As NYISO conducts its Capacity Market Structure Review, its Market Monitoring Unit and FTI Consulting say it should reject the idea of bifurcated pricing.

NYISO and its stakeholders continue to consider different designs as part of their Capacity Market Structure Review, but one idea should be dismissed, according to the Market Monitoring Unit and FTI Consulting: bifurcated pricing.

Though all RTOs with capacity markets may be concerned with their effectiveness in maintaining resource adequacy, NYISO is perhaps more unique in that, according to the MMU, new investment in generation primarily is driven by New York state procurements. In a market based on the net cost of new entry, stakeholders are concerned this could lead to keeping older, more inefficient resources longer than necessary and at a higher cost to consumers. (See NYISO Stakeholders Debate Purpose of Capacity Market.)

A bifurcated — or “discriminatory” — market would have two separate demand prices: one for existing resources and one for new entries to the market. According to NYISO consultant FTI, such markets can result in short-term reductions in costs to consumers, but “in the longer run, as more existing capacity inefficiently exits as a result of the artificially low capacity price and is replaced with high-cost new capacity, the short-run consumer savings will tend to turn into higher costs for future consumers.”

“From a social welfare standpoint, all of this is inefficient,” FTI’s Scott Harvey said in the middle of his presentation to the Installed Capacity Market Working Group on May 22. “It’s going to reduce social welfare because unless we do the price discrimination perfectly, we’re going to shut down some existing capacity that’s got lower cost than new capacity, and that reduces social welfare.”

Biasing the market toward new capacity also incentivizes the construction of short-lived assets because they will make less money as they age, even if initially they are higher cost, he said.

Balancing the market such that it retains enough units to meet reliability needs while incentivizing new entry and economic exit is tricky, Harvey acknowledged, especially amid low reserve margins.

FTI offered several approaches to a bifurcated market: holding a two-stage auction with separate supply curves but a single demand curve, with a lower price cap for existing capacity; a single-stage auction with a single supply curve but separate demand curves; and a two-stage auction with both supply and demand curves completely separated. Each construct, however, had its own drawbacks under certain circumstances, according to FTI’s presentation.

“If you are close to the edge already on reliability, then shutting down existing capacity will have a larger impact,” Harvey said. “Anything that drives up the cost of new capacity and less [generation] comes in than you expected is going to have an impact. If some of the existing capacity is already shut down by the time you realize the new capacity isn’t going to show up, you’re going to have problems.”

FTI noted that the natural gas market was bifurcated by the Natural Gas Policy Act of 1978, but this ultimately resulted in inflated, high prices, and by 1989, the law was repealed.

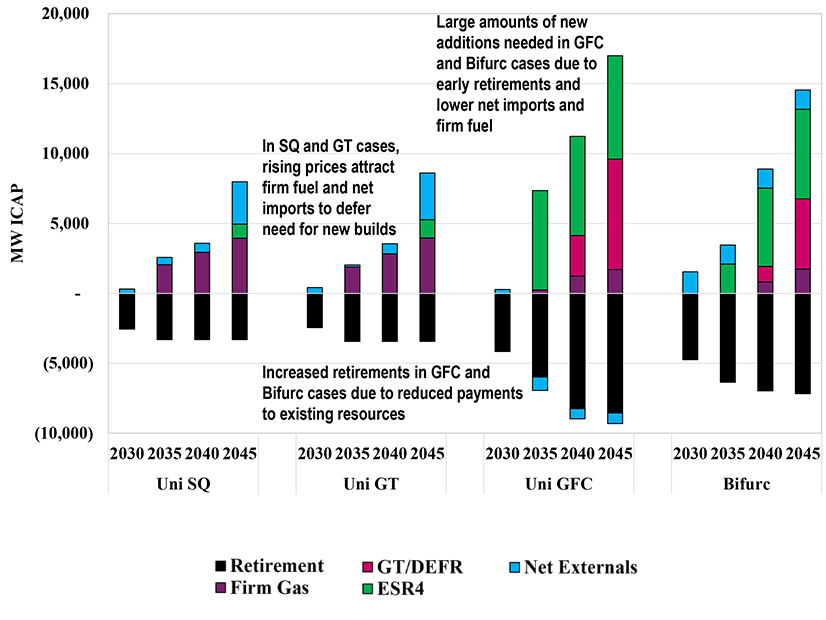

Potomac Economics’ Joe Coscia presented the MMU’s quantitative model using multiple scenarios showing that price discrimination between new and old units would lead to both “inefficient behavior” and higher investment costs.

Capacity prices also rise relative to status quo, and capacity surpluses decrease.

“That’s a result of the early retirement of existing resources or inability to attract imports and firm gas instead of replacing it with more expensive new capacity,” Coscia said.

He said the MMU’s results pointed toward the advantages of uniform clearing prices based on cost of new entry, even when there isn’t much investment in the peaking technology.