Southern Co. CEO Chris Womack said during the company’s quarterly earnings call July 31 that “the economy in the Southeast” remains well positioned to support continued load growth.

Net income for the second quarter came to $880 million ($0.80/share), down from $1.2 billion ($1.10/share) in the second quarter of 2024. Year-to-date net income was $2.2 billion ($2.01/share), down from $2.3 billion ($2.13/share) in the same period in 2024.

Operating revenue for the quarter stood at $7 billion, up from $6.5 billion for the second quarter of 2024; year-to-date operating revenue also grew, from $13.1 billion to $14.7 billion. Operating expenses for the quarter were $5.2 billion, up from $4.5 billion, and year-to-date were $11 billion, up from $9.5 billion.

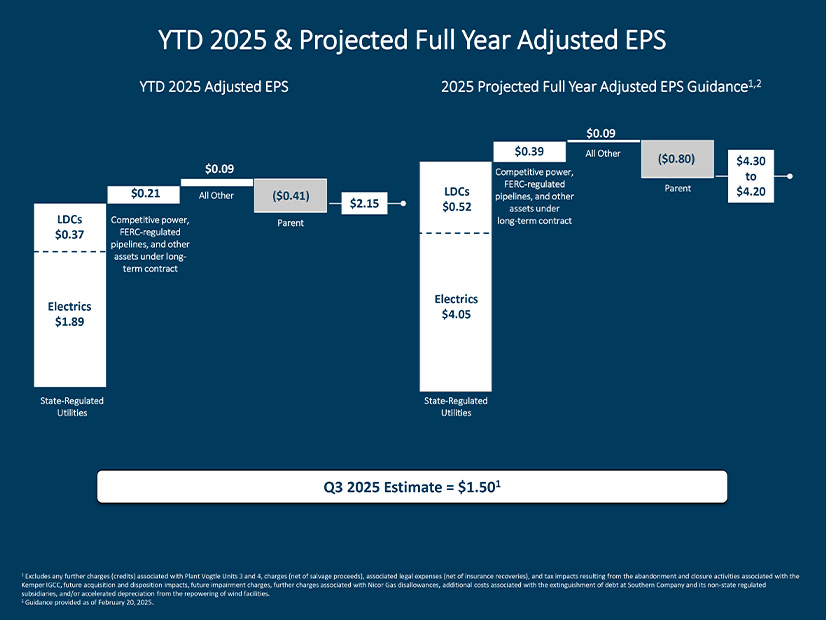

CFO Dan Tucker, attending his last earnings call before his retirement, said adjusted earnings per share for the quarter came to 92 cents, 18 cents lower than the same period last year but 7 cents above the company’s estimate. Tucker said, “Increased earnings from investments in our state regulated utilities, along with higher usage and customer growth,” contributed 6 cents year over year compared to 2024.

Weather-normal retail electricity sales were up 3% “across all customer classes” for the quarter compared to the same period last year, Tucker continued. Residential sales grew 2.8% thanks to both “the addition of over 15,000 new electric customers … and higher overall use per customer.”

Commercial and industrial sales grew 3.5% and 2.8% respectively, which Tucker attributed to growth in data center usage, which was up 13% from last year. Transportation and primary metals were both up 6% as well, and paper was up 16%.

Womack mentioned the data center sector as one where expansion is expected to continue in the Southeast, along with the aerospace and automotive industries. In all, he pointed to nearly $2 billion of capital investments announced during the second quarter across Southern’s service areas.

He also said Southern is working to position itself for this expansion, pointing to an agreement reached in May between Georgia Power and the Georgia Public Service Commission to extend the utility’s 2022 alternate rate plan through 2028. He said this move would preclude the need for a 2025 base rate case filing and keep the “base rate stable and predictable over the next three years … with the exception of any future recovery of storm-related costs.”

“Overall, this outcome demonstrates our commitment to capturing the benefits of this robust projected economic growth and prioritizing customer affordability,” Womack continued. “We believe this outcome, which preserves the existing regulatory framework in Georgia, benefits all stakeholders. Our vertically integrated market and constructive, orderly regulatory processes continue to help ensure we have the critical resources necessary to reliably and affordably serve our growing states.”

Tucker’s successor as CFO, David Poroch, also joined the call to discuss the company’s capital investment plan, which earlier in 2025 was announced to total $63 billion over the next four years. (See Strong Southeast Economy Bolstered Southern Co. Growth in 2024.)

Poroch said the total planned investment has grown to $76 billion, $10 billion of which is associated with planned resource additions of at least 6 GW that Georgia Power filed with the PSC earlier in 2025; $2 billion is attributed to modernization and updates to the existing fleet; and $1 billion for repowering three wind facilities, expected to be completed by the first half of 2027.

Southern is projecting adjusted earnings per share of $1.50 for the third quarter of 2025, and $4.20 to $4.30 for the full year.