FERC said in a letter order April 17 that it has accepted SPP’s proposed compliance revisions to its Markets+ tariff that clarify five issues (ER24-1658).

The commission accepted SPP’s tariff in January 2025 but asked the grid operator for further clarification in five areas: transmission availability, transmission opt-outs, Markets+ transmission contributor responsibilities, resource-aggregation mitigation and the seasonal hydroelectric offer curve’s mitigation methodology.

FERC said the proposed revisions comply with its directives in the January order and accepted the modifications.

SPP’s legal counsel told RTO Insider the compliance filing amounted to clarifying six sentences in its application. One of those was the same sentence written twice.

SPP first filed its Markets+ tariff in March 2024. FERC responded in July with a deficiency letter outlining 16 issues to be addressed. The RTO’s response in January resulted in the commission’s approval. (See SPP Markets+ Tariff Wins FERC Approval.)

Operations Review

FERC on March 31 granted in part and denied in part Basin Electric Power Cooperative’s request for transmission rate incentives for three 345-kV projects in North Dakota’s portion of the Bakken Formation (EL24-140).

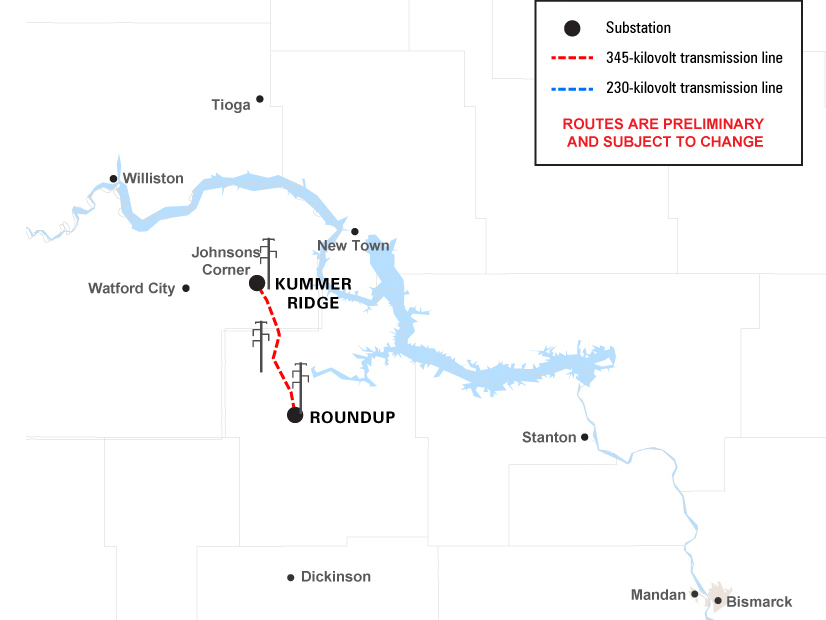

The commission granted Basin’s request for abandoned-plant and hypothetical capital structure incentive for two of the projects but denied the latter incentive for the third, the 33-mile Roundup-Kummer Ridge project.

FERC found Basin’s request for a 50-50 debt-to-equity hypothetical capital structure incentive for the Roundup-Kummer Ridge project had not demonstrated the project had any remaining risks or challenges given that the in-service date was in the past. The line was energized in December 2024.

All three projects were identified as part of the SPP 2021 Integrated Transmission Planning’s 10-year assessment.

Commission Chair Mark Christie both concurred and dissented in part with a separate statement. He agreed with the capital structure incentive’s denial for the Roundup-Kummer Ridge project and dissented with the approval of the other two incentives. Christie said he dissented on the same reasoning as his prior dissents on the topic, where he has argued FERC should revisit granting such transmission incentives because they unfairly transfer wealth and risk.