MISO’s 2022 and 2023 generator interconnection queue cycles are lagging behind their stated timelines once again as the RTO continues working to produce study results in a new, automated process.

MISO’s 2022 and 2023 generator interconnection queue cycles are lagging behind their stated timelines once again as the RTO continues working to produce study results in a new, automated process.

The grid operator said it now will post a final system impact study for the 2022 cycle July 8 and move those generation proposals to the second phase of the three-part queue by Aug. 6. It will move on to studying project applications submitted in 2023 on Aug. 20.

This is MISO’s second postponement for the 2022, 2023 and 2025 queue cycles. The grid operator skipped acceptance of a 2024 cycle while it tried to get a handle on study delays and design a megawatt-capped queue that could sort out projects over a one-year span instead of three to four years.

In January, MISO planned to begin studying the 2023 cycle in May and the 2025 cycle by the end of the year, a few months behind the schedule it announced in 2024. At the time, the grid operator envisioned all generation projects from the three cycles striking interconnection agreements over 2026, with the 2022 cycle proceeding in the second quarter, 2023 in the third quarter and 2025 by the end of 2026. (See MISO Unveils Later Timeline for Queue Processing Restart.)

MISO’s Kyle Trotter said MISO would post a new schedule soon detailing when it will proceed with the 2025 cycle of projects.

Senior Manager of Resource Utilization Ryan Westphal said MISO wants to finalize the 2022 cycle’s system impact study after multiple rounds of adjusting modeling assumptions at stakeholders’ suggestions and presenting different drafts of the study for review.

“We’re ready to move forward at this point,” Westphal said during a June 3 teleconference focused on MISO’s interconnection process. He added that MISO will account for project withdrawals from the 2022 cycle in the screening process for the 2023 batch of projects.

MISO is using Pearl Street’s automated SUGAR (Suite of Unified Grid Analyses with Renewables) study software to screen generation projects and perform the first phase of studies in the queue. (See MISO: New Software Effective, Faster than Previous Queue Study Process.)

Westphal said MISO’s later, Aug. 20 study kickoff also would give the RTO time to seek FERC approval to include MISO and SPP’s $1.65-billion Joint Targeted Interconnection Queue (JTIQ) portfolio in its modeling for the 2023 cycle of generation projects. The move is unpopular among MISO’s generation developers, who are set to shoulder all JTIQ costs; they’ve said the cost allocation could attach high, unpredictable expenses to their projects. (See MISO Gen Developers Sour on RTO’s JTIQ Cost Allocation.)

“We want to make sure we have enough time to hear back from FERC,” Westphal said.

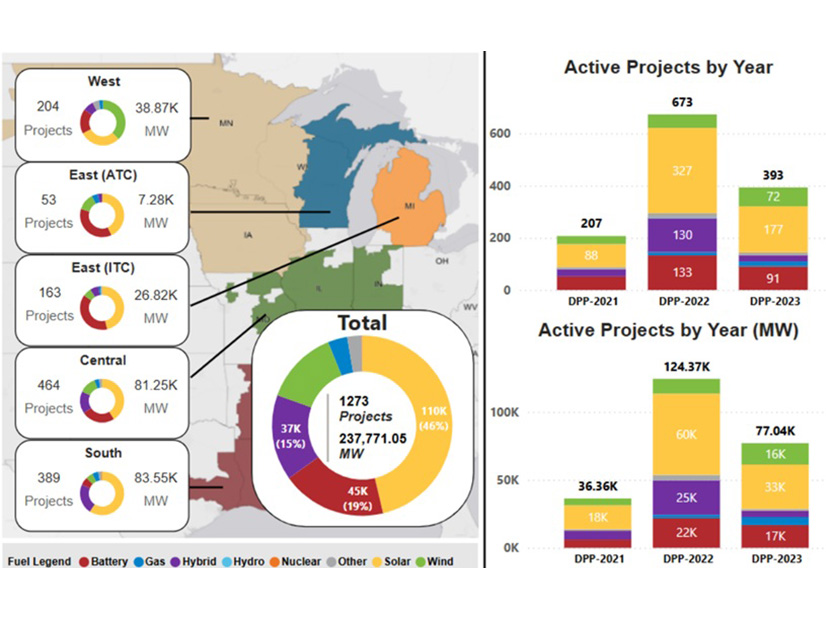

MISO has 1,273 projects totaling 237.8 GW in its interconnection queue.