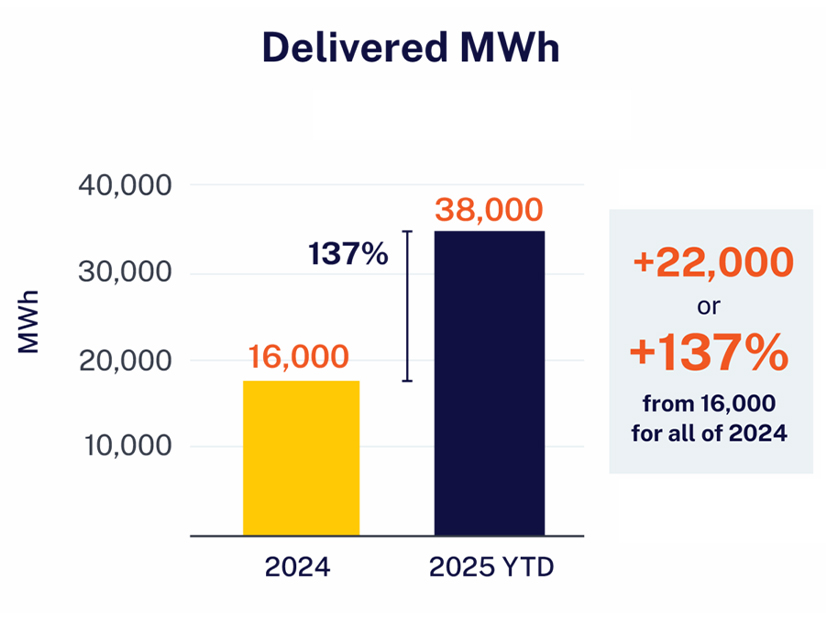

Rising demand and extreme weather led to a huge spike in dispatches across CPower Energy’s Virtual Power Plant (VPP) portfolio as customers it aggregated delivered 38 GWh of load relief over the first nine months of 2025, more than doubling the total from 2024.

“DR and VPPs are having a bit of a moment in the market,” CPower CEO Michael Smith said in an interview Nov. 3. “They’re extremely important flexibility provided to a market that’s growing in terms of demand, that’s experiencing more severe and more frequent weather incursions, and we continue to be an extremely important part of the energy transition in that regard.”

In 2024, CPower’s aggregated customers delivered just 16 GWh to the grid all year, which means for the first three quarters of 2025, they’ve already provided 137% more. That shows VPPs consistently answer the call for grid support and the resources can be relied on in the future, Smith said.

This summer had extreme heat in June that drove dispatches in PJM and ISO-NE, he added.

“You’re seeing, you know, two phenomena,” Smith said. “More customers seeking to access the opportunity represented by these markets. And … weather driving more dispatch.”

CPower also sees increased interest from large loads like data centers that want to be plugged into the grid quickly. Flexibility is going to be vital for the data center industry in the near term as a major goal for them is speed to market.

“Let’s call it three, five, seven years. Generation and transmission build is not going to catch up to the needs of the grid created by extreme demand growth,” Smith said. “So, we’re going to need the shock absorber provided by demand response and VPP providers.”

Once generation and transmission development catch up to the growth and can serve large loads at peak times without issue, some data centers still will want to earn money.

“Customers have inherent flexibility, and they get paid for it,” Smith said. “I think that continuing to go back to that fundamental principle would dictate that you’re always going to have this be part of the market, even when you do get supply/demand, generation/demand balanced.”

One issue CPower and other aggregators always have to balance is ensuring that customers who provide DR do not get burned out by being called upon constantly to balance the grid.

“We work with all of our customers to ensure that they’re comfortable with the commitment they’re making to an evolving market,” Smith said. “Some customers decide they want to commit less because they think they’re going to get dispatched more.”

Another factor they must compete against is large customers engaging in their own peak shaving to lower their bills, which has been a phenomenon since the markets launched.

“I would say those conversations, particularly after the dispatches of the summer of 2025, are more acute in our business,” Smith said. “But we’re not seeing customers fleeing these markets. Customers are in these markets. They’re participating. They’re getting compensated well for their participation in these markets.”

While large loads are driving changes and dominating the broader power industry’s attention in general, the biggest market potential for demand response remains residential and small commercial customers.

CPower supports a pending complaint from Voltus at FERC, which would allow for statistical modeling of their demand response to be used more widely in PJM due to difficulty in obtaining actual smart-meter data. (See Voltus, Mission:data Seek Changes to PJM Data Requirements for DR.)

The states control the rules around releasing data from smart meters to third parties such as DR/VPP aggregators due in part to concerns around data security, which can be overcome, Smith said.

“That’s traditionally been very hard for state commissions to get their heads around,” he added. “Collectively, think about going back to the opening of the retail power markets and retail energy providers not being able to get that same kind of data. So, we’re having those same discussions again. We’re seeing some movement at the state commission levels, but it’s going to take some time to get that right.”