The U.S. energy storage industry proposes to invest $100 billion in U.S. grid-scale battery manufacturing and procurement by 2030.

The April 29 announcement came via the American Clean Power Association (ACP), and it came with a major caveat: A pro-business environment with supportive tariff, tax and permitting mechanisms will be needed if this commitment is to be fulfilled.

These preconditions speak directly to the uncertainty facing the U.S. clean energy sector since January, when President Donald Trump took office with a pro-carbon/anti-renewable message, and his Republican allies took control of both houses of Congress.

Threats of tariffs, the potential end of tax credits and rapid-fire policy changes have contributed to widespread pullback on manufacturing initiatives in the renewables sector.

The Clean Investment Monitor reported April 24 that while $9.4 billion in new clean energy manufacturing projects were announced in the first quarter of 2025, there also were $6.9 billion in cancellations, the most ever in a single quarter.

Against this backdrop, Jason Grumet, CEO of ACP, said the battery industry’s $100 billion commitment is important not only for the energy sector but for the nation itself.

“The energy storage industry is providing essential power when needed most while boosting domestic manufacturing and creating jobs across the country,” he said in the news release. “Today’s historic commitment will invest billions of dollars into American communities and position the United States as a manufacturing leader in battery technology that is critical to national and grid security.”

This is a variation of the message offered since Election Day by ACP and most other renewable energy advocates, emphasizing the economic, practical and political importance of clean energy investment and limiting or omitting any reference to its environmental benefits.

Trump already has targeted offshore wind with damaging directives, despite that message. How effective the message will be in winning support for battery energy storage systems (BESS) remains to be seen.

Batteries can be an important counterpart for intermittent wind and solar generation, but here again, ACP played up the other roles BESS plays:

“Energy storage optimizes all existing power generation, lowering energy bills and hardening the grid against extreme weather events like blizzards and heat waves,” ACP wrote. “As the economy grows, energy storage provides important peaking capacity, freeing up more gas generation to serve as base load and enabling more energy production.”

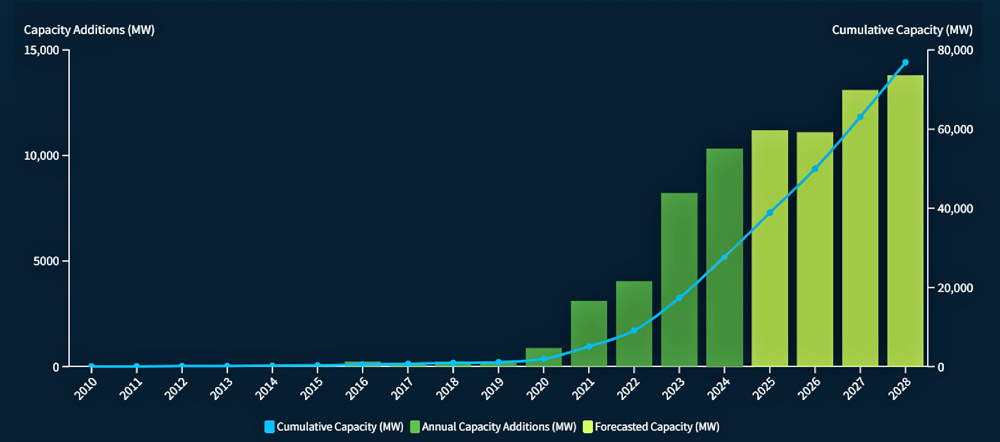

ACP noted that U.S. battery installations have increased 2,500% since 2018; batteries saved Texas more than $1 billion in energy costs in 2024 alone; 25 new or expanded grid-scale battery factories are being planned or built nationwide; and storage projects are under construction in 31 states.

ACP said U.S.-made batteries could satisfy 100% of projected domestic energy storage demand by 2030 — if the support exists to grow the ecosystem.

“Without a pro-business policy approach that ensures enough certainty to sustain these significant investments, there is a risk that America loses out on both becoming a global battery manufacturing leader and meeting the economy’s rapidly growing energy needs,” it said.

Executives of Clearway Energy Group, Eolian, Fluence, Form Energy and LG Energy Solution Vertech voiced their support in the ACP announcement, which was accompanied by an expanded explainer citing major storage manufacturing or deployment projects by Fluence, Form, LG, Powin, Salt River Project/Ørsted and Tesla.