Alabama Power, on behalf of other members of the Southeast Energy Exchange Market (SEEM), has submitted a FERC-ordered filing detailing changes to the market’s agreement intended to comply with a March 14 order from the commission (ER21-1111).

The proposed changes to the agreement detail the ability of utilities to participate in SEEM via pseudo-ties, which are used to represent interconnections between two balancing authorities where no physical connection exists between the load or generation and the power system network. SEEM members proposed the changes take effect April 15.

FERC directed SEEM to update the agreement after members argued in an earlier filing that pseudo-ties offered a means for loads and resources outside the SEEM territory to participate in the market. (See SEEM Members Respond to FERC Briefing Request.) This claim came in response to the commission’s request for briefings after an order from the D.C. Circuit Court of Appeals remanded the commission’s approval of the market in 2021.

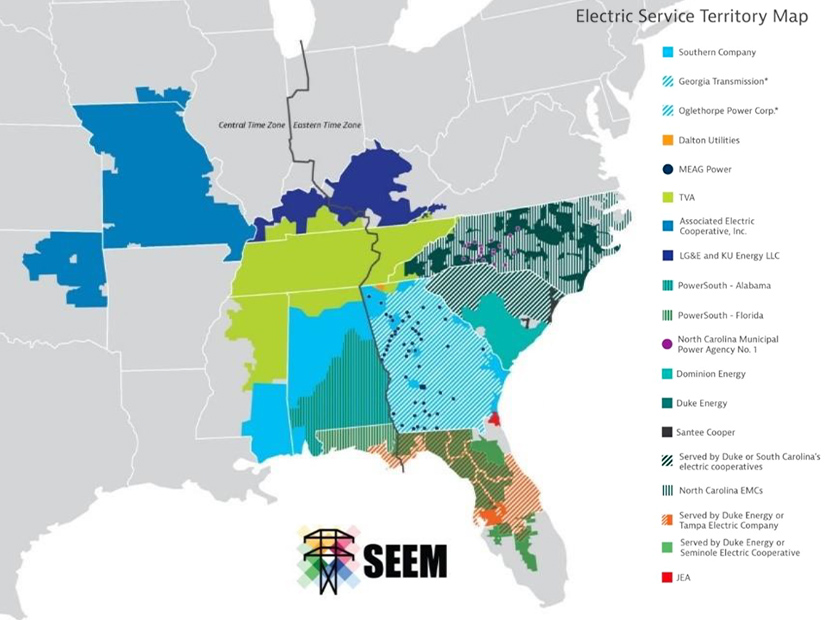

One of FERC’s questions concerned whether entities with a source or sink outside SEEM’s territory could meet the technical requirements of the market’s matching platform. SEEM’s supporters have argued the territorial requirement was needed to implement the market platform that matches excess supply with free transmission every 15 minutes. But the court claimed the limitation resembled “discriminatory practices against third-party competitors by monopoly utilities.” (See DC Circuit Sends SEEM Back to FERC.)

FERC’s March 14 order acknowledged “an external source or sink could be a participant in SEEM if it used a pseudo-tie,” but observed that such a practice would significantly affect “rates, terms or conditions of service” to such an extent that it should be included in the market agreement rather than a business practice manual. In their response, SEEM members agreed “there is not a SEEM entity that … would have the authority to evaluate and approve or reject creation of a pseudo-tie” under the current market agreement.

To address this, members proposed amending the agreement in several places. First, the new agreement adds the words “including through the use of a pseudo-tie” to language in the market rules that says a participant must own or control a source, and/or “be contractually obligated to serve a sink,” within the SEEM territory. A new footnote in the same section specifies that a prospective participant seeking to establish a pseudo-tie must coordinate with relevant BAs, transmission providers and reliability coordinators, along with the SEEM Operating Committee.

Members said that “a pseudo-tied resource or load, once established, would appear no differently from any other resource or load registered as a valid source or sink” participating in SEEM.

A change to Article 5 would establish the Operating Committee’s obligation to coordinate with efforts to participate via pseudo-tie. The language of the new section 5.11 requires the committee not to reject a pseudo-tie that has been accepted by the relevant TP, BAs and RCs.

Similar language is found in proposed changes to section 3.4, adding that TPs “shall have a duty to coordinate and act in good faith in interactions with any prospective participant … utilizing a pseudo-tie,” and with all relevant BAs and RCs. Such good-faith interaction must include transparency about the reason for any denial of participation.

The updates also added definitions of the terms “pseudo-tie” and “reliability coordinator” to be consistent with definitions in the SEEM market rules.

“These changes appropriately commit SEEM to working with potential participants on pseudo-ties, including coordinating with the other identified entities necessary to the establishment of any such pseudo-tie,” members said.