DTE Energy reported it is in various stages of discussion to supply as much as 7 GW to new data centers and is on track to reach agreement on the first project by the end of 2025.

The news came with the Michigan utility’s second-quarter earnings report July 29, which also contained an update on the outlook for continued renewables development.

DTE President Joi Harris fielded most of the questions during an earnings call with financial analysts. CEO Jerry Norcia, whom she will succeed in September, filled in more details.

Harris said data center developers have shown interest in Michigan because there is excess generation capacity and because the state enacted tax incentives to attract them.

She noted that DTE previously had reached framework agreements for 2.1 GW of data center load but said some negotiations are now further along.

DTE will not count one of these potential large customers as part of its pipeline until it has secured land or has strong prospects of doing so and has a pathway to zoning approval.

The utility is in advanced discussions with developers who would present more than 3 GW of new demand; each has secured land, zoning approval and some degree of community support. It is in continuing discussions with developers representing 4 GW of new demand who have not progressed as far with their site planning but are on track with it.

Harris said DTE hopes to seal the first agreement — 1 GW for a hyperscaler’s project — before 2026: “Our intention is to have a really good indicator by the third quarter and have a final deal in hand by the end of the year.”

The utility has more than 1 GW of capacity available and plans to add 1 GW of storage to match the data center’s demand watt for watt, Harris said. This would come from a combination of power purchase agreements and self-build, she said, and the cost is estimated at $1 billion.

Further data center buildouts would require additional storage capacity, she said, as well as new baseload generation — such as carbon capture-ready combined cycle gas plants.

Meanwhile, DTE continues to plan coal retirements, so it plans to add new capacity beyond whatever the data centers need.

“We’re already in the MISO queue for at least one plant and potentially two, and that’s to serve our existing load,” Harris said.

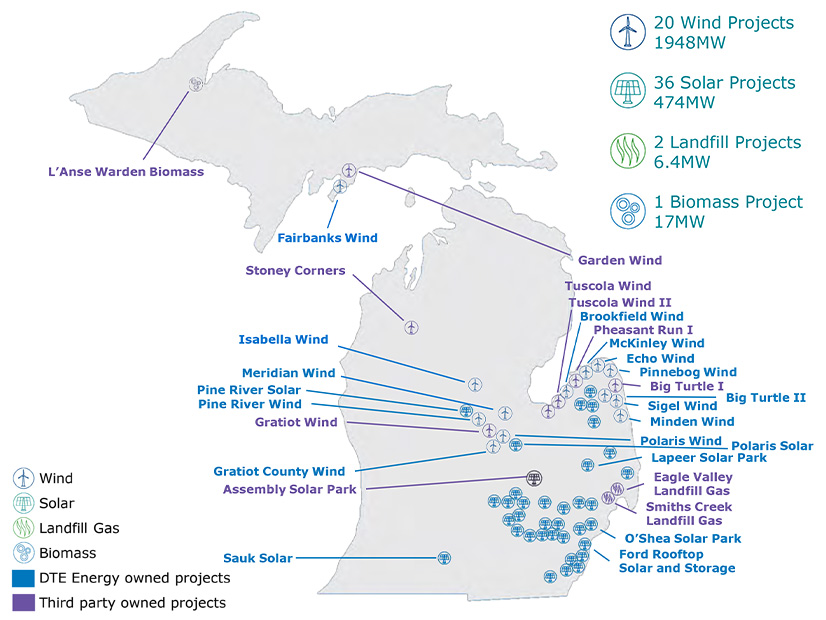

DTE still plans to meet some of that demand with renewables — even as the Trump administration works to make renewables harder and more expensive to build. It has 2,500 MW of renewables in service now and plans to add 900 MW a year for the next five years.

Based on the longstanding definition of “safe harbor” and the provisions for safe-harboring in the reconciliation bill, DTE does think it can bring its projects to completion and still claim the Biden-era tax credits.

“Just as a reminder, we have to build these assets. It is required under the law,” Harris said, apparently referring to the state mandate of 50% clean energy by 2030 and 100% by 2040.

The 900 MW of annual renewable capacity is expected to have a large component of solar and storage, though some consideration is being given to repowering existing wind turbines. The economics of solar are better than wind at this point, and community acceptance of solar has proved greater than for wind.

Analysts asked for greater specificity regarding the infrastructure changes implied by the announcements, and whether DTE needs to pull forward its 2026 Integrated Resource Plan. But the details are fluid.

Harris said DTE’s next IRP will provide more insight on anticipated load growth and strategies to meet that demand, but there is no need to accelerate the timetable.

“So we don’t intend to pull forward the IRP,” she said. “What we intend to do is serve the load near term with our existing riders and tariffs and then move toward building out larger assets based on the results of the IRP.”

DTE reported operating earnings of $283 million or $1.36/share in the second quarter of 2025, down from $296 million or $1.43/share in the second quarter of 2024.

The company reaffirmed its guidance for 2025 operating earnings of $7.09 to $7.23/share. Its stock price closed 0.2% lower July 29.