FERC staff expect “grid operators will have adequate generating resources to meet demand across the United States under normal conditions” during the coming winter months, presenters said at the commission’s monthly open meeting Nov. 20.

However, “difficult to predict” severe weather events “could create tight supply conditions” in some areas and require operational mitigations to avoid reliability issues, they warned.

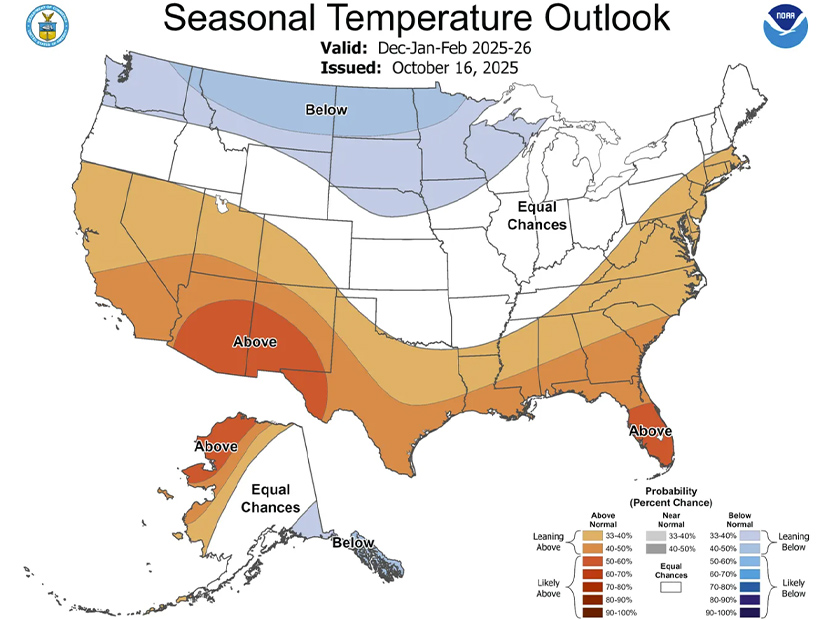

Presenting FERC’s 2025-2026 Winter Energy Market and Electric Reliability Assessment, Eric Primosch, of the Office of Technical Reporting and Economics, told commissioners the National Oceanic and Atmospheric Administration predicts higher-than-average temperatures across most of the southern continental U.S. for the winter months of December, January and February. Only in the northernmost states are mildly lower-than-average temperatures expected.

For this reason, the U.S. Energy Information Administration predicts the number of nationwide heating degree days — a metric that measures how cold a given location is by comparing its average outdoor temperatures to a reference temperature — to drop by about 8% from the previous winter.

Multiple states in the West and Southeast U.S. also either are likely to develop drought conditions over the winter or to see current droughts continue, Primosch said. These dry conditions “could significantly reduce hydroelectric output in WECC, disrupt fuel deliveries and impair cooling for power plants in the Central U.S., and elevate wildfire risk across the country,” he said.

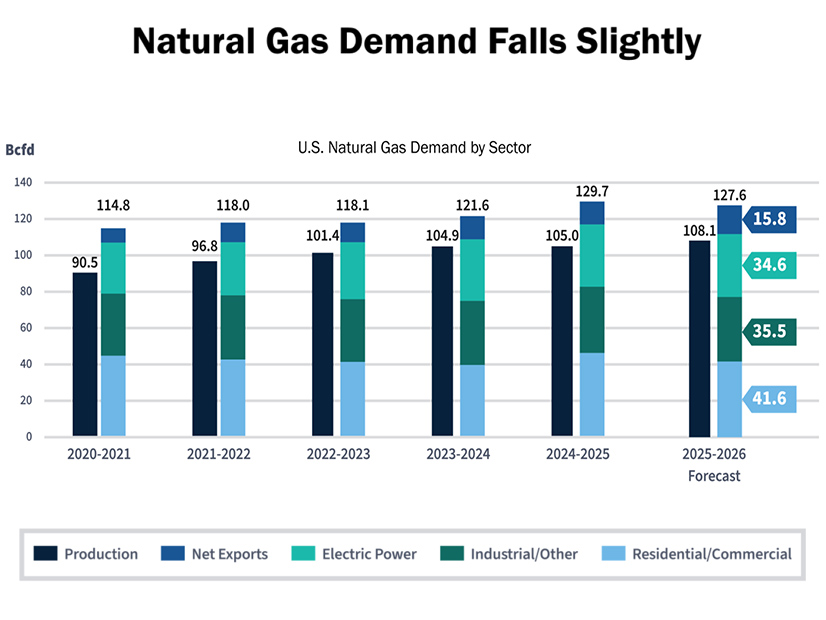

Despite the warmer conditions, and a slight expected increase in natural gas production from last year, Primosch said gas prices are expected to be higher at most hubs than they were last winter. Henry Hub futures averaged $4.39/MMBtu as of Nov. 4, up 26% from last winter’s settled average of $3.49/MMBtu. FERC’s report attributed the rise to growing demand for gas in the South-Central region.

Possible explanations for rising prices at other hubs include competition with other regions for LNG at the Algonquin Citygates hub, potential supply constraints at Transco Zone 6, and infrastructure constraints at both SoCal-Citygate and PG&E-Citygate in California. However, gas storage inventories stood at 3,915 Bcf at the beginning of the withdrawal season, near the top of the five-year range, and are expected to “remain relatively robust through winter,” helping to moderate price volatility.

Solar, Batteries Lead Capacity Additions

On the electricity side, Shannon Zaret of OTRE told commissioners that EIA predicts total electricity consumption of 1,035 TWh this winter, slightly less than the 1,041 TWh recorded the previous winter but still higher than the five-year average.

Zaret said the greatest use is expected in the residential sector, at 387 TWh, followed by commercial users at 359 TWh and industrial at 254 TWh.

Electricity usage in the commercial sector is projected at 5% above its five-year average, Zaret said, with EIA attributing the rise in part to data centers in the PJM region.

EIA forecasts the electric sector to have new generation capacity totaling 64.7 GW this winter, comprising 25.7 GW of generation completed between March and November and 39 GW expected between December and February 2026. The new generation is offset by 2.4 GW of retirements already completed by November and 6.2 GW of further retirements expected by February. Most of the retirements are coal-fired plants, while solar generation accounts for half of the capacity additions and batteries 30%.

NERC Senior Engineer Robert Tallman shared a summary of the ERO’s Winter Reliability Assessment, published Nov. 18. (See NERC Winter Reliability Assessment Finds Many Regions Facing Elevated Risk.) That report found that several subregions face elevated risk for outages this winter if they experience severe weather, with the highest risk in the WECC Northwest and Basin subregions, ERCOT, SERC Reliability’s Central and East subregions, and the Northeast Power Coordinating Council’s New England and Canadian Maritime Provinces subregions.

Asked by FERC Chair Laura Swett whether gas production in the U.S. will “keep pace” with demand this winter, Primosch said the elevated production, along with precautions taken by producers, gave cause for optimism.

“We’ve seen producers really focus on improving winterization … in terms of preventing equipment failure [and] wellhead freeze-offs, [and] really trying to maintain as much production as possible on their system during these winter weather events,” Primosch said. “This strategy was effective last winter, as we saw the collaboration of producers, pipelines [and] storage operators all work together to help meet peak record demand, [and] we expect that to be the case again this winter.”