PPL expects that the current surplus of generation in its Pennsylvania territory will be lost to demand growth from data centers in the next five years and said it has plans to help meet that growing demand with new generation.

“We have made it a strategic priority at PPL to serve data centers across our service territories, as AI will be critical to America’s continued competitiveness and national security, as well as the execution of our utility-of-the-future strategy,” CEO Vincent Sorgi said on the company’s second-quarter earnings call July 31. “We are enabling speed to market for the data centers by being able to connect them to the grid faster than they can get the data centers built.”

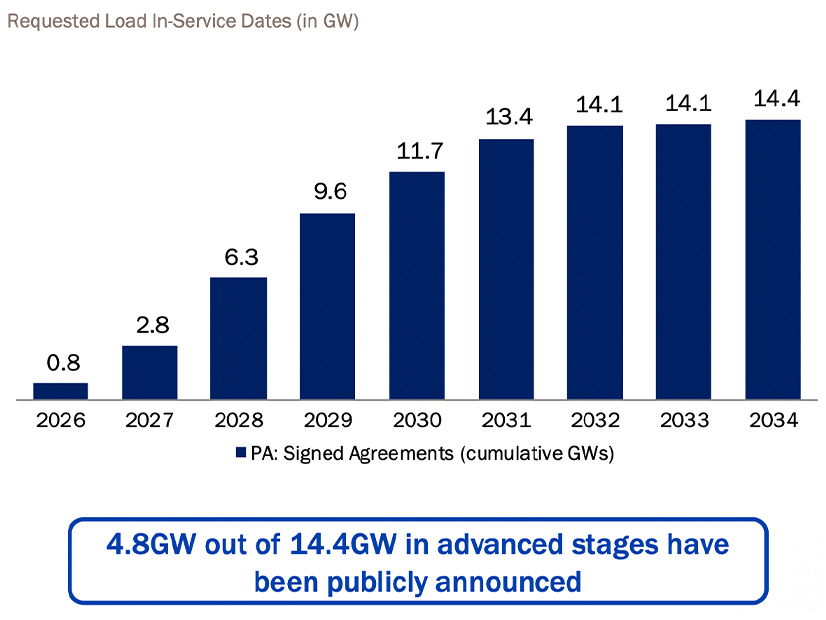

PPL sees about 14.5 GW of data centers in advanced stages of development that could come online by the early 2030s. Assuming those all come online, the net long position in PPL’s territory would disappear, and an additional 7.5 GW of supply would be needed. Sorgi said that while the numbers outside its territory are fuzzier for the firm, Pennsylvania could need an additional 12 GW.

“Our current capital plan includes another $7 billion through 2028. That means we can connect data centers as quickly as developers can build them,” Sorgi said.

Once the existing long generation is used up, PPL would shift to building out more generation, and it is backing a few horses there. The company has entered a joint venture with Blackstone to supply data centers using “energy services agreements” (ESAs), which was announced at a high-profile event in July. (See $92B in Power, Data Center Infrastructure Planned in Pa.)

“Those ESAs will have regulated-like risk profiles that do not expose the companies to merchant energy and capacity price volatility as PPL is not getting back into the merchant generation business,” Sorgi said. “Therefore, construction of any new generation will require the successful execution of ESAs with hyperscalers. The joint venture is actively engaged with hyperscalers, landowners, natural gas pipeline companies, turbine manufacturers and land parcels to enable this new generation buildout.”

Sorgi did not want to get into much more detail about the ESAs, as negotiations are ongoing, but he anticipated placing orders for new natural gas-fired turbines by next year.

PPL is also still backing legislation that would let the utility rate-base new generation in Pennsylvania, which would represent a major shift in policy for an early and once enthusiastic adopter of restructuring and wholesale markets. (See Utilities Pushing for Return to Owning Generation in Pennsylvania.)

A pair of bills that would authorize utility-owned generation are pending in the relevant committees in the Pennsylvania General Assembly: SB 897 and HB 1272.

“Both the House and Senate bills would allow regulated utilities, like PPL Electric Utilities, to build and own generation again to solve a resource adequacy need,” Sorgi said. “And both pieces of legislation would also encourage utilities to enter into agreements with [independent power producers] to help de-risk their new generation investment. As a company, we are primed to act quickly once this proposed legislation becomes law.”

A key difference between the deal with Blackstone and building its own generation is that the former would require PPL Electric Utilities to run an open request for proposals to get around affiliate rules, while the latter could happen without any competition.

PPL’s subsidiaries in Kentucky — Louisville Gas & Electric and Kentucky Utilities — are also seeing load growth. The utilities have entered a deal in a pending certificate of public convenience and necessity proceeding to build new gas plants, among other investments.

“The stipulation strikes the right balance between building new generation needed to support economic development in the state, including supporting anticipated data center load, and ensuring we maintain affordability for our customers,” Sorgi said.

The utilities will build two new 645-MW combined-cycle natural gas plants, add selective catalytic reduction to Ghent Generating Station Unit 2 and extend the 300-MW Mill Creek coal plant Unit 2’s life from 2027 to at least 2031, with analysis required in their next integrated resource plan to consider keeping the plant open even longer. They also withdrew a request to build a new battery storage plant in the state, but without prejudice so that project could still be developed in the future, Sorgi said.