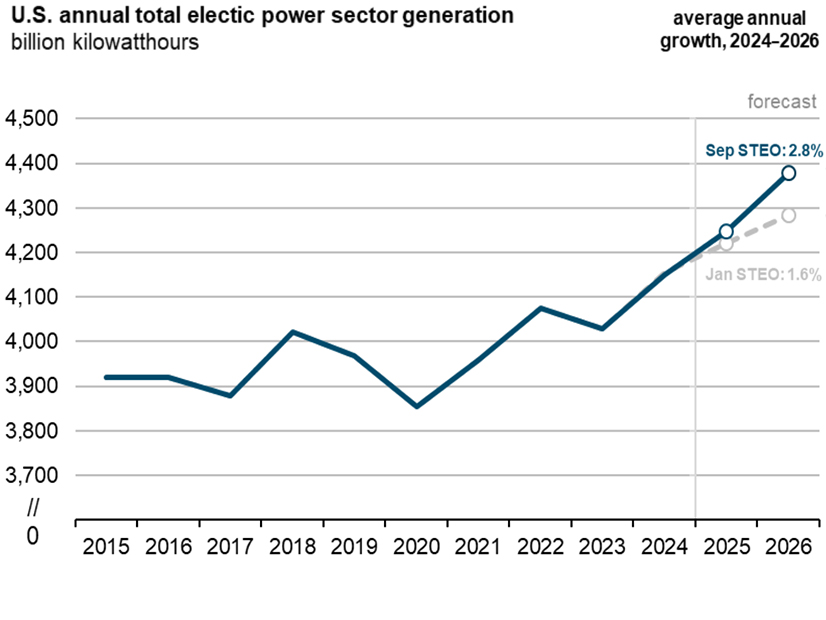

The U.S. Energy Information Administration is boosting its estimate of national power generation growth to 2.3% this year and 3% next year.

The details are reported in the September Short Term Energy Outlook the agency issued Sept. 9. In the outlook published in January, it had forecast an average of 1.5% growth in 2025 and 2026.

EIA said the increase is from a colder-than-expected start to 2025 and load growth assessments by ERCOT and PJM. The latter had the largest amount of generation of any region in 2024: 873 billion kWh. It is expected to have 904 billion in 2025 and 946 billion in 2026.

ERCOT is forecast to have the largest increase in generation, from 459 billion kWh in 2024 to 560 billion in 2026 — a 22% jump.

The January STEO forecast only 499 billion kWh in ERCOT in 2026 and only 902 billion kWh for PJM.

The predictions for all other grid regions are nearly the same in the September report as in the January report.

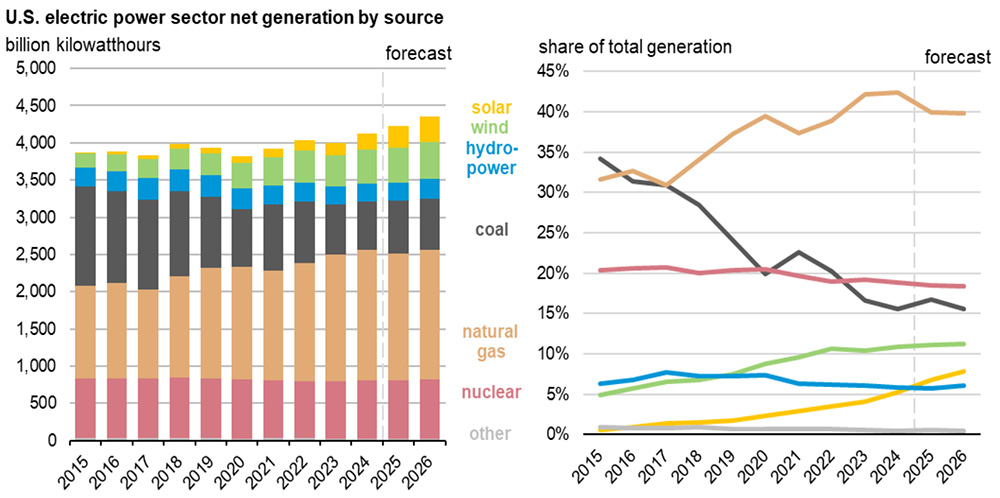

To meet this rising demand, utility-scale solar generation is expected to increase 33% this year over 2024, the most of any technology, and then 19% in 2026.

Natural gas generation is expected to be 3% lower in 2025 than in 2024 because of sharply higher gas prices, but it still will be the largest source of electricity by a wide margin, providing 1,698 billion kWh, or 40% of the country’s electricity.

Coal-fired generation is expected to be 9% higher this year than last — the first year-over-year increase for coal since 2021. The 2024-2025 decrease in gas and increase in coal both are approximately 61 billion kWh.

Small increases also are forecast in 2025 for wind power (4%) and hydropower (2%). Together with solar, this puts renewable energy at 25% of U.S. electricity generation in 2025 and 26% in 2026, compared with 23% in 2024.

Nuclear fission is expected to produce only slightly more power in 2025 than in 2024 but 2% more in 2026, thanks to the anticipated restart of the Palisades Nuclear Plant in Michigan.

The average price per kilowatt-hour is projected to increase from 16.48 cents in 2024 to 17.22 cents in 2025 and 17.9 cents in 2026 for residential customers; 12.85 to 13.36 and 13.5 cents for commercial customers; and 8.15 to 8.49 to 8.54 cents for industrial customers.

Nationwide average electricity prices for the three classes are projected to be 13.53 cents/kWh this year and 13.79 cents next year. The West South Central region — Texas, Oklahoma, Arkansas and Louisiana — retains the lowest average in 2025, at 9.87 cents/kWh, and New England remains highest, at 25.12 cents.