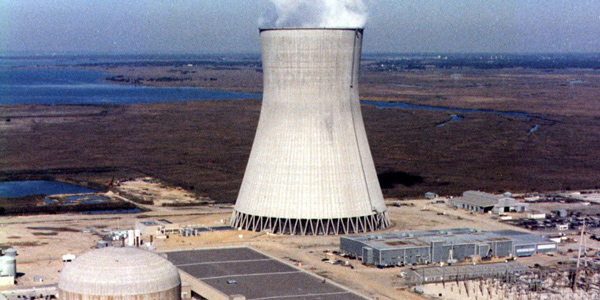

zero-emission credits (ZEC)

PSEG used the company’s earnings call to lobby for increased nuclear subsidies and said it expects to sell its non-nuclear generation by the end of 2021.

NYISO and sympathetic intervenors filed comments urging FERC to reject a request that it require the ISO to implement a “clean" MOPR.

FirstEnergy fired CEO Charles Jones and two others over an alleged bribery scandal in Ohio after two men pleaded guilty in the scheme.

Exelon (NASDAQ: EXC) will close 2 Illinois nuclear plants that face hundreds of millions of dollars of revenue shortfalls.

Illinois electric customers filed a federal civil racketeering lawsuit against ComEd and House Speaker Michael Madigan, seeking $450M in damages.

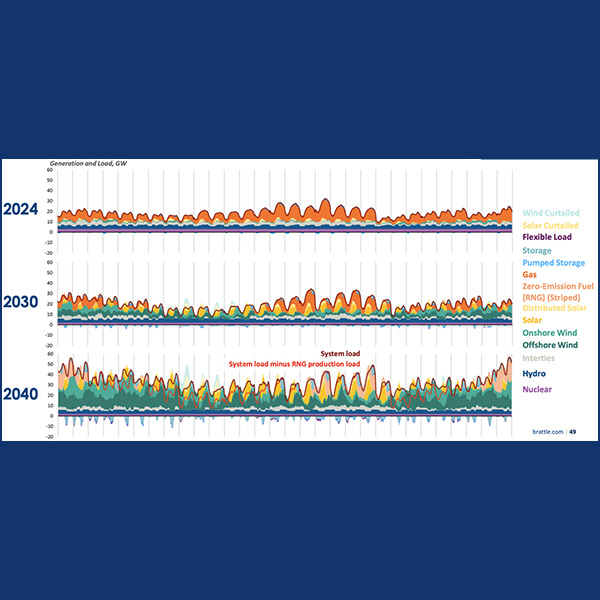

NYISO will face a myriad of challenges as New York decarbonizes its economy and the power sector transitions to zero-emissions generation.

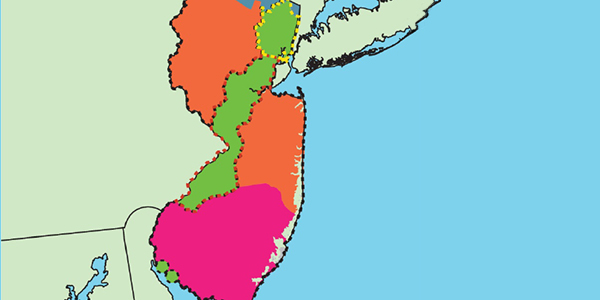

PJM’s Monitor released a report concluding that New Jersey ratepayers would likely see costs increase if the state left the RTO’s capacity market.

Exelon said its Illinois nuclear plants are “up against a clock,” with the legislature unable to meet to consider withdrawing from PJM’s capacity market.

PSEG CEO Ralph Izzo said it would be “logical” for New Jersey to abandon the PJM capacity market by adopting the fixed resource requirement option.

Independent power producers and renewable energy groups petitioned FERC to convene a conference on integrating carbon pricing in the electric markets.

Want more? Advanced Search