CAISO’s 2024/25 draft transmission plan recommends 31 new projects at an estimated cost of $4.8 billion, slanting heavily toward reliability needs.

The plan is based on California Public Utilities Commission forecasts projecting the state must add more than 76 GW of new capacity by 2039, the ISO said in the draft.

“This reflects greenhouse gas reduction goals and load growth, including the potential for increased electrification occurring in other sectors of the economy, most notably in transportation and the building industry,” CAISO wrote.

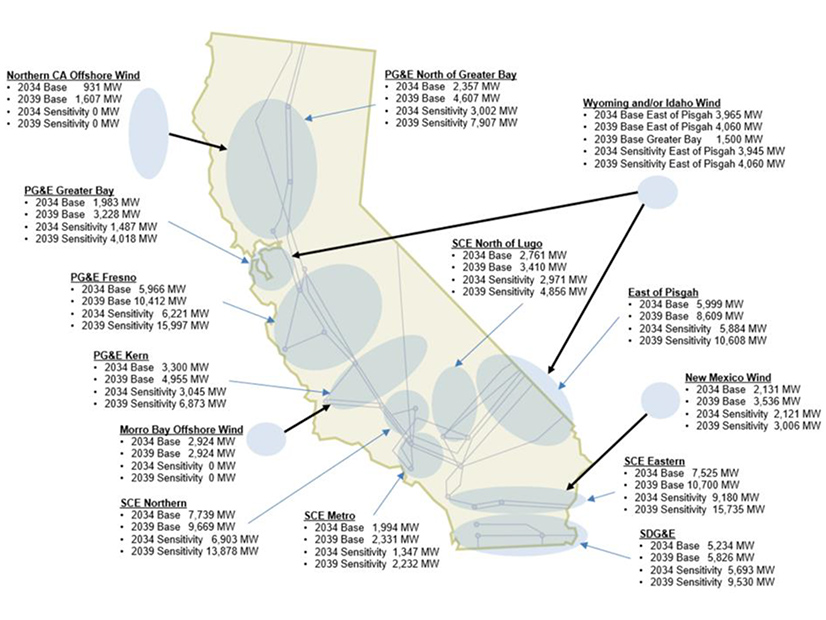

The new capacity needs include 30 GW of solar generation spread throughout the state, 7 GW of in-state wind resources in existing wind development regions, and more than 4.5 GW of offshore wind in the Morro Bay and Humboldt call areas.

The plan also factors in the need to import an additional 9 GW of wind energy from Idaho, Wyoming and New Mexico, which will require “enhancing corridors from the ISO border in southeastern Nevada and from western Arizona into California load centers.”

The plan additionally considers the transmission access needs of co-located battery storage projects across California, as well as for standalone projects close to major load centers in the Los Angeles Basin, the Greater Bay Area and San Diego.

“Our draft plan reflects the ISO’s proactive approach to transmission planning and underscores our ongoing collaboration with local, state and regional partners to ensure California has the necessary infrastructure to deliver clean energy reliably and cost-effectively to consumers,” Neil Millar, CAISO vice president for transmission planning and infrastructure development, said in a statement.

The ISO noted some of the projects would use grid-enhancing technologies.

Mostly Reliability

Twenty-eight reliability-driven projects account for nearly all the proposed spending, at roughly $4.56 billion.

“While the resource planning needs have not increased materially from those reflected in last year’s transmission plan, the increased rate of load growth reflected in the most recent load forecast associated with building and other electrification, data center growth and transportation electrification results in significant reliability-driven needs in this year’s transmission plan,” the plan says.

The 2024/25 plan assumes the state’s peak demand will increase at a 1.53% yearly rate, compared with a 0.99% forecasted growth rate in the previous plan. Peak demand in the Greater Bay Area now is expected to grow by 2.14% annually (up from 1.22%), translating into a 2,000-MW increase in the region’s 2035 peak load forecast, “with most of the growth coming from electrification of the transportation and building sectors of the state’s economy and an anticipated increase in data centers associated with artificial intelligence.” (See Data Centers Contribute to 60% Increase in San Jose Load Forecast.)

The Bay Area would host the priciest reliability projects in the plan, including Pacific Gas and Electric’s North Oakland ($1.13 billion) and Greater Bay 500-kV transmission ($700 million) reinforcement projects. San Diego Gas & Electric’s Downtown Reliability reinforcement project comes in third at $500 million.

Three policy-driven projects would entail about $289.5 million in spending.

All three recommended policy projects are in PG&E’s territory, including two in Fresno and one in the North Coast/North Bay local area. “They are needed to meet the renewable generation requirements established in the CPUC-developed renewable generation portfolios,” the ISO said.

CAISO said the plan identified no economically driven projects, representing those that would reduce costs for ratepayers but are not needed for reliability.

The ISO said the 31 recommended projects “represent significant investments that are phased in over lead times of up to eight to 10 years, which are reasonable for some of the projects to be completed.”

Costs would translate into about 0.5 cents/kWh over the life of the projects and will be phased in as lines come into service, the ISO said.

CAISO will hold an April 15 public stakeholder call on the draft plan and is taking comments through April 29. The ISO’s Board of Governors is expected to vote on the plan at its May meeting.