The PJM Board of Managers has directed staff to proceed with a Quadrennial Review design that reworks the capacity auction price curve and sets the reference resource as a combustion turbine for all zones. (See PJM MIC Endorses 2 Quadrennial Review Proposals.)

“The board believes this proposal strikes the appropriate balance of reliability and cost implications,” it said in an announcement posted Oct. 22. It also noted that the proposal, jointly sponsored by PJM staff and Pennsylvania Public Utility Commission Vice Chair Kimberly Barrow, was the only one to be supported by the Markets and Reliability Committee.

Six proposals were considered by the Market Implementation Committee over the past year, with two being endorsed in September. The PJM/Barrow proposal received 75% sector-weighted support at the MRC. PJM spokesperson Jeff Shields told RTO Insider that staff intend to file the proposal within the next few weeks.

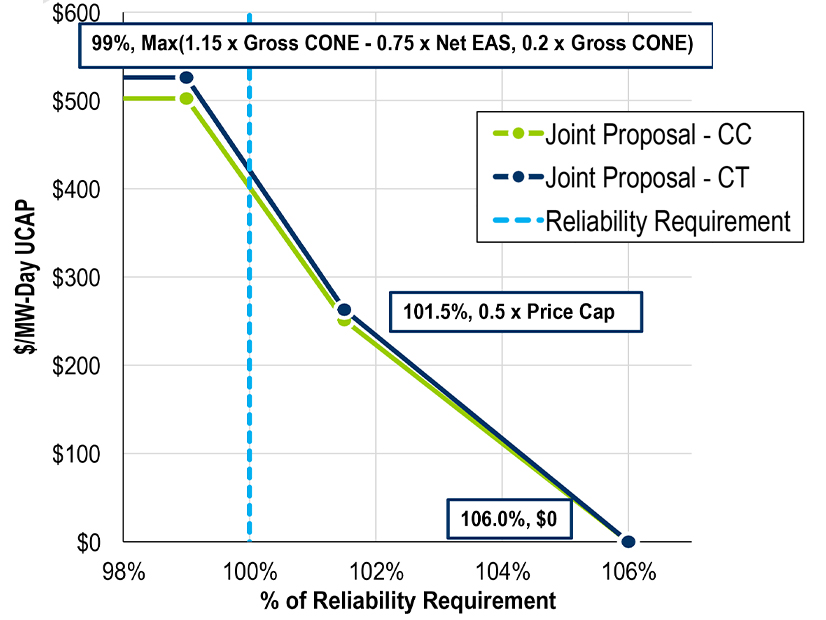

The proposal aims to improve the stability of the variable resource requirement (VRR) curve by reducing reliance on multipliers of the cost of new entry (CONE) parameter; the curve defines the clearing price to be procured in a Base Residual Auction (BRA) and at what cost.

It would shift the design of the VRR curve to set the maximum price at the larger of either 20% of the gross CONE, or 115% gross CONE minus 75% of the net energy and ancillary services offset. The formula establishes a floor meant to prevent high energy market revenues lowering the maximum capacity price to zero. The curve approved by the commission in 2023 set the maximum at the greater of gross CONE or 1.75 times net CONE, which subtracts the EAS offset from gross CONE. (See FERC Approves PJM Quadrennial Review.)

The midpoint on the curve would procure 101.5% of the reliability requirement at half of the maximum price, which is also meant to improve the stability of the curve. The midpoint for the prior curve was set at 75% of net CONE and 101.5% of the reliability requirement.

The curve would reach zero at 106% of the reliability requirement, shifting further to the right from the 104.5% anchor used in the previous curve shape.

During the Sept. 25 MRC meeting, PJM’s Skyler Marzewski said there is little difference in the maximum price when the curve is based on a combined cycle reference resource, the RTO’s preference, and a CT. The maximum would fall between $483/MW-day of unforced capacity in CONE Area 3 and $785/MW-day for ComEd. Some areas would see a lower maximum using a CC reference resource, such as a $463/MW-day maximum for CONE Area 3, while it would be higher in ComEd at $841/MW-day.

PJM’s original proposal sought to use a four-hour battery electric storage system as the reference resource in the ComEd region and a CC in all other CONE areas. Marzewski said a curve based on storage for ComEd would reflect environmental restrictions in Illinois that would reduce the lifespan of new gas generation. Instituting a CC for the other regions would reflect development trends in the region, with several CCs in the interconnection queue. (See “Stakeholders Divided on Reference Technology,” PJM Stakeholders Discuss Quadrennial Review Proposals.)

PJM had intended to shift to a CC in the last Quadrennial Review but backtracked when it determined that high estimated energy prices could cause capacity prices to fall to zero, along with disruptions to other parameters based on the reference resource. (See FERC OKs Changes to PJM Capacity Market to Cushion Consumer Impacts.)

PJM’s proposal adopted Barrow’s recommendation to use the 67th percentile of the net EAS offset for each CONE area, which Marzewski said is meant to reflect that developers will seek to maximize their potential revenues when siting projects.