With electric utilities worldwide facing rapidly rising demand and an “unpredictable” planning environment, natural gas continues to hold a strong role “supporting long-term sustainability and energy security” in the global market, according to the International Gas Union’s 2025 Global Gas Report.

The report, released Sept. 10 and co-authored with European gas pipeline operator Snam, analyzed trends in the international gas market and compared them with developments in the electric landscape. Overall gas demand grew to 4,122 billion cubic meters in 2024, up 1.9% from the year before, while gas production grew by 65 Bcm, or 1.6%.

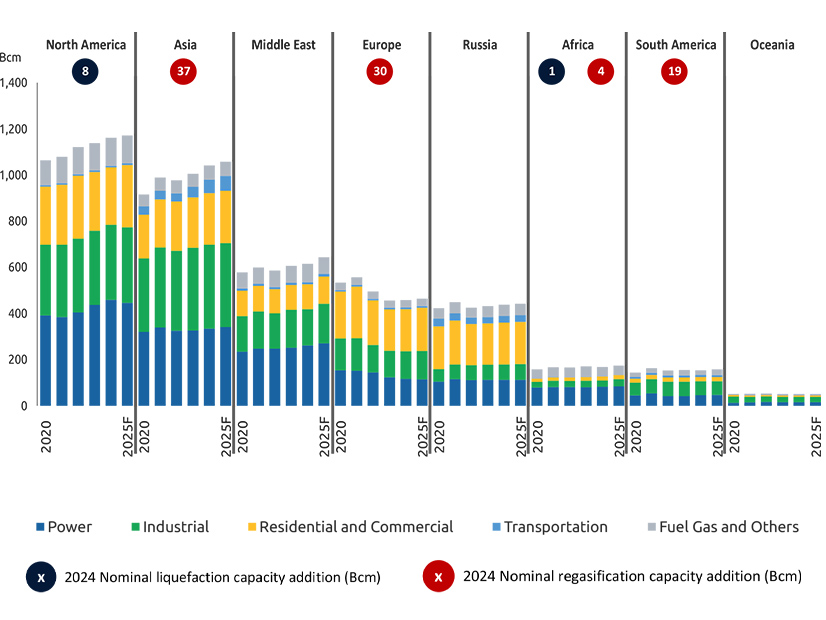

Demand growth was strongest in Asia, which consumed 36 Bcm (3.6%) more in 2024 than in 2023, followed by Russia, up 11.5 Bcm (2.5%), and North America, up 22.9 Bcm (2%). Consumption fell by 0.6% in South America and 1.5% in Africa. About 80% of the natural gas supplied in North America went to the U.S., IGU said, partly because of historically low Henry Hub prices making gas more cost-competitive with coal for electric utilities.

Power generation made up about one-third of gas consumption worldwide in 2024, more than any other application; industrial applications and residential and commercial uses came in second and third, continuing the pattern of the previous four years. Similar results were seen in North America, Asia and the Middle East.

Despite this steady demand growth, the report noted that “shifts in technology, climate and geopolitics” have introduced uncertainty into the market. Record high summer temperatures in 2024 contributed to peak power demands in multiple countries including the U.S. Import tariffs imposed by the Trump administration also have the potential to “weaken global liquified natural gas demand despite strong support for the oil and gas sector domestically … exacerbated by the unpredictable pace of the energy transition.”

The ongoing data center boom is expected to drive structural increases in electricity demand as well. IGU observed that about 73 GW of new data center capacity is under construction and planned in the next five years, on top of the close to 45 GW that existed in 2024, with most facilities concentrated in Georgia, Arizona, Texas and Virginia. “Favorable conditions such as low-cost energy, tax incentives and robust fiber infrastructure” are behind the anticipated growth, according to the report.

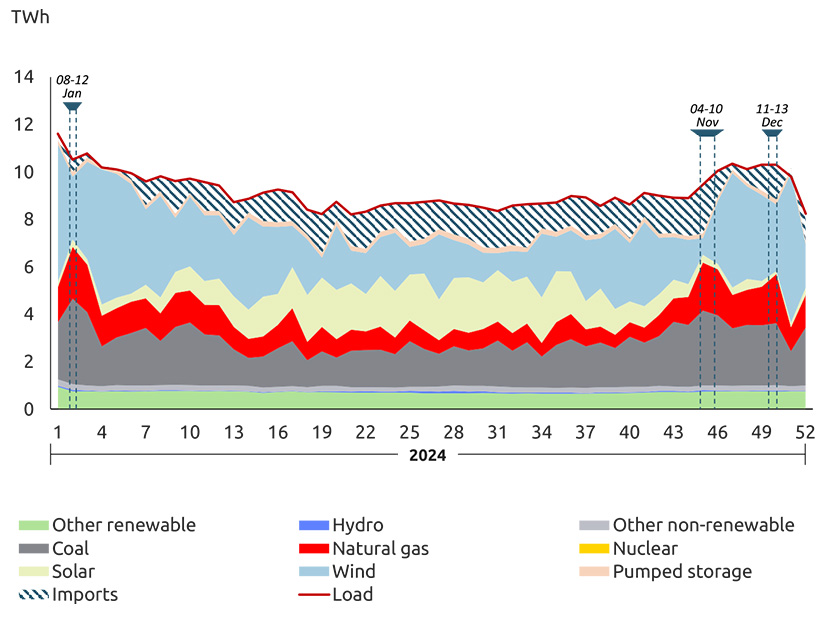

In light of these growing pressures, IGU argued that “gas is well positioned as a force of resilience [and] a lower-carbon alternative to coal.” The organization noted the use of gas as “insurance for power systems” that have seen growing penetration by intermittent resources like wind and solar, citing the “dunkelflaute” incidents in Germany in 2024 when wind activity, and thus wind power generation, fell off steeply, leaving the slack to be taken up by gas, coal and imports.

Gas also constitutes “a proven technology partner to batteries,” the report said, pointing to the experience of California in the first six months of 2025, when gas regularly ramped up to compensate for decreased output from solar and battery facilities. These global examples show the role of gas “as a flexible solution in balancing [renewable energy] variability,” IGU said.

Given the importance of gas, the report argued for the U.S. and other developed nations to pursue “targeted investment across the natural gas value chain, careful alignment of technology choices with system needs and reform of power market structures to ensure project viability.” Potential value chain investments include upstream supply, midstream infrastructure such as pipelines and storage, and increased gas generation capacity. Market reforms could include clarifying the role of gas plants as support for renewable energy rather than as baseload power.

“The future role of natural gas in power systems will vary widely depending on feasibility considerations, best practices and regional integration strategies,” the report said. “Existing infrastructure, current power mixes and policy environments will determine how extensively gas-to-power can contribute to system flexibility. Therefore, unlocking the full potential of natural gas as a dispatchable and balancing power source will require a set of targeted measures at both national and global levels.”