Five state public service commissions have banded together to request that FERC order a recasting of MISO’s long-range transmission projects, arguing the projects aren’t as beneficial as MISO has advertised.

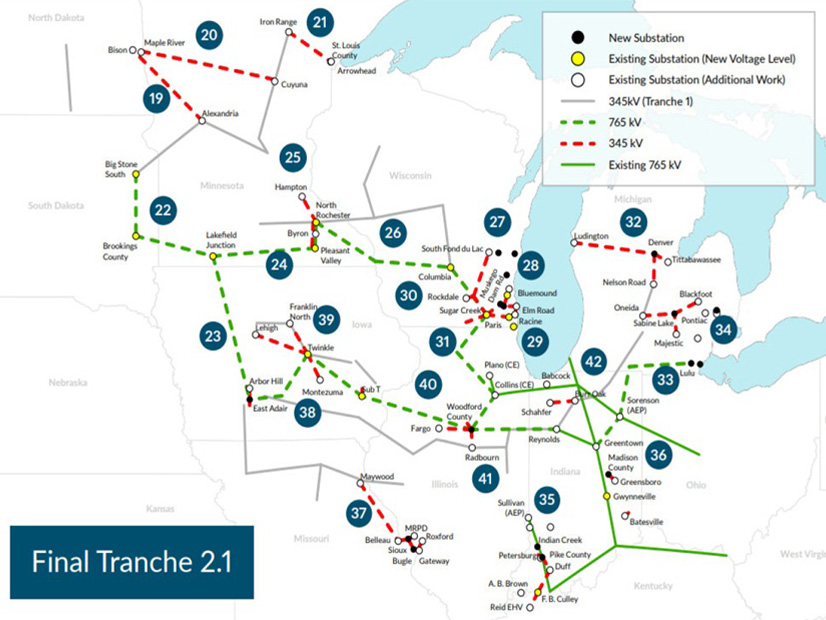

The public service commissions of Arkansas, Louisiana, Mississippi, Montana and North Dakota registered a July 31 complaint. The states, calling themselves the “Concerned Commissions,” said MISO and its Board of Directors violated the MISO tariff when they recommended and approved the second, nearly $22 billion long-range transmission portfolio in late 2024 (EL25-109).

The five asked FERC to conclude that MISO and its board erred by advancing transmission projects that will cost more than they’re worth, order MISO to reclassify the projects so they’re not regionally cost-shared and direct the RTO to file all future business cases supporting long-range transmission portfolios.

The state commissions said MISO’s “miscalculation of benefits and a defective business case” convinced its Board of Directors to approve the plan. (See MISO Board Endorses $21.8B Long-range Transmission Plan.)

The state commissioners argued that MISO’s collection of long-range transmission projects cannot provide benefits “equal to or in excess of forecasted costs” and should thus be reclassified, likely with a different cost allocation method. They said MISO currently has no authority to direct the projects’ construction because the projects don’t meet a required 1:1 benefit-cost ratio.

The states said other MISO states are free to pay for the projects per the MISO tariff if they need them for decarbonization targets or renewable energy goals.

MISO estimates the benefit-to-cost ratio of the portfolio to be between 1.8:1 and 3.5:1 over the first 20 service years of the projects, owing to production costs, improved reliability, avoided construction of new capacity and environmental benefits. The grid operator’s planners have emphasized that the benefit values are intentionally conservative. (See $21.8B Long-range Tx Plan Goes to Membership Vote; MISO Resolute, IMM Protesting.)

However, some states and MISO’s Independent Market Monitor have disputed MISO’s benefit estimates and said they’re overinflated. IMM David Patton appraised the value of the portfolio closer to a 0.3:1 benefit-to-cost ratio and advocated for a condensed portfolio. He repeatedly said the 20-year future MISO relied on to recommend the portfolio of mostly 765-kV lines is impractical and doesn’t represent the resource mix that will be built. (See MISO IMM Makes Closing Arguments Against $21.8B Long-range Tx Plan.)

