IESO’s Technical Panel approved measures to reduce unfulfilled capacity commitments and began discussion of proposed changes for how the ISO breaks ties in its annual auctions.

IESO’s Technical Panel approved measures to reduce unfulfilled capacity commitments and began discussion of proposed changes for how the ISO breaks ties in its annual auctions.

At its July 15 meeting, the panel approved by a voice vote rule changes to reduce unfulfilled capacity commitments by making it easier for participants to transfer their obligations and harder to buy them out. The vote recommends the IESO Board of Directors approve the changes at its meeting in August.

Resources selected in the annual capacity auction are expected to participate in the energy market or they can buy out or transfer their obligations. But some resources fail to fulfill their obligations for reasons including not completing the registration requirements. (See IESO Seeks to Shore up Capacity Market.)

Unfulfilled obligations reduce “the capacity available to the IESO and distorts auction clearing price signals,” the ISO says.

Under the changes, suppliers who fail to complete the registration process no longer would have the option of simply forfeiting their deposits and would be required to buy out their obligations. In addition, the buyout charge will increase from 30 to 50% of the obligation value.

The revisions also would remove the requirement that obligations can be transferred between resources only with the same attributes.

Tie-break Rules

The TP also discussed a revised method for breaking capacity auction ties that the ISO has promised in time for the 2025 contest in November.

A tie-break occurs when two or more participants offer the same price for the last available quantity of capacity in a zone.

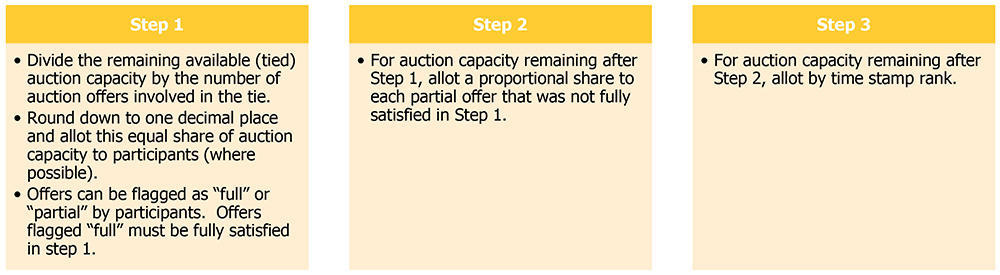

Under current rules, the ISO uses time stamps to select the bid submitted first, a method stakeholders have complained is inequitable. The new rules would create a multistep process IESO said will be fairer. (See IESO Eyes New Tie-break Rules for November Capacity Auction.)

The initial design proposed last September was to proportionally allocate capacity based on the offer amounts, said IESO Capacity Auction Supervisor Laura Zubyck.

“The feedback that we received from stakeholders was that there’s a risk in that design that participants could inflate their offer amount in order to try to clear the largest amount possible,” she said.

As a result, the ISO revised the rules to award an equal share in the first step and apply a proportional allocation in step two, based on what’s left over from step one.

Zubyck said stakeholders have been “unanimous” that the proposed change is an improvement.

Michael Pohlod, director of energy markets for Voltus, a virtual power plant operator and DER platform, praised the ISO’s movement on the issue, calling it a “a major concern.”

But Forrest Pengra, director of strategic initiatives for Seguin Township, noted that the final solutions are not proportional to offers, citing one example in which one supplier would clear 100% of its offer, while two others receive 64 and 48% of theirs. “That, to me, doesn’t seem as an equitable distribution,” he said.

“You’re not wrong in terms of how it’s distributed,” Zubyck responded. But she said the original plan to proportionally allocate in the first step based on the offer amounts created “the risk of offers being manipulated” to increase the amount cleared.

Pohlod said the original proposal created a “game theory problem.”

“You have people wind up clearing more than they wanted because they thought other people were going to offer more proportionately. And this way … creates the right incentive.”

Zubyck also said stakeholders sought a way to discourage the creation of multiple subsidiary organizations in order to clear more capacity through the tie-break.

“We acknowledge this could be a risk: The tie-break methodology does not prevent somebody from creating a subsidiary organization,” she said. “However, it’s one that we can’t address solely through the tie-break methodology. It has larger impacts in the auction that … will be considered more broadly as part of our future enhancement discussions.”

The Technical Panel is scheduled to vote to post the changes in September, with board approval anticipated in October. The Nov. 26-27 auction will seek capacity for the periods beginning May 1 and Nov. 1, 2026, with results posted Dec. 4.

No ‘Misalignment’ Seen

In response to questions raised at the Technical Panel’s May meeting by Vladislav Urukov of Ontario Power Generation, IESO officials said they had reviewed the Technical Panel’s Terms of Reference (ToR) and Chapter 3, Section 4.3 of the market rules for consistency.

Urukov had asked whether provisions for amending market rules were consistent with the “deemed warrants consideration” provision in Section 3.2.1 of the ToR.

“The deeming provision, although not explicit in the market rules, is supported by the IESO Board’s authority pursuant to market rule S.4.3.6, whereby the IESO Board has authority to direct whether an amendment submission warrants or does not warrant consideration,” IESO’s Paula Lukan wrote in a memo to the TP. “The approval of the ToR in 2017 by the IESO Board, and in particular the inclusion of the deeming provision, constitutes the direction of the IESO Board that all IESO-driven engagements warrant consideration, thereby streamlining the process for most market rule amendments.”

Lukan said IESO will look more broadly at Section 4 of the market rules to clarify the rule amendment process as part of its initiative to review market rules and manuals not directly affected by the Market Renewal Program.

“We conducted a review, and while we did not find any misalignment between the rules and the terms of reference, we did identify a number of instances where the market rules could benefit from greater clarity,” said Lukan, who noted that the section hasn’t been updated since Ontario‘s market opening.

“As a result, for example, it does make reference to consultations and not to stakeholder engagement.”

“Are we saying that there’ll be no substantive changes to the rules, just clarification that does not in any way change the rules themselves?” Urukov asked.

“I think that’s right,” Lukan responded. “We did recognize … in some instances it did create a little bit of confusion, but we’re confident that there aren’t any contradictions. It’s just there is an opportunity to clarify the language. So, no substantive changes that we’ve identified so far. It’s really just bringing them up to date, making the language a little simpler. During the [Market Renewal Program] process, this section did not get updated, so there’s definitely opportunity there to make some improvement.”