The International Energy Agency released its World Energy Outlook 2025, which found new emerging economies are poised to drive the near-term future of energy.

China accounted for half of oil and gas demand growth and 60% of electricity demand growth for the past decade, but in the future the markets will be driven by what happens in India, Southeast Asia and countries in the Middle East, Africa and Latin America. No country, or even group of them, is expected to come close to replicating the scale of China’s energy-intensive rise.

The world continues to face security risks to oil and gas supplies, but IEA said China’s dominance of rare earth minerals vital to power grids, batteries and electric vehicles now accompany those much older risks. China is the dominant refiner for 19 out of 20 energy-related strategic minerals, with average market share across those of around 70%.

“When we look at the history of the energy world in recent decades, there is no other time when energy security tensions have applied to so many fuels and technologies at once — a situation that calls for the same spirit and focus that governments showed when they created the IEA after the 1973 oil shock,” IEA Executive Director Fatih Birol said in a statement. “With energy security front and center for many governments, their responses need to consider the synergies and tradeoffs that can arise with other policy goals — on affordability, access, competitiveness and climate change.”

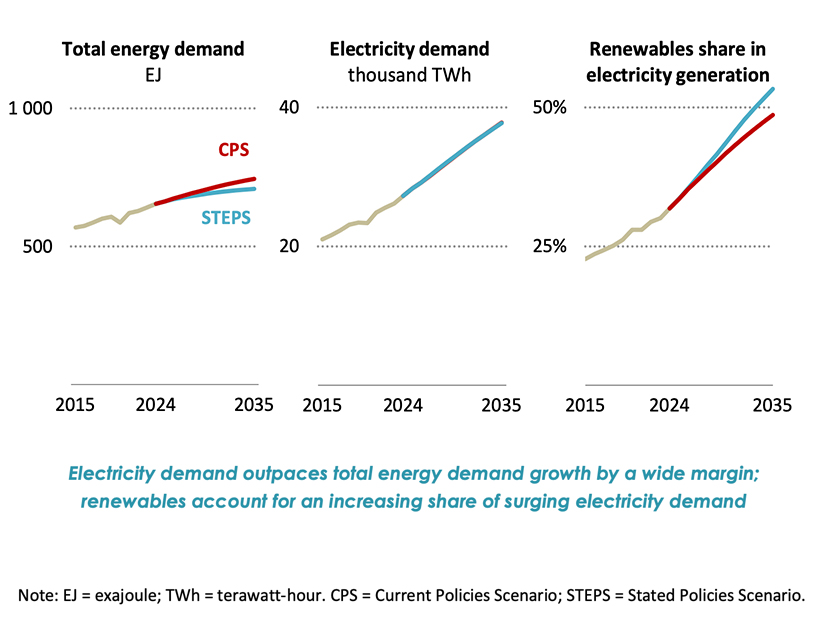

Electricity is at the heart of modern economies, and its demand grows faster than overall energy demand in all scenarios that IEA ran for its report. In 2024, the group said the world was moving into the “Age of Electricity”; that already has arrived, it said in the latest report.

“In a break from the trend of the past decade, the increase in electricity consumption is no longer limited to emerging and developing economies,” Birol said. “Breakneck demand growth from data centers and AI is helping drive up electricity use in advanced economies too. Global investment in data centers is expected to reach $580 billion in 2025. Those who say that ‘data is the new oil’ will note that this surpasses the $540 billion being spent on global oil supply — a striking example of the changing nature of modern economies.”

With the growing importance of electricity and pressures from growing demand adding to higher prices, electricity bills are rising to the top of the political agendas in many countries, the report said.

“This shift underscores a growing tension: While electrification offers long-term efficiency gains and emissions reductions, it also increases the sensitivity of movements in electricity prices, which are shaped by a complex mix of fuel costs, infrastructure investment, market design and policy choices,” the report said.

Electricity is becoming a larger share of household energy spending around the world because of electrification. The report expects average household demand to grow by 25% by 2035 and 60% by 2050, with significant variations by region.

Advanced economies have a decadelong trend of demand stagnation, but households there should see it grow by 15% by 2035 and 35% by 2050.

“While increases in energy efficiency moderate consumption for appliances, the electrification of transport is a major driver of expanding electricity use in regions with supportive policy frameworks and increasing EV sales shares,” the paper said. “This shift underscores the need for grid readiness and demand flexibility solutions like smart charging to manage peak demand and to improve affordability.”

Developing countries will see even higher household demand growth – 30% by 2035 and 90% by 2050 — because of air conditioning that comes from rising incomes and higher average temperatures.

“Rapid growth in electricity demand brings with it a need for substantial investment across the power sector,” the report said. “Grid infrastructure, in particular, is seeing a marked increase in capital spending to connect new loads, integrate new sources of electricity and enhance resilience. While rising investment does not necessarily translate into higher average system costs — especially if demand rises in parallel — the financing conditions and timing of the investment are critical.”

Some things are working to lower prices, with IEA saying natural gas prices should drop in many markets as more LNG becomes available and the growth in renewable power helps bring down wholesale electricity prices.

“As electricity demand rises, the fixed costs of new infrastructure can be spread across a larger volume of consumption, potentially reducing the cost per megawatt-hour,” the report said. “In some cases, this dynamic may even lead to lower electricity prices in real terms despite rising investment levels, highlighting the importance of well designed policies and market frameworks that enable efficient investment recovery while protecting consumers.”