MISO and its IMM’s disagreements over the second long-range portfolio culminated in a FERC case itself, where FERC decided that MISO’s Market Monitor was allowed to stray from markets to inspect the value of the RTO’s transmission planning — and get paid for it. (See FERC Sides with Market Monitor over MISO in Compensation Dispute.)

The five state commissions said MISO ignored its IMM’s guidance while adjusting the benefit metrics it used in its first, $10 billion long-range portfolio in 2022 in an attempt to make the second round of projects look more valuable than it will be.

Like MISO’s IMM, the states said MISO didn’t give enough thought to the concept that without a backbone network of 765-kV lines, members would build different generating units closer to their load at lower costs compared to the transmission expenses. MISO should not assume that its members would build the same remote generation with or without the portfolio, they said.

The states also echoed the Monitor’s view that MISO should not have assumed it would have instances of load-shedding at the $3,500-$10,000/MWh value of lost load if it didn’t recommend the lines. They said state officials undoubtedly would take action to mend reliability before it reached that point.

Finally, the states said it was inappropriate for MISO to use a social cost of carbon to justify transmission investment and said they do not share MISO’s estimation.

The states argued that if MISO eliminated its overstated benefit estimates of a reliability upsurge and avoided capacity costs and decarbonization, the value of the portfolio would fall to $15.7 billion, far from MISO’s low-end estimate of $51.7 billion. They said with a more realistic view of benefits, the second long-range transmission portfolio would not be able to cover its construction costs.

The group of states told FERC they are not relying on the $22 billion worth of projects to meet resource adequacy requirements or clean energy goals. Three of the MISO states — Arkansas, Louisiana and Mississippi — are in MISO South and not affected by the second long-range portfolio, whose projects are all in and cost shared among MISO Midwest.

“These states and their utilities have or are building new generation, either close to load or where existing transmission can provide delivery to load, that is consistent with their integrated resource plans or similar state processes,” the states said, adding that they don’t have use for the additional transfer capability the projects will offer, nor “any interest in subsidizing … costs to advance the clean energy and decarbonization goals of other states in MISO.”

MISO South Involvement May Presage Cost Allocation Battle

While Arkansas, Louisiana and Mississippi are not included in the cost allocation for the long-range transmission portfolio so far, the complaint could have implications for future long-range transmission projects prescribed for MISO South.

MISO limited its 100% postage stamp allocation (based on a load ratio share) for the first two long-range transmission portfolios to MISO Midwest, where the projects will be built.

MISO South won’t be the focus of long-range transmission planning until 2026, when MISO officials said they would begin drawing up early plans. MISO initially pledged to explore the development of a separate cost allocation for the South region, which it says has different priorities, and then insisted that its postage stamp remains the most appropriate mechanism for splitting up transmission costs. (See Clean Energy Orgs Push Entergy Players to Consider Broader Cost Allocation.)

MISO South regulators appear to be behind a recent push for the Organization of MISO States to take a stab at proposing a new cost allocation for MISO’s long-range projects. If efforts prove unsuccessful, the postage stamp design could become a backstop. (See State Regulators Weigh Drafting Alternative to MISO Tx Cost Allocation.)

MISO South never has been the site of construction for a regionally cost-shared transmission project. MISO has said it could spend up to $100 billion across its long-range transmission portfolios. To date, it has designated $33 billion only in MISO Midwest. Multiple nonprofits and consumer advocates alongside former FERC Commissioner John Norris have called on MISO to start assembling a long-range plan for MISO South. (See MISO Says Public Communication Needs Work After NOLA Load Shed.)

At a July 30 MISO stakeholder workshop to discuss reliability, MISO transmission planning lead Laura Rauch said she “would still be very comfortable testifying” to the benefits of the nearly $22 billion long-range transmission plan, even with the rollback of federal incentives for clean energy.