U.S. investor-owned electric companies invested $178 billion in 2024 and are projected to invest more than $1.1 trillion through 2029, their trade organization reported.

The Edison Electric Institute said July 23 in its annual Financial Review that this level of capital expenditure exceeds every other U.S. business sector and places electric companies at the forefront of a transformational time for the economy.

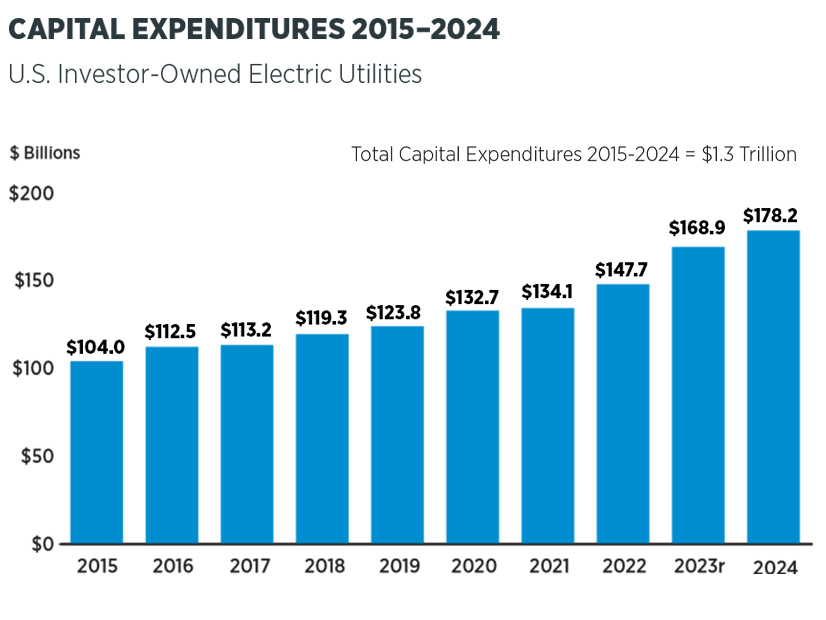

2024 was the 13th straight record-setting year for investment, EEI said. In just the past decade, annual capital outlay has jumped from $104 billion to $178.2 billion. The largest single jump was from $147.7 billion in 2022 to $168 billion in 2023.

The 2024 financials indicate the scale of the industry. The report shows that collectively, U.S. investor-owned electric companies had:

-

- $403.5 billion in 2024 operating income, down 0.1% from 2023;

- $54.6 billion in net income, up 4.5%;

- $34 billion in dividends paid on common stock, up 5.8%;

- $1.57 trillion in property, facilities and equipment, up 5.5 %; and

- $2.18 trillion in total assets, up 5.1%.

The industry’s average credit rating remained at BBB+ for the 11th year in a row, EIA said, and 94% of EEI Index companies increased their dividend. At 62.2%, the dividend payout ratio is the highest of any U.S. business sector, EEI said.

On the regulatory front, 81 rate reviews were filed in 2024 and 78 decided; average awarded return on equity was 9.73%, up from 9.58% a year earlier. The 2024 ROE broke down to 9.84% for vertically integrated companies and 9.53% for distribution-only companies.

The data covers 38 investor-owned electric companies whose stock is publicly traded on major U.S. stock exchanges, plus five companies that provide regulated electric service in the United States but are not listed on the U.S. exchanges.

Stock prices for the 38 EEI Index companies ended 2024 19.1% higher, placing them well ahead of the Dow Jones Industrial Average, well short of the S&P 500, and far short of the Nasdaq. Interest rate changes in the fourth quarter stunted the EEI Index’s full-year performance.

The index companies had a combined $1.02 trillion market capitalization at the end of 2024, with NextEra Energy the leader at $147.2 billion, Southern Co. a distant second at $90.3 billion and Unitil bringing up the rear at $900 million.

In a news release, EEI President Drew Maloney looked beyond the numbers to the significance of the financials: “America’s electric companies are leading in this unique and critical moment for our nation. As demand for electricity continues to grow, we remain committed to making the investments needed to strengthen America’s energy security while ensuring that our customers receive reliable, affordable energy.”

EEI said these companies support more than 7 million jobs nationwide and account for 5% of the U.S. GDP.