California’s fastest-growing energy resource — battery storage — is earning less net revenue each year, while capacity is forecast to continue to boom.

California’s fastest-growing energy resource — battery storage — is earning less net revenue per unit with each passing year, while capacity is expected to continue to boom in the Golden State.

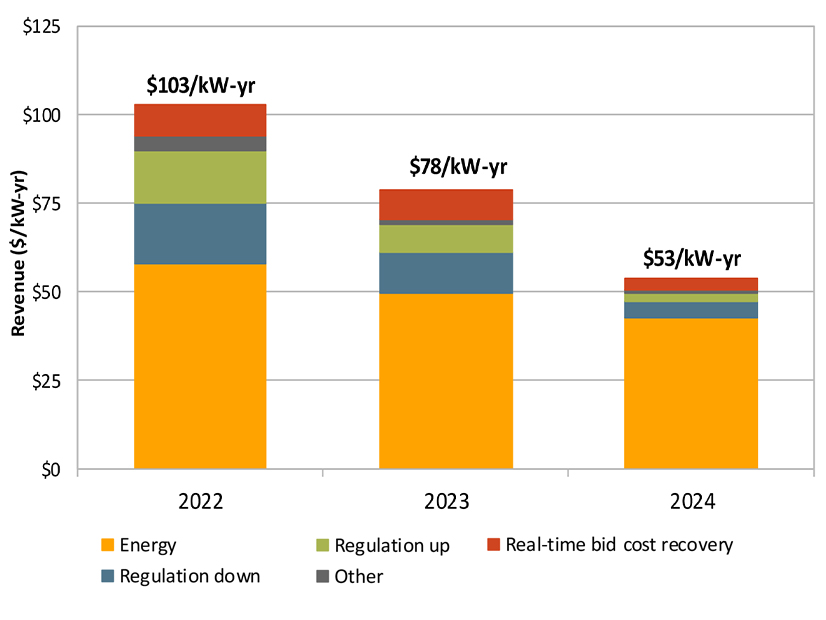

Battery storage net revenue dropped from an average of $102/kW-year in 2022 to $78/kW-year in 2023, to $53/kW-year in 2024, indicating a “trend,” CAISO’s Department of Market Monitoring (DMM) said in a July 15 memo, which was included in reports provided to the July 22 general session of the Western Energy Markets Governing Body.

Lower peak energy prices are the primary cause of the revenue decline, and revenue from ancillary services also has continued to decrease significantly as the volume of battery capacity has increased, the DMM said.

Even so, an additional 14,000 MW of battery storage capacity is planned to be online by 2030, pushing CAISO’s total to about 28,000 MW by that year. Battery storage capacity has gone from 500 MW in 2020 to close to 14,000 MW as of June.

Nearby states also are going bonkers over batteries: Arizona plans to install more than 5,000 MW of additional battery storage capacity by 2028, while Nevada is looking to add about 2,500 MW by that year. In total, more than 19,000 MW is planned to be installed in Western Energy Imbalance Market (WEIM) states by 2028, DMM Executive Director Eric Hildebrandt said in the memo. Much of the battery capacity in other WEIM states is being installed to meet the renewable energy requirements of load-serving entities in California, Hildebrandt said.

The DMM recommended CAISO revise its bid cost recovery rules for batteries because the current rules “significantly decrease the incentive for batteries to bid in a manner that ensures their capacity is usually fully available during the most critical peak net load hours,” Hildebrandt said in the memo.

“In addition to increasing bid cost recovery payments and related gaming opportunities, this can result in batteries being discharged prior to the peak net load hours, when battery capacity is needed most,” Hildebrandt said.

In 2024, battery storage facilities in CAISO’s region received about $18 million in real-time bid cost recovery payments, representing 11% of total bid cost recovery payments and 4% of batteries’ total net market revenues.

Batteries tend to contract less than their maximum power capacity for resource adequacy purposes. This means batteries theoretically could provide more power than their RA value, Hildebrandt added.

During the five highest load days of 2024, battery storage resources provided significant RA capacity. However, RA storage capacity can drop in the later peak net load hours — when batteries are critical for system reliability — due to insufficient state-of-charge, Hildebrandt said.

In 2024, batteries supplied about 9% of CAISO’s energy during peak net load hours, while battery charging represented about 15% of CAISO’s load during mid-day hours, according to the memo. Battery charging helped reduce the need to curtail or export surplus solar energy at very low prices, the memo said.

CAISO will rely heavily on battery storage facilities to meet peak demand this summer, state energy officials said in May. A surplus of at least 5,500 MW is projected to be available to California during peak demand under normal conditions and 1,368 MW under extreme conditions, the officials said.