markets+ over CAISO’s EDAM, the debate over whether BPA made the right choice likely will heat up as the West confronts a split into two major markets.

When Arizona utilities file their next integrated resource plans, they’ll be required to include an analysis of cost savings and other benefits they could realize from Western regional market participation.

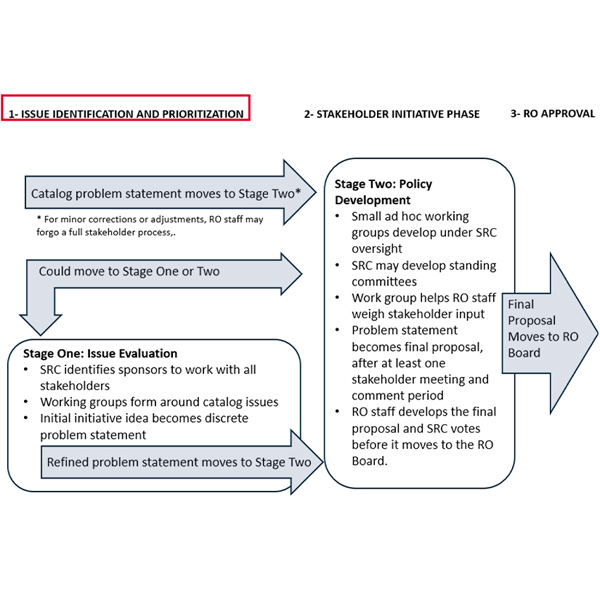

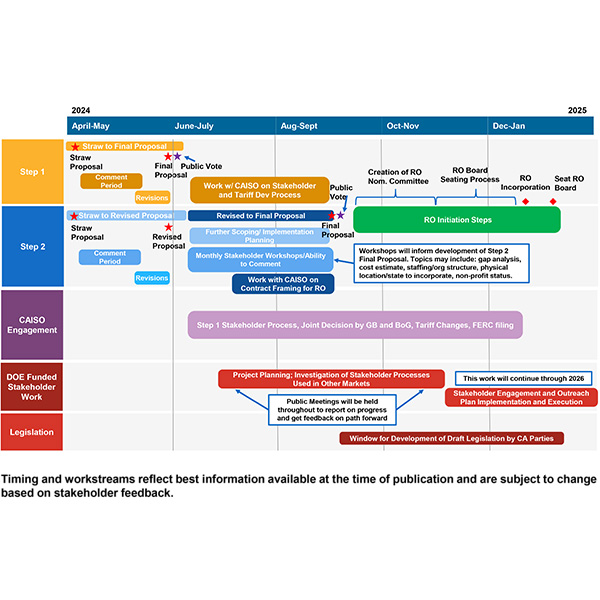

Stakeholder comments filed with the West-Wide Governance Pathways Initiative illustrate the complexity of building the new kind of Western regional organization envisioned by backers of the effort.

Colorado’s investor-owned utilities must compare available alternatives when asking regulators for approval to participate in an RTO or ISO, but not to join a day-ahead market.

Arizona regulators are under fire for decisions on the expansion of a UNS gas-fired plant and third-party IRP audits.

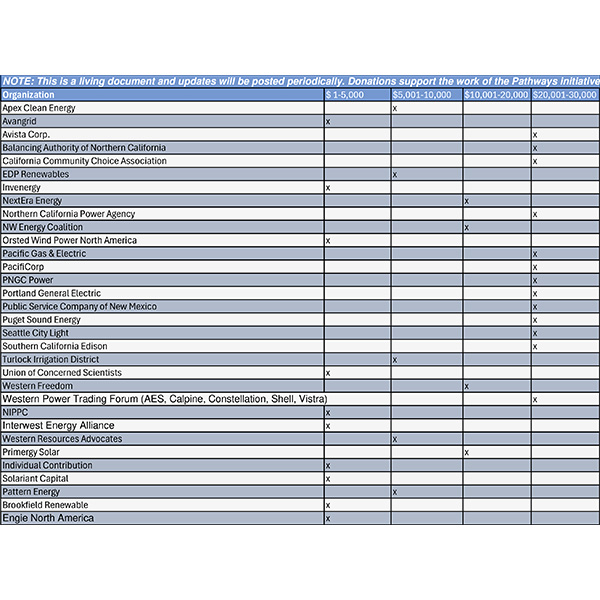

The West-Wide Governance Pathways Initiative applied for the money in January in response to a DOE Funding Opportunity Announcement, seeking two tranches of $400,000 each to be disbursed over two years to help support the effort build an independent Western RTO.

Backers of an initiative to create an independent Western RTO that builds on CAISO’s markets have floated a plan to untangle the snag that’s hung up past efforts to “regionalize” the ISO: a lack of independent governance.

Nevada regulators approved NV Energy’s plan to convert its last coal-fired power plant to natural gas, while also allowing the company to move forward with a $1.5 billion, 400-MW solar-plus-storage project.

SPP met a major milestone in its Western efforts as a Markets+ committee approved the day-ahead market’s proposed governing document.

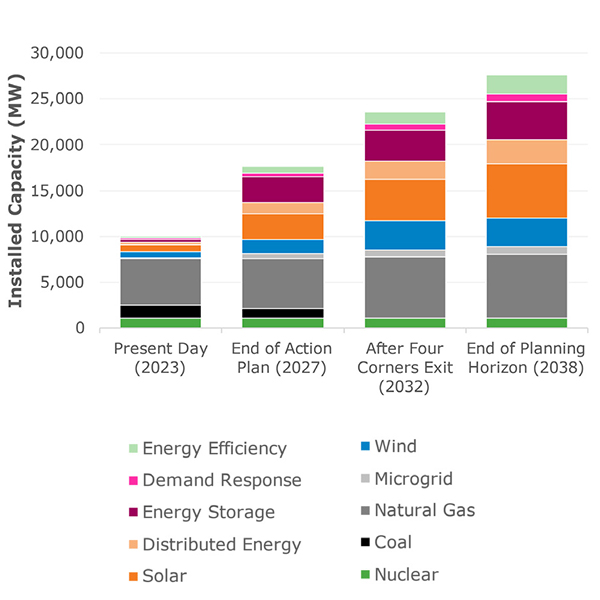

Arizona Public Service has filed a 15-year resource plan that lays out a strategy for meeting increasing demand and replacing capacity lost from its coal plant exit.

Want more? Advanced Search